Key Takeaways

- Rising costs, regulatory pressures, and shifts in workplace demand are squeezing margins and threatening predictability of earnings and occupancy rates.

- Heavy dependence on key biotech hubs and evolving funding trends increases revenue volatility and prolongs vacancy risks.

- The company's specialized life sciences assets and strategic locations drive high tenant retention, pricing power, and stable long-term revenue growth in a supportive market.

Catalysts

About Alexandria Real Estate Equities- Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

- The persistence of hybrid and remote work models, alongside evolving life sciences technology such as AI-driven research and remote diagnostics, is expected to steadily erode long-term demand for large-scale physical lab and office campuses, directly pressuring occupancy rates and rental growth, and ultimately resulting in stagnating or declining revenues.

- Sustained high interest rates and restricted access to affordable credit are raising Alexandria's cost of capital at the same time as the company maintains significant capital expenditure needs for maintaining and modernizing highly specialized assets; this dynamic will further compress net margins, especially if same-property rental income fails to accelerate or declines as warned for the second half of 2025.

- Intensifying tenant and geographic concentration in key biotech hubs exposes Alexandria to amplified revenue volatility, particularly if local markets face pullbacks in biotech funding or M&A consolidation reduces tenant diversity, which could result in longer lease-up times and increased vacancy-threatening predictable NOI and FFO growth.

- Accelerating ESG-related and regulatory requirements will force the company to undertake costly upgrades across its aging property base, with much of the spend unlikely to be fully recovered through rents, thus shrinking margins and leaving shareholders with reduced net earnings growth.

- Structural changes to life science funding-including ongoing delays or reductions in government and venture capital allocations, and continued uncertainty over NIH and HHS budget doling-will likely keep leasing decisions slow and vacancy durations high, weighing on future revenue and limiting the ability to cover dividends from internal cash flow.

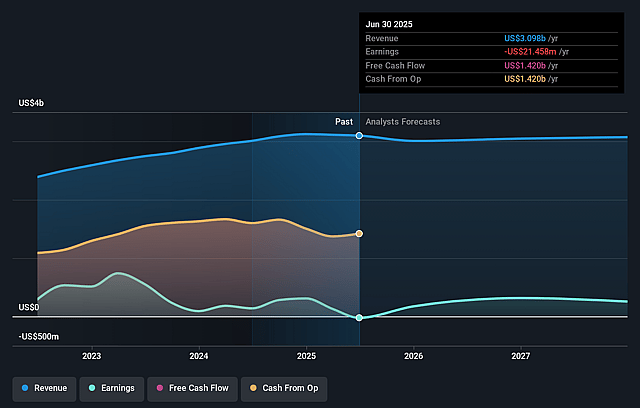

Alexandria Real Estate Equities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Alexandria Real Estate Equities compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Alexandria Real Estate Equities's revenue will decrease by 2.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.7% today to 8.2% in 3 years time.

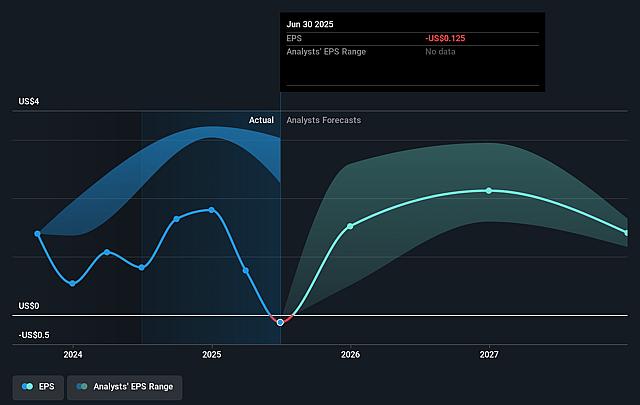

- The bearish analysts expect earnings to reach $238.7 million (and earnings per share of $1.6) by about July 2028, up from $-21.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 65.3x on those 2028 earnings, up from -668.5x today. This future PE is greater than the current PE for the US Health Care REITs industry at 33.7x.

- Analysts expect the number of shares outstanding to decline by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Alexandria Real Estate Equities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global trend of increased investment and tailwinds for life sciences-including aging demographics, persistent healthcare innovation, and chronic disease prevalence-are creating sustained long-term demand for Alexandria's specialized lab and R&D infrastructure, which provides a strong foundation for revenue and supports consistently high occupancy rates and rental growth.

- Alexandria's reputation and proven expertise in life sciences real estate, as evidenced by winning major long-term leases with top-tier pharma tenants and receiving awards for operational excellence, enables it to maintain premium pricing and high tenant retention, which bolsters predictable cash flows and stabilizes net operating income and margins.

- The company's focus on high-demand, supply-constrained urban innovation clusters-like Boston, San Francisco, and San Diego-alongside a disciplined, strategic development pipeline and asset recycling, positions it to achieve higher yields and capitalize on market recovery, supporting future earnings and organic growth.

- Long lease terms with creditworthy tenants-including a significant portion of Fortune 500 and investment-grade companies-minimize cash flow volatility, ensuring stable funds from operations (FFO) and providing downside protection to earnings even during industry or economic headwinds.

- Institutional capital continues to flow into life sciences real estate, benefiting incumbents like Alexandria by supporting high property valuations, while rising barriers to entry in lab development preserve Alexandria's pricing power and occupancy, which helps sustain or improve long-term asset values and revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Alexandria Real Estate Equities is $74.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Alexandria Real Estate Equities's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $144.0, and the most bearish reporting a price target of just $74.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $238.7 million, and it would be trading on a PE ratio of 65.3x, assuming you use a discount rate of 8.0%.

- Given the current share price of $82.94, the bearish analyst price target of $74.0 is 12.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.