Key Takeaways

- Capitalizing on rent escalations and market-rate leases aims to enhance revenue and occupancy, boosting earnings and growth.

- Strategic acquisitions and asset densification efforts focus on increasing property value and rental income, positively impacting net margins.

- Diversified high-quality portfolio and strategic market positioning bolster revenue stability, supported by strong bond issuance enhancing liquidity and financial flexibility.

Catalysts

About American Assets Trust- A full service, vertically integrated and self-administered real estate investment trust ("REIT"), headquartered in San Diego, California.

- The company plans to capitalize on embedded rent escalations and bring below-market leases to market, which is expected to positively impact revenue growth in the future.

- Future lease-up and stabilization of new office developments and redevelopments could enhance occupancy rates and rental income, potentially boosting overall earnings.

- Anticipated return of Asian tourism to Oahu is expected to drive growth in hotel revenues, contributing positively to the company's earnings.

- Focused efforts on densifying existing assets to unlock multifamily development opportunities could lead to increased property value and rental revenue, impacting net margins positively.

- Pursuing accretive acquisitions aligned with strategic goals could drive growth through increased asset base and rental income, which could positively impact earnings and net margins.

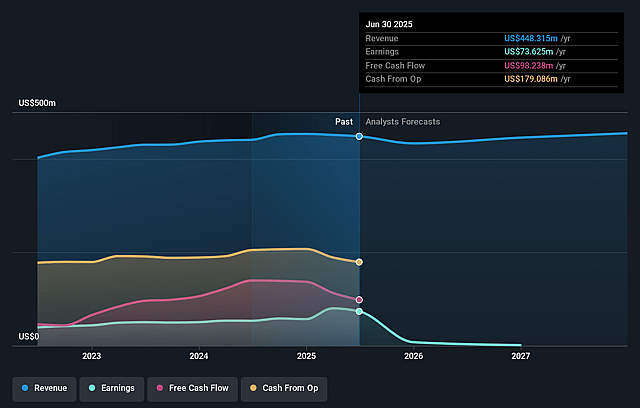

American Assets Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Assets Trust's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.9% today to 0.1% in 3 years time.

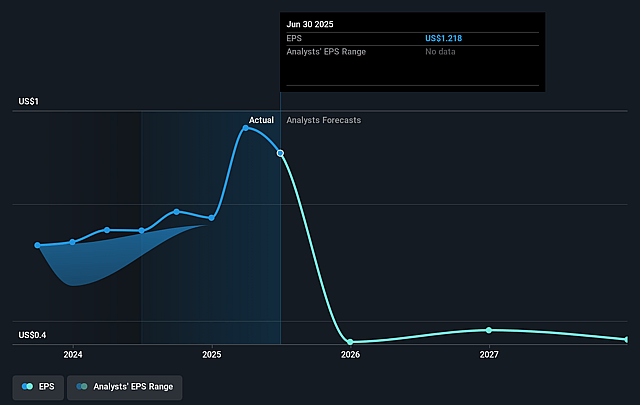

- Analysts expect earnings to reach $290.0 thousand (and earnings per share of $0.81) by about January 2028, down from $58.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 0.0x on those 2028 earnings, down from 25.7x today. This future PE is lower than the current PE for the US REITs industry at 25.7x.

- Analysts expect the number of shares outstanding to decline by 83.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

American Assets Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- American Assets Trust has a diversified, high-quality portfolio with a strong operating platform and experienced management team, which can help maintain stable revenue streams despite economic uncertainties.

- The company successfully issued a $525 million bond with strong demand and favorable rates, enhancing liquidity and financial flexibility, potentially positively impacting earnings and reducing financing risk.

- Their retail segment has been performing well, with increases in leasing spreads and tenant sales, suggesting continued resilience in consumer spending and stable retail revenue.

- Multifamily properties are experiencing strong demand and occupancy rates, with year-over-year increases in net operating income and rents, which could lead to stable or growing revenue in the multifamily segment.

- The company is positioned in high barrier-to-entry markets like San Diego with a well-diversified economy, which may lead to stable or increased leasing activity and net margins, especially as companies enforce return-to-office mandates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.0 for American Assets Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $487.2 million, earnings will come to $290.0 thousand, and it would be trading on a PE ratio of 0.0x, assuming you use a discount rate of 7.9%.

- Given the current share price of $24.6, the analyst's price target of $26.0 is 5.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.