Last Update07 May 25Fair value Increased 0.83%

AnalystHighTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Sustained demand for real-world evidence, advanced analytics, and proprietary platforms is driving high-margin revenue growth and stronger recurring earnings visibility.

- Expansion in emerging markets and adoption of AI technologies are enhancing operational efficiency, diversifying revenue streams, and supporting long-term earnings stability.

- Heightened regulation, pricing pressure, client concentration, and tech-driven competition threaten IQVIA’s growth prospects, profitability, and ability to maintain premium service differentiation.

Catalysts

About IQVIA Holdings- Provides clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries in the Americas, Europe, Africa, and the Asia-Pacific.

- IQVIA’s robust double-digit growth in real-world evidence (RWE) is set to accelerate further as both regulatory bodies and pharmaceutical companies increasingly require these analytics for pricing, safety, and effectiveness demonstrations. The recent pivot towards RWE in drug approvals and the pent-up demand from delayed projects are likely to drive sustained, high-margin revenue expansion.

- As aging populations and the rise of chronic diseases continue to increase global healthcare spending, IQVIA’s expertise in complex clinical trials and deep data assets position it to capture a growing share of new drug launches and pipeline expansion, supporting reliable topline growth.

- The continued integration of advanced AI, automation, and machine learning into clinical trial delivery is already generating measurable productivity gains, such as threefold reduction in delivery time and 30% cost savings in pilot use cases. Scaling these technologies across the business is expected to structurally improve operational efficiency and gradually lift net margins.

- Investment in proprietary datasets, technology platforms, and expanding recurring service relationships, especially in real-world and commercialization support for new therapies, will lock in higher recurring revenue streams and improve earnings visibility as biopharma customers consolidate spend with leading partners like IQVIA.

- IQVIA continues to expand in emerging markets, with growing penetration in Asia-Pacific and Latin America providing diversification benefits and offering new revenue engines, helping to underpin long-range earnings and mitigate regional slowdowns in the US or Europe.

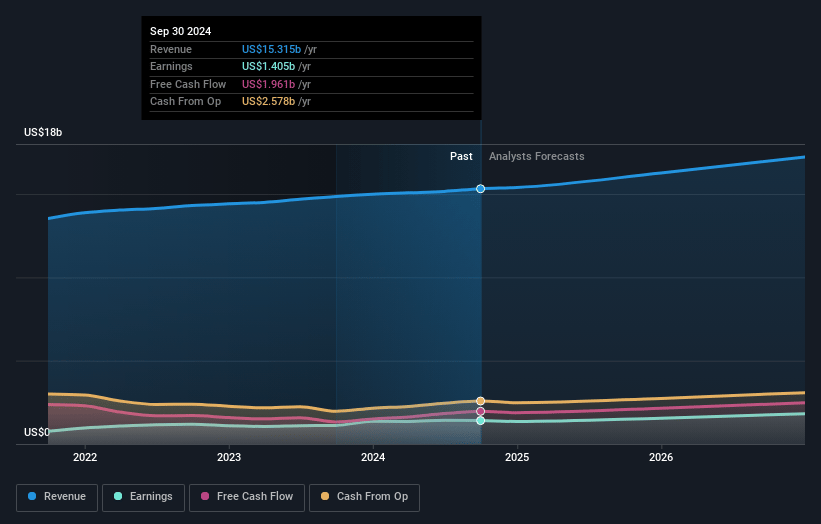

IQVIA Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on IQVIA Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming IQVIA Holdings's revenue will grow by 5.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.6% today to 12.7% in 3 years time.

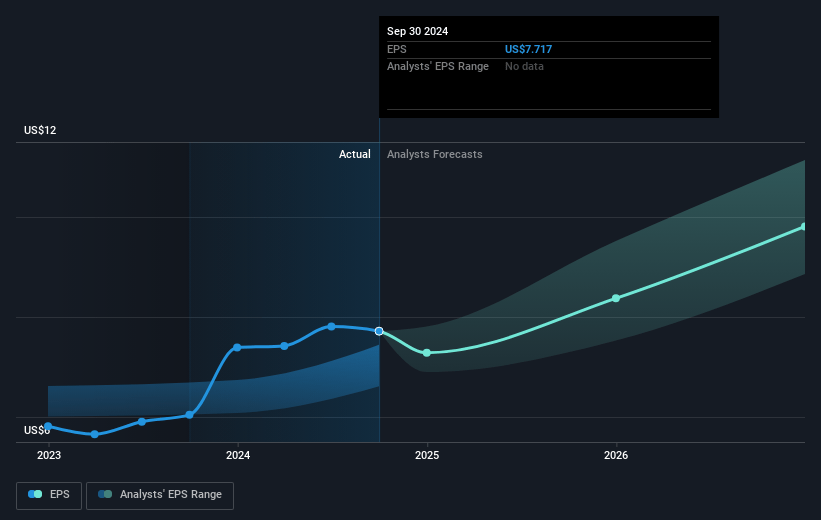

- The bullish analysts expect earnings to reach $2.3 billion (and earnings per share of $12.67) by about May 2028, up from $1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.0x on those 2028 earnings, up from 19.3x today. This future PE is lower than the current PE for the US Life Sciences industry at 36.1x.

- Analysts expect the number of shares outstanding to decline by 4.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

IQVIA Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing global data privacy regulations and heightened scrutiny of healthcare data could significantly raise compliance costs for IQVIA, limiting their ability to efficiently collect and monetize large-scale healthcare data, which would likely negatively affect long-term revenue growth and profitability.

- Persistent pressure from payers and governments to reduce healthcare costs may force IQVIA’s large pharmaceutical clients to prioritize internal cost controls, leading to lower spending on outsourced clinical trial and real-world evidence projects, ultimately constraining IQVIA’s revenue and net margin expansion over time.

- Accelerating adoption of artificial intelligence in healthcare and clinical research poses the risk that pharmaceutical and biotech companies bring more R&D and data analysis capabilities in-house; IQVIA’s heavy investment in AI and infrastructure may not generate adequate competitive differentiation or return on investment if clients become less dependent on external providers, leading to margin erosion and weaker earnings growth.

- A growing dependence on a concentrated group of large pharma clients introduces revenue concentration risk, as any loss of a major contract or increased pricing pressure from these customers due to their bargaining power could lead to significant drops in revenue and compressed net margins for IQVIA.

- Rising competition from both legacy contract research organizations and technology-driven new entrants, combined with industry shifts toward decentralized and virtual clinical trials, threatens to commoditize IQVIA’s core service offerings and may reduce its ability to secure premium pricing or expand market share, thus hindering long-term revenue growth and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for IQVIA Holdings is $268.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IQVIA Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $268.0, and the most bearish reporting a price target of just $160.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $18.4 billion, earnings will come to $2.3 billion, and it would be trading on a PE ratio of 22.0x, assuming you use a discount rate of 7.8%.

- Given the current share price of $146.2, the bullish analyst price target of $268.0 is 45.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.