Narratives are currently in beta

Key Takeaways

- Osteoarthritis and dermatology franchises show robust revenue potential, driven by strong product demand and market needs, indicating further growth opportunities.

- Strategic divestitures and international expansion enhance capital allocation, net margins, and earnings growth, particularly in companion animal pharmaceuticals and emerging markets.

- Increased competition, execution risks, and macroeconomic challenges could impact Zoetis' financial growth and market positioning, especially with unsustainable pricing strategies in volatile markets.

Catalysts

About Zoetis- Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, and diagnostic products and services in the United States and internationally.

- The osteoarthritis pain franchise, led by products Librela and Solensia, is showing significant potential for revenue growth. Global operational revenue from these products grew by 97%, driven by their ability to address unmet needs in canine osteoarthritis treatment. This trajectory supports further revenue growth as market penetration in the U.S. is currently high but has room for expansion.

- The Simparica franchise's growth, spurred by its flagship product Simparica Trio, demonstrates robust demand even amidst competition. This supports not only revenue growth but also a positive impact on net margins as operational efficiencies scale.

- The dermatology franchise, led by APOQUEL and CYTOPOINT, continues to benefit from established market dominance and innovation. As unmet dermatological needs in veterinary medicine continue, revenue within this segment is expected to grow.

- The divestiture of medicated feed additives illustrates Zoetis' strategic capital allocation, allowing reinvestment into higher growth potential areas such as companion animal pharmaceuticals. This is expected to improve net margins and support earnings growth.

- International market expansion remains a significant growth catalyst. With key international revenues still experiencing double-digit growth and uncapitalized potential in emerging markets, there is a strong outlook for future revenue increase.

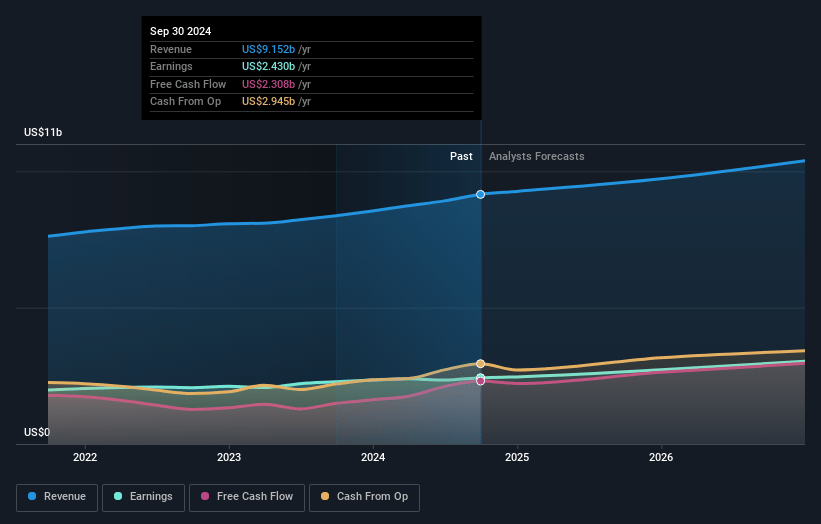

Zoetis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zoetis's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.6% today to 30.4% in 3 years time.

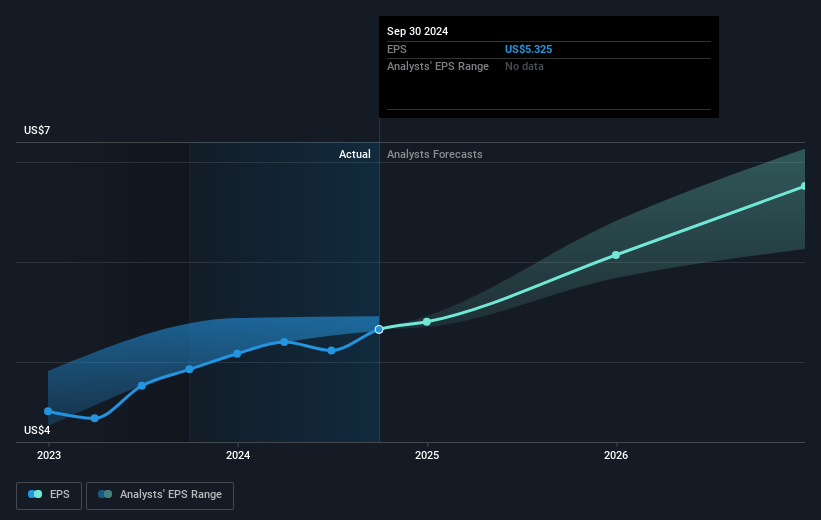

- Analysts expect earnings to reach $3.3 billion (and earnings per share of $7.45) by about December 2027, up from $2.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.1x on those 2027 earnings, up from 31.7x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 18.6x.

- Analysts expect the number of shares outstanding to decline by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Zoetis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of Zoetis' medicated feed additives and certain water-soluble products could result in a loss of revenue, impacting overall financial growth projections.

- Increased competition for key products, such as Simparica Trio and Apoquel, could result in price pressures, potentially affecting net margins and market share.

- Dependence on new product launches and market penetration of products like Librela presents execution risk, which could impact revenue and growth if adoption is slower than expected.

- The company's reliance on increased pricing, especially in hyperinflationary markets like Argentina, may not be sustainable long-term and could impact the overall pricing strategy and profitability.

- Macroeconomic challenges, including exchange rate volatility and geopolitical uncertainties, may influence international growth prospects and contribute to earnings fluctuations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $214.22 for Zoetis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $248.0, and the most bearish reporting a price target of just $180.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $10.9 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 34.1x, assuming you use a discount rate of 5.9%.

- Given the current share price of $170.79, the analyst's price target of $214.22 is 20.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives