Narratives are currently in beta

Key Takeaways

- High-impact innovation and strategic M&A activities drive revenue growth through customer adoption, operational efficiencies, and new market opportunities.

- Strong positioning in key markets, combined with process optimization, enhances revenue, market share, and profit margins through cost management.

- Market declines and economic uncertainties, especially in pharma, biotech, and China, pose risks to revenue and operating margin growth despite strategic innovations.

Catalysts

About Thermo Fisher Scientific- Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

- Thermo Fisher Scientific is leveraging high-impact innovation, such as the recent launches and industry recognition of products like the Gibco CTS Detachable Dynabeads and the Thermo Scientific Orbitrap Astral Mass Spectrometer, which are expected to drive future revenue growth through continued customer adoption and technological advancements.

- Expansion plans, such as the enhancement of solid dose formulation capabilities and laboratory services globally, indicate a strategy to meet increasing customer demands which could positively impact the company's revenue growth and operational efficiencies, potentially boosting future net margins.

- Strong customer relationships and strategic positioning in key markets like China, where government stimulus and economic improvements are anticipated, position Thermo Fisher to capitalize on future market opportunities, potentially enhancing revenue and market share gains.

- The company's PPI Business System, focused on process improvement and efficiency gains, is likely to continue contributing to cost management and operational optimization, supporting stronger profit margins and earnings growth.

- Strategic M&A activities, such as the recent acquisition of Olink and its integration into operations, are expected to expand Thermo Fisher's capabilities in areas like proteomics research, opening new revenue streams and contributing to earnings growth through synergies and market penetration.

Thermo Fisher Scientific Future Earnings and Revenue Growth

Assumptions

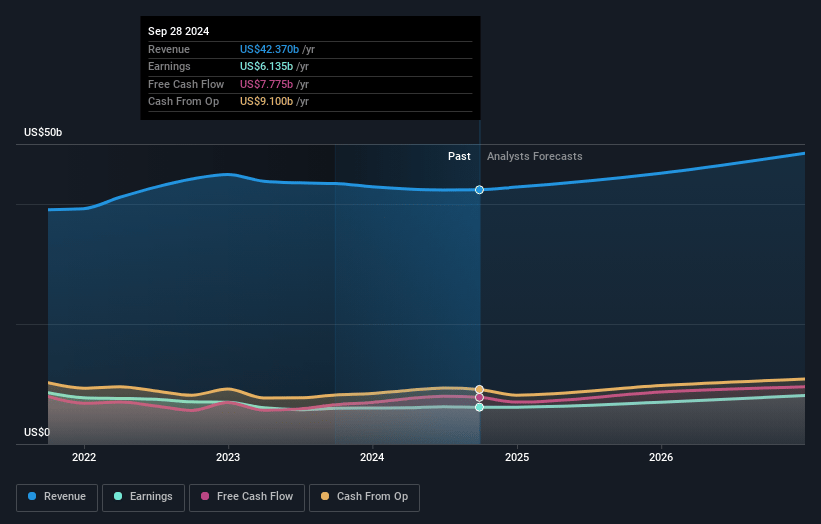

How have these above catalysts been quantified?- Analysts are assuming Thermo Fisher Scientific's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.5% today to 17.1% in 3 years time.

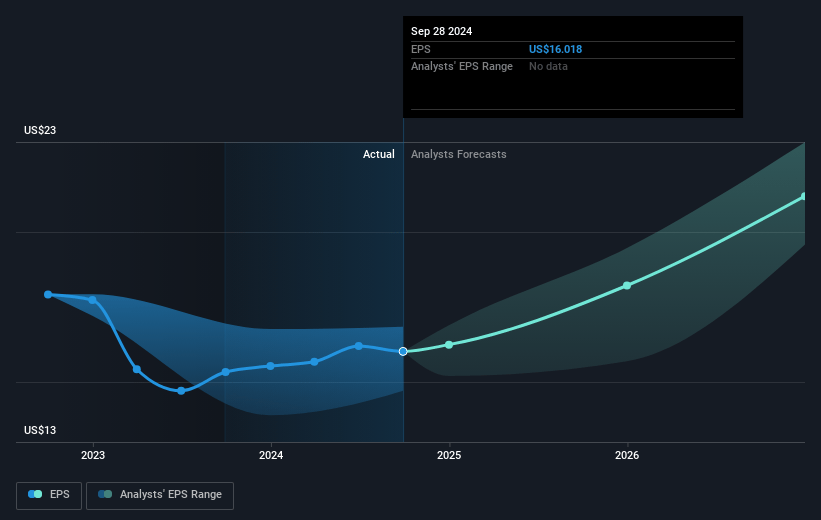

- Analysts expect earnings to reach $8.6 billion (and earnings per share of $22.73) by about December 2027, up from $6.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $9.6 billion in earnings, and the most bearish expecting $7.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.8x on those 2027 earnings, up from 33.0x today. This future PE is lower than the current PE for the US Life Sciences industry at 45.5x.

- Analysts expect the number of shares outstanding to decline by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.65%, as per the Simply Wall St company report.

Thermo Fisher Scientific Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced a sequential decline in the pharma and biotech segment due to the runoff of vaccine and therapy revenue, and market conditions in this area remain muted, which could impact future revenue growth and earnings.

- Growth in the diagnostics and healthcare segment was reported as flat for the quarter, partly due to the runoff of COVID-19 testing-related revenue, posing a risk to revenue stability in that market.

- The headwinds from pandemic-related revenue decline, specifically vaccines and therapies, represent a significant impact on revenue, with an anticipated $1.3 billion to $1.4 billion decrease year-over-year, which affects the company's overall revenue and margins.

- China's market conditions have been described as muted, with economic improvements and stimulus impacts expected mostly in 2025, creating potential risks to revenue growth and financial results in the short term.

- Despite the company's growth strategy and strong technological innovations, market declines, and economic uncertainties, especially in regions like China and segments like pharma and biotech, pose key risks to maintaining revenue and operating margin growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $652.98 for Thermo Fisher Scientific based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $767.0, and the most bearish reporting a price target of just $585.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $50.5 billion, earnings will come to $8.6 billion, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of $528.84, the analyst's price target of $652.98 is 19.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives