Key Takeaways

- Optimizing the Engineering segment and strategic shifts towards ready-to-use systems are expected to drive cost savings, improve margins, and boost productivity.

- Recovery in vial orders and capacity expansion projects aim to enhance revenue and profitability through increased high-value solution offerings.

- High costs and inefficiencies from new sites, along with uncertain vial market recovery, pose risks to profitability and top-line growth.

Catalysts

About Stevanato Group- Engages in the design, production, and distribution of products and processes to provide integrated solutions for bio-pharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

- The ongoing optimization plan in the Engineering segment, including efficient project completions and operational restructuring, is expected to drive future cost savings and boost productivity, likely improving net margins.

- The anticipated recovery in vial orders towards the end of 2024 into 2025, driven by inventory normalization among customers, should favorably impact revenue growth.

- The multiyear capacity expansion projects in Fishers and Latina, with commercial production already started, are set to increase high-value solution offerings, expected to enhance revenue and gross profit margins.

- Strong demand for high-value solutions, such as biologics and ready-to-use systems, supports expanded capacity investment and is likely to boost revenue growth and overall profitability.

- The strategic shift towards ready-to-use vials and cartridges is expected to enhance production efficiency and compliance, potentially leading to increased revenue and improved operating margins as adoption grows.

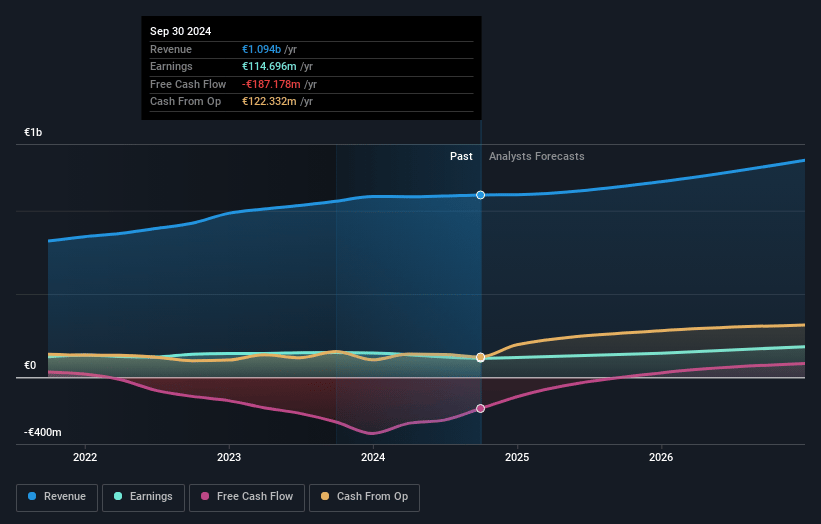

Stevanato Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Stevanato Group's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.5% today to 14.7% in 3 years time.

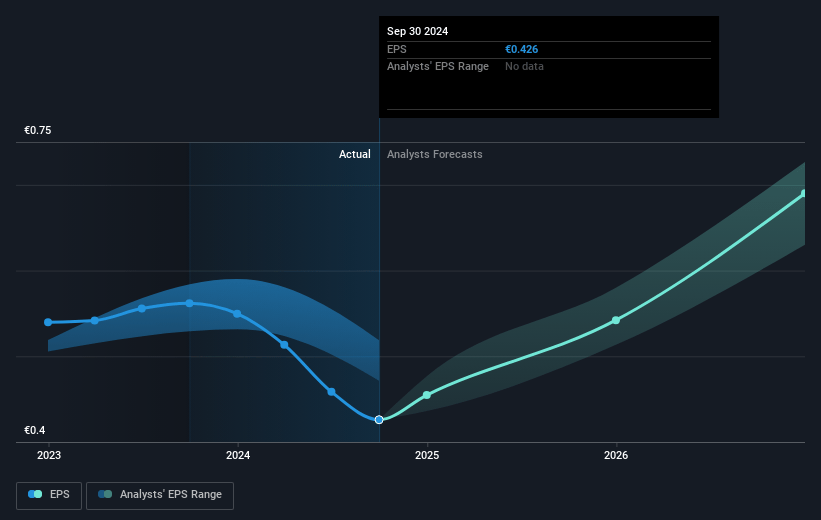

- Analysts expect earnings to reach €210.6 million (and earnings per share of €0.77) by about January 2028, up from €114.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.3x on those 2028 earnings, down from 47.7x today. This future PE is lower than the current PE for the US Life Sciences industry at 45.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.93%, as per the Simply Wall St company report.

Stevanato Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing higher costs in the Engineering segment due to its optimization plan, and there are temporary inefficiencies associated with starting new manufacturing sites, which could impact net margins and profitability.

- Vial destocking remains a concern, with inventory normalization expected to extend into 2025, creating uncertainty and potentially impacting revenue growth.

- The ramp-up of new manufacturing facilities in Fishers and Latina is incurring significant startup costs and inefficiencies, affecting gross profit margins and resulting in negative free cash flow.

- Stevanato has lowered its guidance for adjusted EBITDA and EPS for the full year, indicating current challenges that might negatively affect earnings.

- The recovery in the vial market, a critical revenue driver, is uncertain and dependent on customer inventory strategies, which presents risks to achieving forecasted top-line growth in the near term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.41 for Stevanato Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.4 billion, earnings will come to €210.6 million, and it would be trading on a PE ratio of 42.3x, assuming you use a discount rate of 8.9%.

- Given the current share price of $20.91, the analyst's price target of $26.41 is 20.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives