Key Takeaways

- Persistent remote work, retail transformation, and demographic shifts threaten occupancy, rent growth, and long-term revenue across office, retail, and multifamily assets.

- High leverage and coastal climate risk expose earnings and shareholder value to interest rate, refinancing, insurance, and capital expenditure pressures.

- Strong demand for core properties, proactive asset management, and strategic geographic focus support recurring revenue growth, earnings stability, and financial flexibility.

Catalysts

About Armada Hoffler Properties- Armada Hoffler (NYSE: AHH) is a vertically integrated, self-managed real estate investment trust with over four decades of experience developing, building, acquiring, and managing high-quality retail, office, and multifamily properties located primarily in the Mid-Atlantic and Southeastern United States.

- Armada Hoffler's heavy exposure to office and mixed-use assets in secondary markets could become increasingly problematic as hybrid and remote work trends persist, potentially suppressing occupancy rates and rent growth and directly impacting long-term revenue and net operating income expansion.

- Elevated net leverage-standing at 7.7 times EBITDA, with only a slow expected reduction-magnifies risk in a persistently high interest rate and inflation environment, making the company more vulnerable to increased debt service costs and potential refinancing challenges, which will pressure net margins and earnings.

- The continued retail transformation driven by e-commerce threatens Armada Hoffler's sizable retail portfolio, where further store closures or bankruptcies among national tenants could drive up vacancy rates, compress net operating income, and slow AFFO per share growth over the long term.

- Many of Armada Hoffler's growth markets in the Southeast may face slowing population growth and demographic shifts, such as an aging population and weaker-than-expected net migration, leading to a reduced demand backdrop for multifamily and retail developments and ultimately capping future revenue and NOI growth.

- An increasing frequency and severity of climate-related events, especially in coastal regions where much of Armada Hoffler's portfolio is concentrated, will likely drive up insurance and capital expenditures, potentially force property write-downs, and erode earnings stability and shareholder value over time.

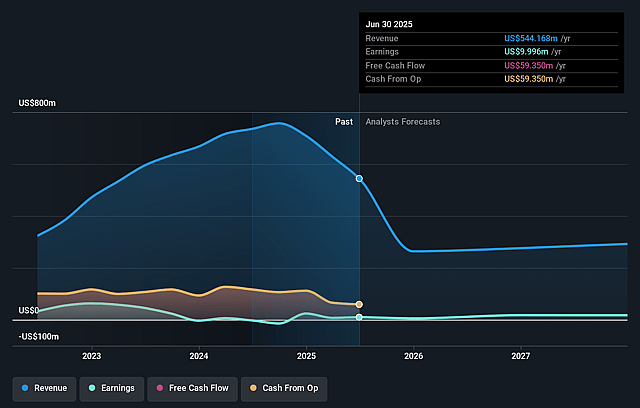

Armada Hoffler Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Armada Hoffler Properties compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Armada Hoffler Properties's revenue will decrease by 22.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.8% today to 8.3% in 3 years time.

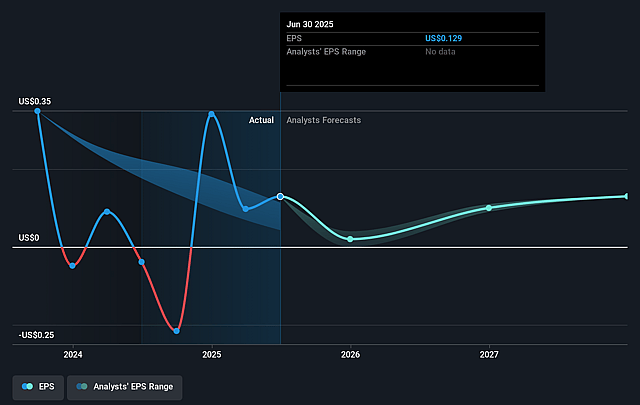

- The bearish analysts expect earnings to reach $20.9 million (and earnings per share of $0.13) by about August 2028, up from $10.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 46.8x on those 2028 earnings, down from 56.9x today. This future PE is greater than the current PE for the US REITs industry at 29.6x.

- Analysts expect the number of shares outstanding to grow by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.05%, as per the Simply Wall St company report.

Armada Hoffler Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High and stable occupancy rates across office and retail assets, combined with strong positive re-leasing spreads-such as 96.3 percent occupancy in office and 11.7 percent renewal spreads-suggest resilient demand for Armada Hoffler's core properties, supporting recurring rental revenue and reducing the likelihood of downward pressure on net operating income.

- The successful backfilling of former big-box retail vacancies with higher-credit tenants at significantly higher rents-including increases of 33 percent to 60 percent-demonstrates proactive asset management and the ability to capture embedded rental upside, which could drive both revenue and property-level income growth in the long term.

- Strategic focus on mixed-use, walkable communities in high-growth Southeastern markets, such as Virginia Beach and the Atlanta suburbs, aligns Armada Hoffler with demographic and secular urbanization trends, potentially ensuring sustained tenant demand and supporting future rental growth and portfolio appreciation that could buoy earnings.

- The company's transition to a simpler, fixed-rate, long-duration capital structure via a $115 million private placement, reduction in variable debt, and rightsizing of the dividend has improved financial flexibility and decreased interest rate risk, boosting the potential for stable net margins and consistent AFFO per share over time.

- Expanding high-quality multifamily assets in markets with favorable household incomes, strong school districts, and operating synergies-such as the acquisition of The Allure and Gainesville II-positions Armada Hoffler to grow recurring net operating income, diversify cash flows, and support long-term earnings stability and growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Armada Hoffler Properties is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Armada Hoffler Properties's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.5, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $252.9 million, earnings will come to $20.9 million, and it would be trading on a PE ratio of 46.8x, assuming you use a discount rate of 10.0%.

- Given the current share price of $7.09, the bearish analyst price target of $7.0 is 1.3% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.