Key Takeaways

- Strategic upgrades of retail assets and rapid leasing momentum in mixed-use projects position the company for outsized, sustained revenue and margin growth.

- Expansion through multifamily acquisitions and prudent balance sheet management enhances scale, operational efficiency, and resilience against market headwinds.

- High leverage, regional and sector concentration, shifting tenant demand, and elevated costs from regulations collectively threaten stability, margin growth, and long-term profitability.

Catalysts

About Armada Hoffler Properties- Armada Hoffler (NYSE: AHH) is a vertically integrated, self-managed real estate investment trust with over four decades of experience developing, building, acquiring, and managing high-quality retail, office, and multifamily properties located primarily in the Mid-Atlantic and Southeastern United States.

- Analyst consensus expects positive rent spreads and high occupancies to drive gradual NOI growth, but the robust repositioning of former big-box retail with premium tenants like Trader Joe's and Golf Galaxy at rent uplifts of up to 60 percent could spark a far greater and more sustained acceleration in recurring revenue and margin expansion than currently reflected in market valuations.

- While consensus recognizes resilient demand for mixed-use and multifamily assets in coastal and growth markets, current leasing momentum and faster-than-anticipated stabilization at projects like Allied in Harbor Point signal Armada Hoffler could unlock a powerful step-function in earnings growth, particularly as urban migration and live-work-play preferences accelerate beyond forecast levels.

- Armada Hoffler's embedded pipeline of multifamily acquisitions, including The Allure and Gainesville II, offers significant operational synergies and scale efficiencies in high-income, fast-growing jurisdictions, pointing to a meaningful runway for FFO and NAV expansion as these assets are integrated and optimized.

- The successful migration toward long-duration, fixed-rate institutional debt, alongside BBB investment-grade balance sheet discipline, positions Armada Hoffler to benefit disproportionately from increased institutional capital flows into REITs as interest rates moderate, lowering cost of capital and enhancing earnings resilience for years to come.

- With escalating construction and land costs constraining new supply, Armada Hoffler's proven ability to build and redevelop high-barrier, necessity-based mixed-use destinations makes its existing portfolio increasingly irreplaceable, strengthening pricing power and driving structurally higher revenue and margin growth well above what the sector at large can achieve.

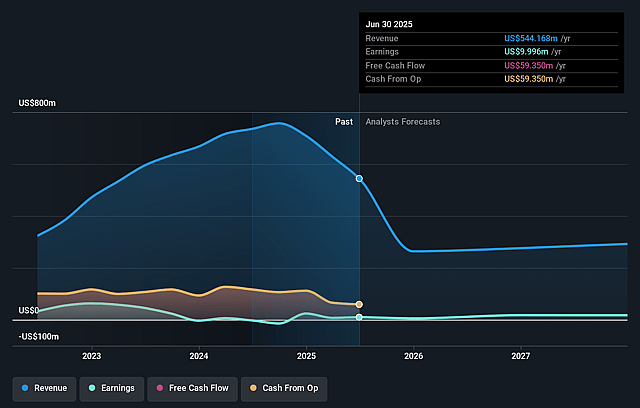

Armada Hoffler Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Armada Hoffler Properties compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Armada Hoffler Properties's revenue will decrease by 21.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.8% today to 7.4% in 3 years time.

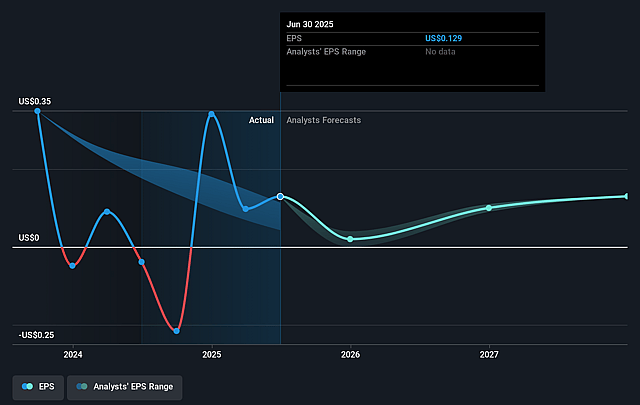

- The bullish analysts expect earnings to reach $19.7 million (and earnings per share of $0.13) by about September 2028, up from $10.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 74.5x on those 2028 earnings, up from 58.1x today. This future PE is greater than the current PE for the US REITs industry at 29.4x.

- Analysts expect the number of shares outstanding to grow by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.08%, as per the Simply Wall St company report.

Armada Hoffler Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained high leverage, with net debt to adjusted EBITDA at 7.7 times and an AFFO payout ratio approaching 97 percent after adjustments, leaves Armada Hoffler exposed to interest rate volatility and tighter credit conditions, which could compress net margins and constrain future earnings growth.

- Portfolio concentration in the Southeast and Mid-Atlantic regions increases vulnerability to regional economic downturns or demographic shifts, which could depress long-term occupancy rates and property-level income, ultimately pressuring total revenue and cash flow stability.

- Exposure to office and mixed-use properties makes Armada Hoffler susceptible to secular trends such as the ongoing adoption of hybrid and remote work, which may gradually erode office space demand and leasing revenue, raising the risk of vacancy and reducing earnings visibility.

- The retail portfolio's ongoing reliance on backfilling large vacancies and re-leasing to new tenants, in an era of e-commerce disruption and changing consumer habits, could lead to persistent vacancy risk, margin compression, and diminished property-level income if experiential or anchor tenant demand deteriorates.

- Elevated capital expenditures triggered by regulatory pressures, environmental standards, and the need for building improvements-such as the ongoing phased remediation for water intrusion at Greenside in Charlotte-could increase operating costs and reduce long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Armada Hoffler Properties is $10.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Armada Hoffler Properties's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.5, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $265.3 million, earnings will come to $19.7 million, and it would be trading on a PE ratio of 74.5x, assuming you use a discount rate of 10.1%.

- Given the current share price of $7.24, the bullish analyst price target of $10.5 is 31.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.