Last Update 11 Nov 25

Fair value Decreased 19%ARE: Expected Revenue Decline Will Be Offset By Biotech Expansion Momentum

Analysts have lowered their price target for Alexandria Real Estate Equities from $96.07 to $77.85. They cite a higher discount rate and anticipated revenue declines as primary factors in their revised outlook.

What's in the News

- Lowered 2025 earnings guidance, with expected net loss income per share midpoint reduced by $3.44 to $(2.94) (Corporate Guidance)

- Impairment of real estate reported at $323.9 million for Q3 2025, up significantly from $5.7 million a year earlier (Impairments/Write Offs)

- No shares repurchased between July and October 2025. Completed share buyback totaling 2,648,569 shares for $258.25 million since December 2024 (Buyback Tranche Update)

- Lilly Gateway Labs San Diego opened in collaboration with Alexandria, featuring advanced lab facilities and supporting biotech innovation in the Torrey Pines region (Business Expansions)

- Analyst/Investor Day held for stakeholders and investors (Analyst/Investor Day)

Valuation Changes

- Fair Value: Decreased substantially from $96.07 to $77.85. This reflects a more cautious outlook on future performance.

- Discount Rate: Increased from 8.72% to 9.42%. This indicates a higher perceived risk or cost of capital for the company.

- Revenue Growth: The projection shifted from growth of 1.1% to an expected decline of 0.2%.

- Net Profit Margin: Remained largely stable, rising only slightly from 7.38% to 7.45%.

- Future P/E: Declined from 88.17x to 75.29x. This suggests lower expected earnings or a decrease in investor sentiment toward future growth.

Key Takeaways

- Premium assets in major innovation clusters secure long-term leases with top tenants, supporting stable cash flows and above-market rent growth.

- Rising demand for specialized lab space and high entry barriers strengthen Alexandria's competitive position and earnings potential.

- Sluggish leasing, weak biotech markets, and valuation challenges are pressuring occupancy, revenue growth, margins, and long-term profitability in a tough capital environment.

Catalysts

About Alexandria Real Estate Equities- Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

- The continued growth of global healthcare investment and R&D, with a persistent focus on addressing currently untreatable diseases, is fueling demand for specialized lab and life science space; this supports robust long-term revenue growth through high-value, resilient tenant relationships.

- Demographic tailwinds, especially the aging population in developed economies, are expected to drive sustained increases in healthcare innovation and spending-translating to strong, long-duration tenancy and stable, predictable cash flows for Alexandria.

- Alexandria's premium, strategically located assets in high-barrier-to-entry innovation clusters (such as Boston, San Diego, and San Francisco) are allowing for successful large-scale, long-term leases to blue-chip tenants; this provides significant support for above-market rental rates, NOI expansion, and net margin stability.

- An active development and redevelopment pipeline in top-tier markets, along with the successful execution of transformative build-to-suit projects, positions Alexandria for incremental NOI growth and earnings acceleration as new projects are delivered and leased.

- High and rising barriers to entry for specialized lab space-driven by increasing infrastructure and technical requirements-are enhancing Alexandria's competitive moat, resulting in a defensive asset class with improved occupancy, rental spreads, and long-term earnings power.

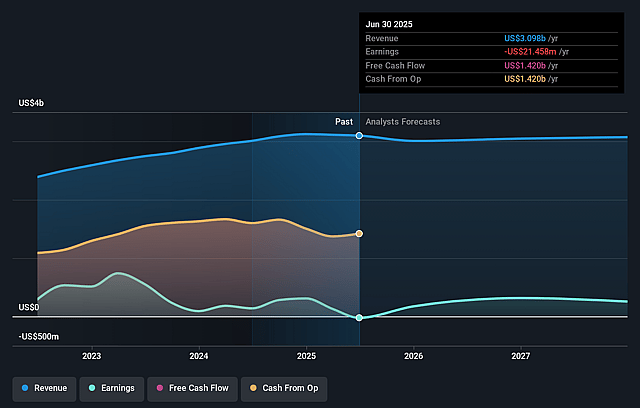

Alexandria Real Estate Equities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alexandria Real Estate Equities's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.7% today to 9.1% in 3 years time.

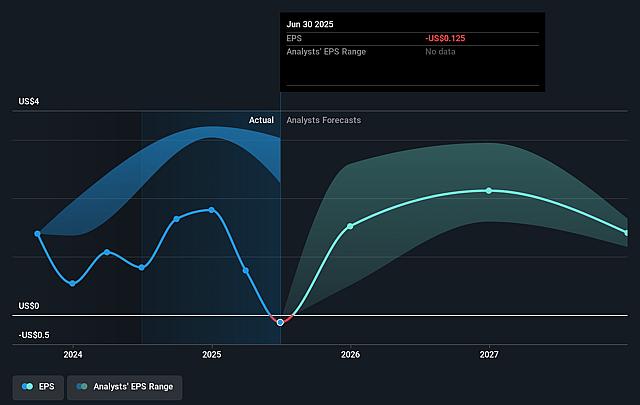

- Analysts expect earnings to reach $288.1 million (and earnings per share of $1.44) by about September 2028, up from $-21.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $125.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 71.5x on those 2028 earnings, up from -674.8x today. This future PE is greater than the current PE for the US Health Care REITs industry at 33.2x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.56%, as per the Simply Wall St company report.

Alexandria Real Estate Equities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The prolonged high-interest rate environment and continued capital markets uncertainty are negatively impacting transaction activity and tenant decision-making, leading to slower leasing velocity, pressure on occupancy rates, and potential future declines in NOI and earnings.

- Persistent weakness in public biotech equity markets, reflected by a lack of IPOs and a risk-off investor climate, may dampen tenant expansion and leasing demand-especially for smaller or earlier-stage tenants-thus impacting topline revenue growth.

- Pressure on same property NOI, including a recent 5.4% decline (as reported in the quarter), is being driven by elevated vacancy, lease expirations, and the burn-off of initial free rent, creating downward pressure on net margins and earnings in the near to medium term.

- Uncertainty surrounding future NIH and government healthcare funding, coupled with delays in the disbursement of appropriated NIH grants, could slow institutional tenant leasing and capital flows, negatively impacting revenue growth and stability from the academic/biomedical segment.

- Ongoing asset dispositions weighted toward non-core and transitional properties are occurring at higher cap rates (7.5%–8.5%) and notable real estate impairments, which reflect challenges in market valuations and may constrain growth in net asset value and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $96.417 for Alexandria Real Estate Equities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $144.0, and the most bearish reporting a price target of just $71.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $288.1 million, and it would be trading on a PE ratio of 71.5x, assuming you use a discount rate of 8.6%.

- Given the current share price of $83.72, the analyst price target of $96.42 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.