Narratives are currently in beta

Key Takeaways

- Restructuring initiatives and cost-cutting efforts aim to enhance operating margins and earnings while capturing market share through client-centric technology initiatives.

- Robust growth in Manufacturing Solutions and strong cash flow leverage support profitability, foster shareholder value, and improve earnings potential.

- Challenging biopharmaceutical demand and restructuring pressures could impact revenues and margins, while internal adjustments aim to sustain growth despite macroeconomic headwinds.

Catalysts

About Charles River Laboratories International- Charles River Laboratories International, Inc.

- Charles River Laboratories is undertaking significant restructuring initiatives to cut costs, optimize their global footprint, and streamline operations, which are expected to generate approximately $200 million in cumulative annualized cost savings by 2026. This will positively impact operating margins and overall earnings as these savings are realized.

- The company is focusing on commercial enhancements to promote a client-centric approach, which is intended to capture additional market share and drive revenue growth, particularly through technology initiatives like their Apollo platform and RMS e-commerce.

- There is an expectation of a gradual recovery in demand from biotech clients as funding indicators are showing more favorable trends than the previous year. This could translate to improved revenue growth in the coming quarters.

- The Manufacturing Solutions segment is experiencing robust revenue growth, with high single-digit organic growth expected for the full year, driven by strong performance in the CDMO and Biologics Testing businesses. This segment has a high operating margin, which supports overall profitability and earnings growth.

- Charles River is leveraging strong free cash flow generation to rebalance capital allocation priorities, including modest stock repurchases. This, combined with the planned reduction of debt and restructuring efforts, positions the company for enhanced shareholder value and potentially improved earnings per share.

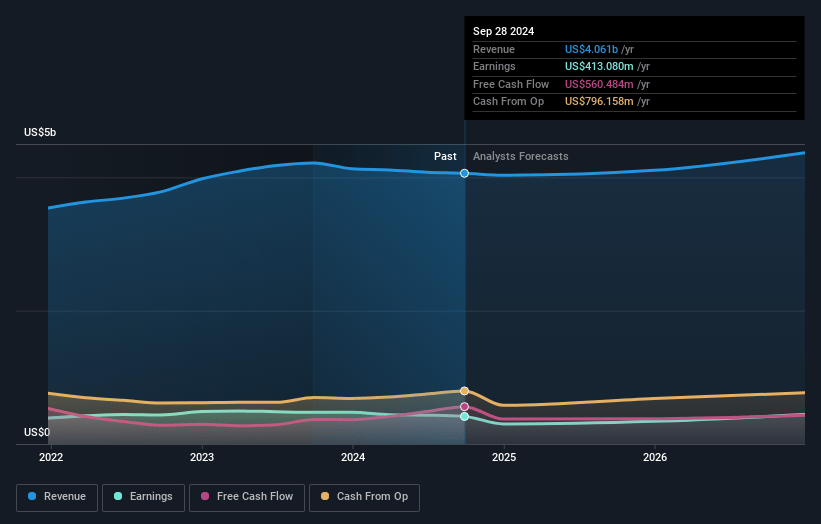

Charles River Laboratories International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Charles River Laboratories International's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 10.6% in 3 years time.

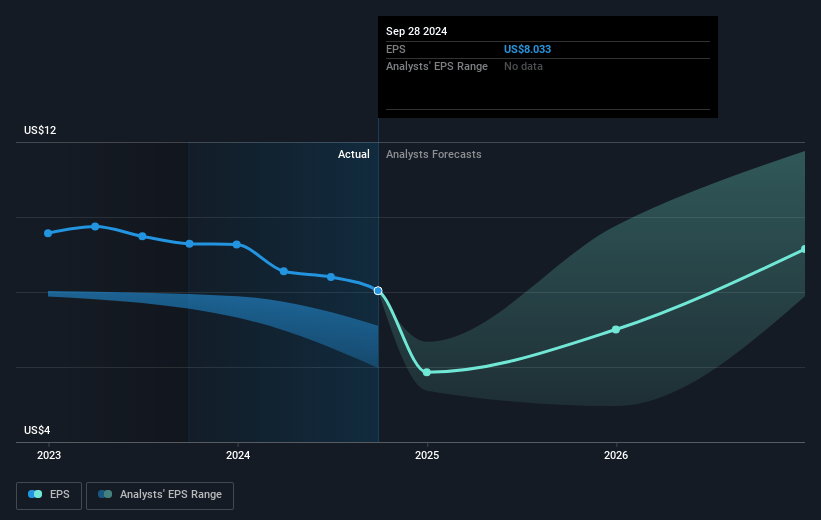

- Analysts expect earnings to reach $482.3 million (and earnings per share of $9.42) by about January 2028, up from $413.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.6x on those 2028 earnings, up from 23.5x today. This future PE is lower than the current PE for the US Life Sciences industry at 43.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

Charles River Laboratories International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued challenging biopharmaceutical demand environment with organic revenue decline suggests potential future revenue pressures.

- Restructurings by major global biopharmaceutical clients could indicate existing pressures on earnings and net margins, as these clients make adjustments to their operations and budgets.

- Safety Assessment business pricing expected to trend lower, which could pressure margins since the segment is a significant contributor to the company’s revenue.

- Ongoing restructuring, site consolidations, and headcount reductions signify internal efforts to offset macroeconomic challenges, potentially suggesting difficulties in sustaining revenue growth.

- Potential persistent headwinds in the DSA segment due to the current pricing environment and decreased global biopharma demand, which may pressure revenue and profitability going into 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $213.69 for Charles River Laboratories International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $260.12, and the most bearish reporting a price target of just $164.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.6 billion, earnings will come to $482.3 million, and it would be trading on a PE ratio of 27.6x, assuming you use a discount rate of 6.9%.

- Given the current share price of $189.76, the analyst's price target of $213.69 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives