Narratives are currently in beta

Key Takeaways

- The acquisition of VTAMA and its potential approval could significantly expand Organon's market, driving revenue growth and improving net margins by 2026.

- NEXPLANON's growth and new biosimilars launches support sustained revenue growth and strategic enhancement of profit margins.

- Competitive and pricing pressures, coupled with loss of exclusivity, threaten revenue growth and profitability, while Dermavant acquisition risks diluting margins.

Catalysts

About Organon- Develops and delivers health solutions through a portfolio of prescription therapies and medical devices within women’s health in the United States and internationally.

- The acquisition of Dermavant and its key asset, VTAMA, presents a significant growth opportunity in the atopic dermatitis market. VTAMA’s potential approval for a new indication could address a large unmet need, significantly expanding the market and driving future revenue growth.

- Organon expects VTAMA to achieve at least $150 million in sales in 2025, with growth potential to $0.5 billion over the next 3 to 5 years, contributing to a substantial revenue increase.

- The addition of VTAMA and Organon’s leverage in dermatology could improve net margins in the medium term, as VTAMA is expected to become accretive to earnings by 2026 as revenue accelerates and synergies are realized.

- NEXPLANON, a leading product in the contraception market, is expected to reach $1 billion in revenue in 2025. The U.S. growth, aided by pricing strategies and expanding indications, supports continued robust revenue growth.

- The biosimilars franchise, with new asset launches such as denosumab and potential launches in 2025 and beyond, provides a pipeline for revenue growth and a strategic approach to sustaining and enhancing profit margins.

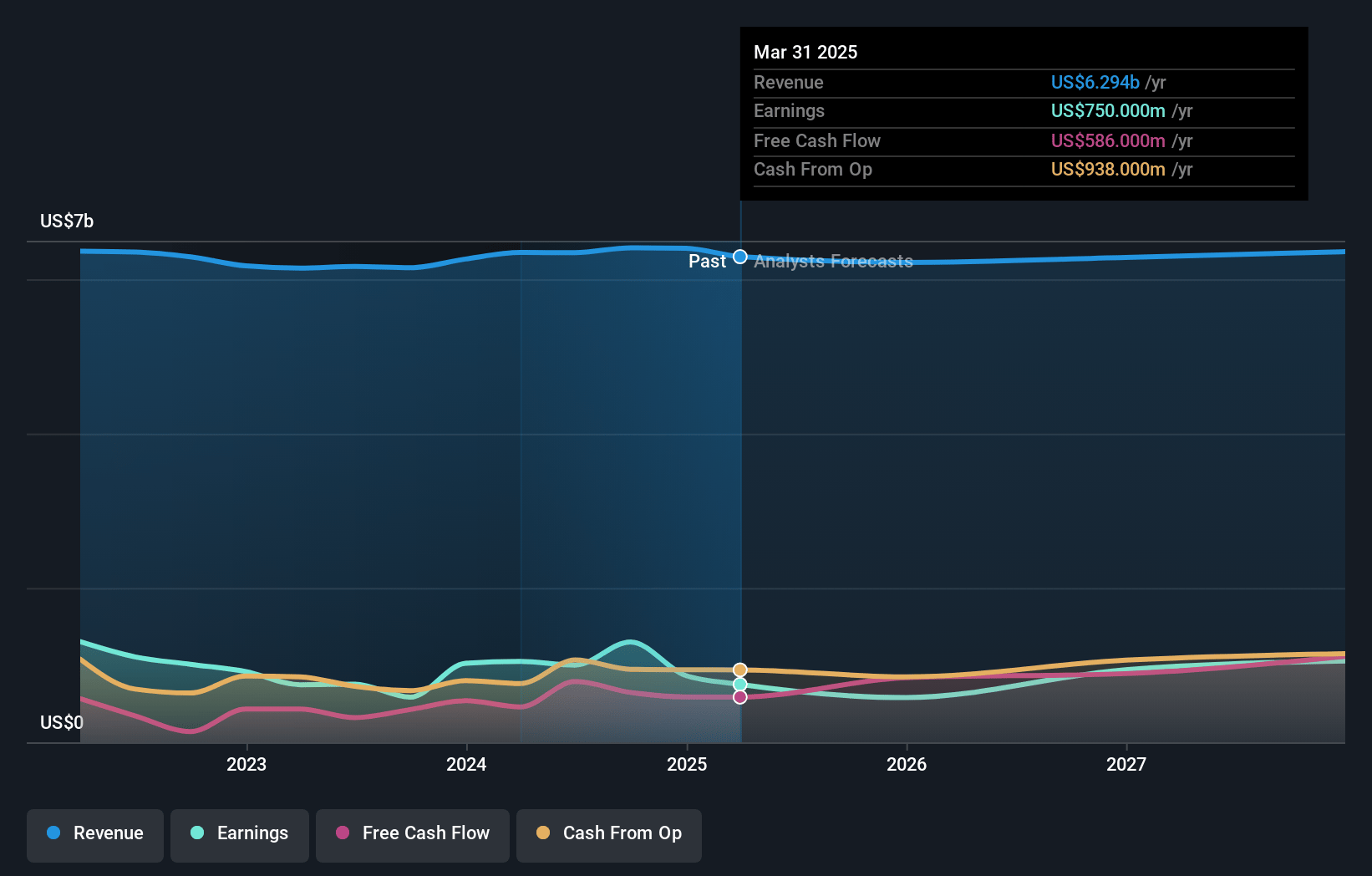

Organon Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Organon's revenue will decrease by -0.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.3% today to 14.1% in 3 years time.

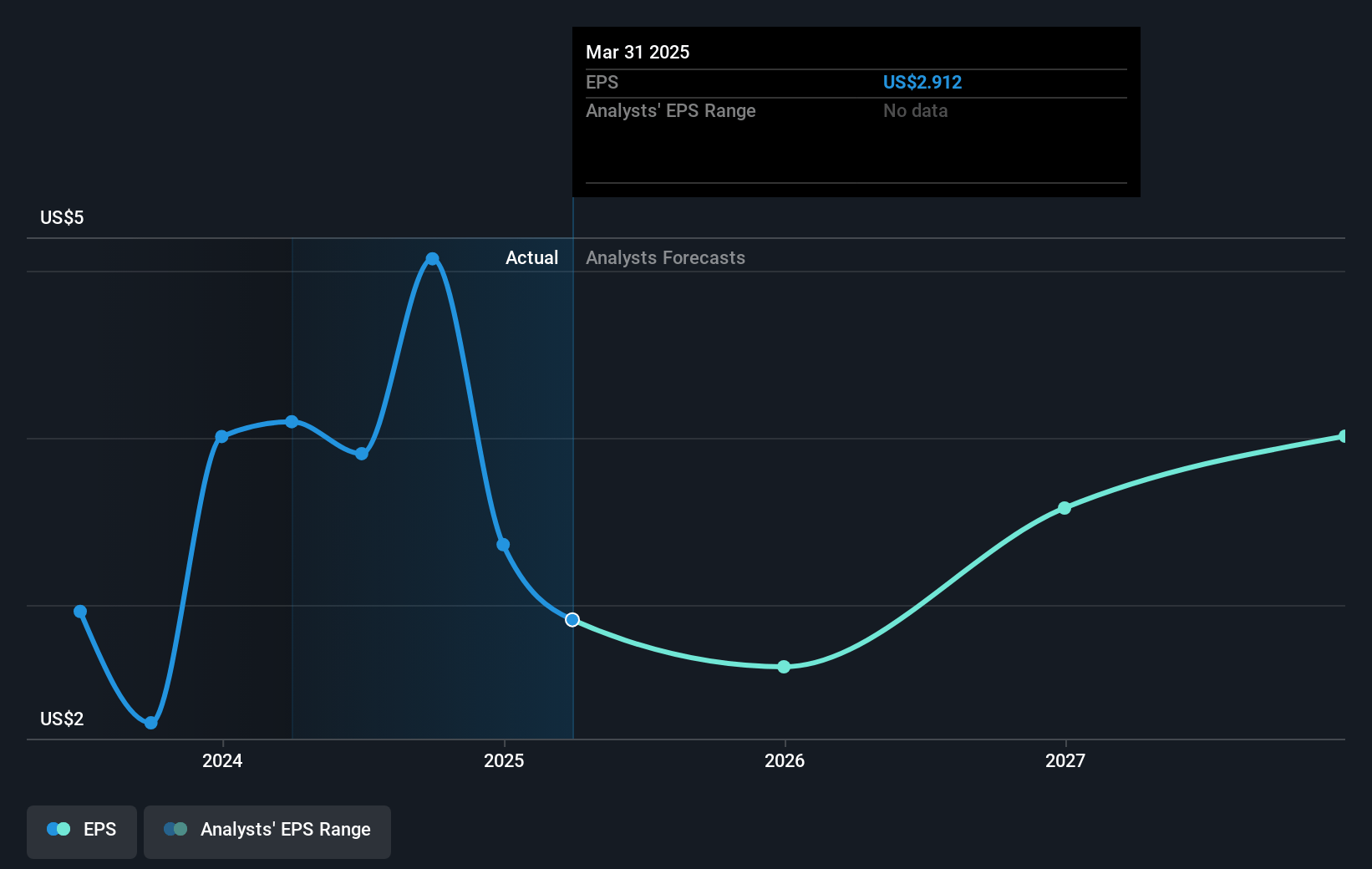

- Analysts expect earnings to reach $884.5 million (and earnings per share of $3.4) by about January 2028, down from $1.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, up from 3.0x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

Organon Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Pricing pressures in mature U.S. products like DULERA, RENFLEXIS, and NuvaRing could negatively impact revenue and gross margins.

- Loss of exclusivity (LOE) for key products like Atozet in Europe might reduce revenue growth and affect overall profitability.

- Mandatory pricing reductions in Japan, particularly in the cardio and respiratory portfolios, present a significant pricing headwind, impacting net margins.

- Competitive pressures, including the launch of generic alternatives, could slow down NEXPLANON's market share expansion, impacting future earnings.

- The Dermavant acquisition is expected to be dilutive to EBITDA margins in 2025, thus potentially impacting net profitability if VTAMA sales do not meet expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.25 for Organon based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $29.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.3 billion, earnings will come to $884.5 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of $14.92, the analyst's price target of $22.25 is 32.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives