Key Takeaways

- Regulatory changes in key states and at the federal level could unlock new markets, enhance margins, and increase liquidity for Jushi.

- Strategic retail expansion and product innovation are expected to drive higher revenue, lower costs, and capture greater market share.

- Eroding profit margins, high debt, geographic concentration, and regulatory uncertainty heighten risks to Jushi's growth, earnings stability, and future expansion opportunities.

Catalysts

About Jushi Holdings- A vertically integrated cannabis company, engages in the cultivation, processing, retail, and distribution of cannabis for the medical and adult-use markets in the United States.

- The company is poised to benefit from expected regulatory shifts in Pennsylvania and Virginia, where bipartisan and bicameral discussions on adult-use legalization and favorable gubernatorial election polling could unlock significant increases in Jushi's addressable market. If realized, this would provide a material uplift to revenue, cash flow, and operating margins by leveraging existing infrastructure and underutilized fixed costs.

- Expansion of Jushi's retail footprint, particularly in strategically selected, limited-license states such as Ohio and New Jersey, aligns with growing consumer demand, adding new revenue streams and improving scale efficiencies, which should further support margin expansion over the next several quarters.

- Implementation of vertically integrated cultivation and processing improvements, along with planned canopy expansions, are projected to drive lower unit costs and enhance yields; this positions Jushi to capture greater gross profit and expand net margins as new harvests come online and adult-use sales ramp up.

- Broadening and innovating within the branded product portfolio-such as the launch of new high-margin SKUs and strong proprietary brands-positions Jushi to capture a greater share of the mainstream wellness and cannabis-derived product markets, potentially increasing average transaction values and strengthening overall gross margin.

- Anticipated federal-level reforms, including more favorable tax treatment and potential rescheduling of cannabis, could significantly improve access to capital, reduce non-cash expenses, and enhance liquidity, positively impacting earnings and making Jushi more attractive from a financial standpoint if and when regulatory changes materialize.

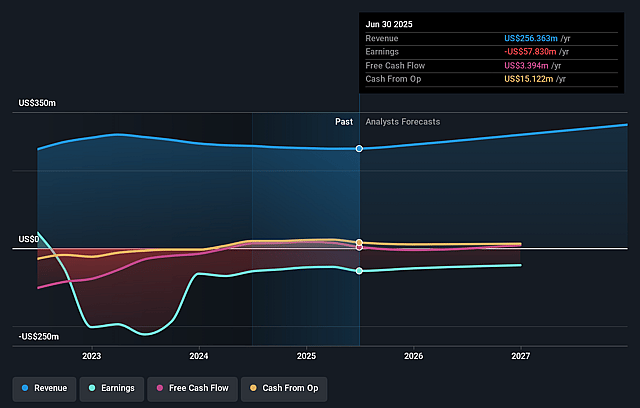

Jushi Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jushi Holdings's revenue will grow by 8.6% annually over the next 3 years.

- Analysts are not forecasting that Jushi Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Jushi Holdings's profit margin will increase from -22.6% to the average US Pharmaceuticals industry of 23.2% in 3 years.

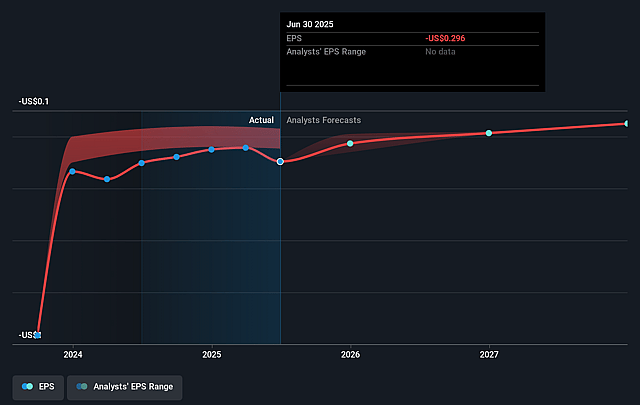

- If Jushi Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $76.2 million (and earnings per share of $0.39) by about September 2028, up from $-57.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.2x on those 2028 earnings, up from -2.3x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 19.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.8%, as per the Simply Wall St company report.

Jushi Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent competitive pricing pressure across key retail markets, as noted by management, continues to erode gross profit margins (from 50% a year ago to 44%), causing revenue growth to outpace profitability and creating risk to future net margins and earnings.

- Material declines in wholesale revenue-particularly in Virginia and Massachusetts-demonstrate Jushi's growing reliance on internal retail channels and expose the company to risks from limited geographic diversification and heightened market concentration, which could increase revenue volatility.

- Jushi remains burdened by significant debt ($192 million outstanding), with future refinancing subject to uncertain industry conditions and cost of capital; this leverage, alongside continued net losses, increases risk of future dilution or limits ability to fund growth, ultimately impacting earnings per share.

- The company's aggressive retail expansion is increasingly being scaled back in favor of capital-light projects, reflecting a need for prudent cash management but also highlighting the risk of saturating markets and possibly slower top-line growth than originally anticipated, affecting both revenues and future expansion opportunities.

- The outlook for growth is heavily dependent on uncertain state-level regulatory changes (e.g., adult-use legalization in Pennsylvania and Virginia) and favorable macro trends; any delays, failure to enact reform, or continued pressure from illicit channels and hemp-derived cannabinoids could constrain Jushi's addressable market, impairing revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $1.0 for Jushi Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $328.3 million, earnings will come to $76.2 million, and it would be trading on a PE ratio of 3.2x, assuming you use a discount rate of 7.8%.

- Given the current share price of $0.68, the analyst price target of $1.0 is 32.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.