Key Takeaways

- Increased generic competition and foreign exchange headwinds may lead to declining revenue and impact overall earnings.

- High spending on drug development and strategic initiatives could strain finances, affecting net margins and short-term financial performance.

- Strong growth potential for Bristol-Myers Squibb due to new drug launches, strategic investments, cost-saving measures, and advancements in R&D and established segments.

Catalysts

About Bristol-Myers Squibb- Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

- The expected near-term impact of generics on multiple products is projected to lead to a revenue decline in the legacy portfolio by 18% to 20%, putting pressure on the company's revenue performance.

- The aggressive ramp-up in spending on the Cobenfy drug development program may strain financial resources, potentially impacting net margins and earnings.

- Any delay or unexpected outcome from the announced new trials, including Phase III studies of Cobenfy and other ongoing programs, could impact predicted growth and revenue outcomes negatively.

- Factors like foreign exchange headwinds, estimated at $500 million, could offset revenue gains and affect the overall earnings forecast for the company.

- The strategic productivity initiative, while aiming for $2 billion in savings by 2027, could initially result in disruptive restructuring costs, impacting short-term earnings and financial performance.

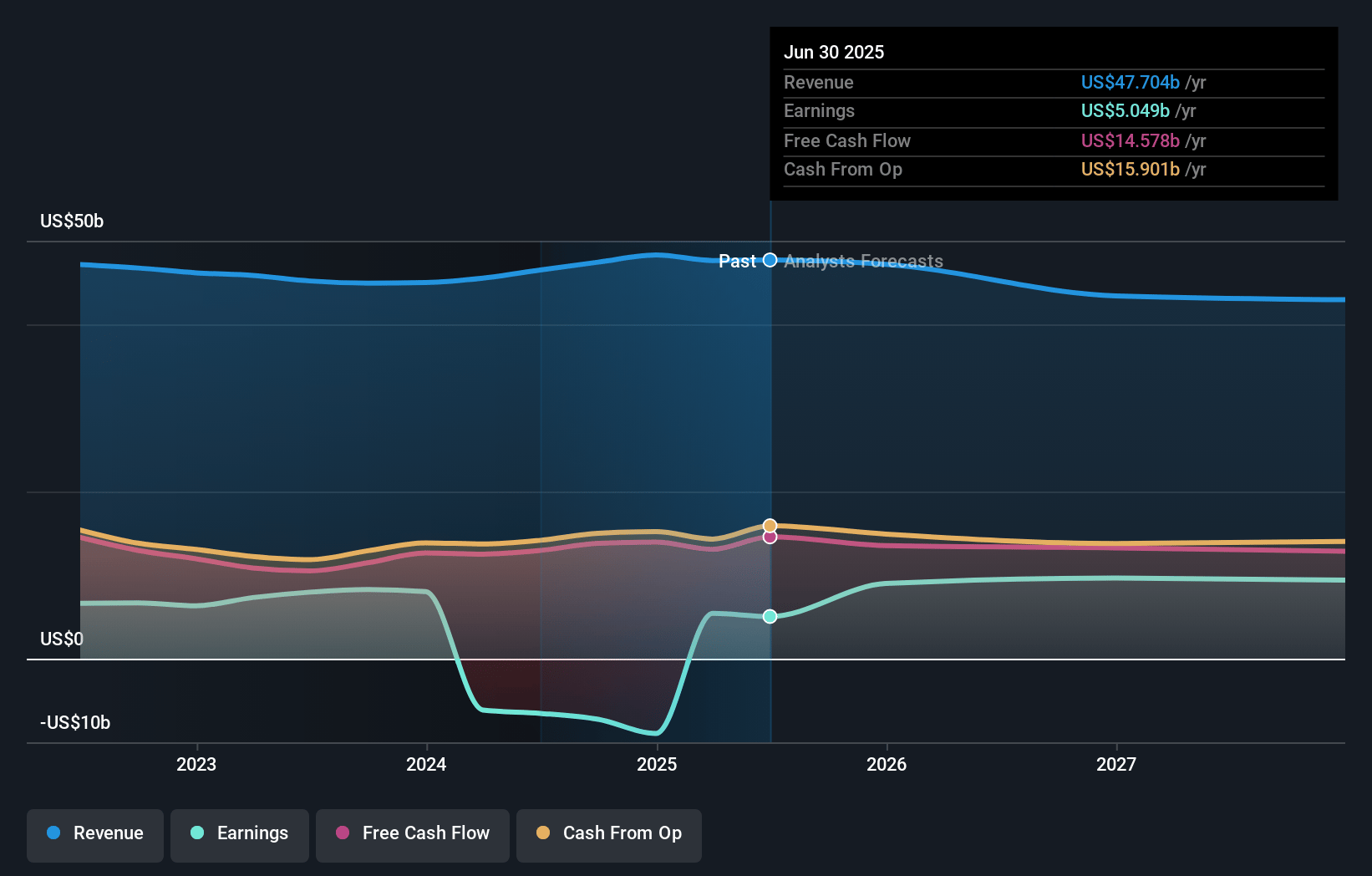

Bristol-Myers Squibb Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bristol-Myers Squibb compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bristol-Myers Squibb's revenue will decrease by 5.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -18.5% today to 15.5% in 3 years time.

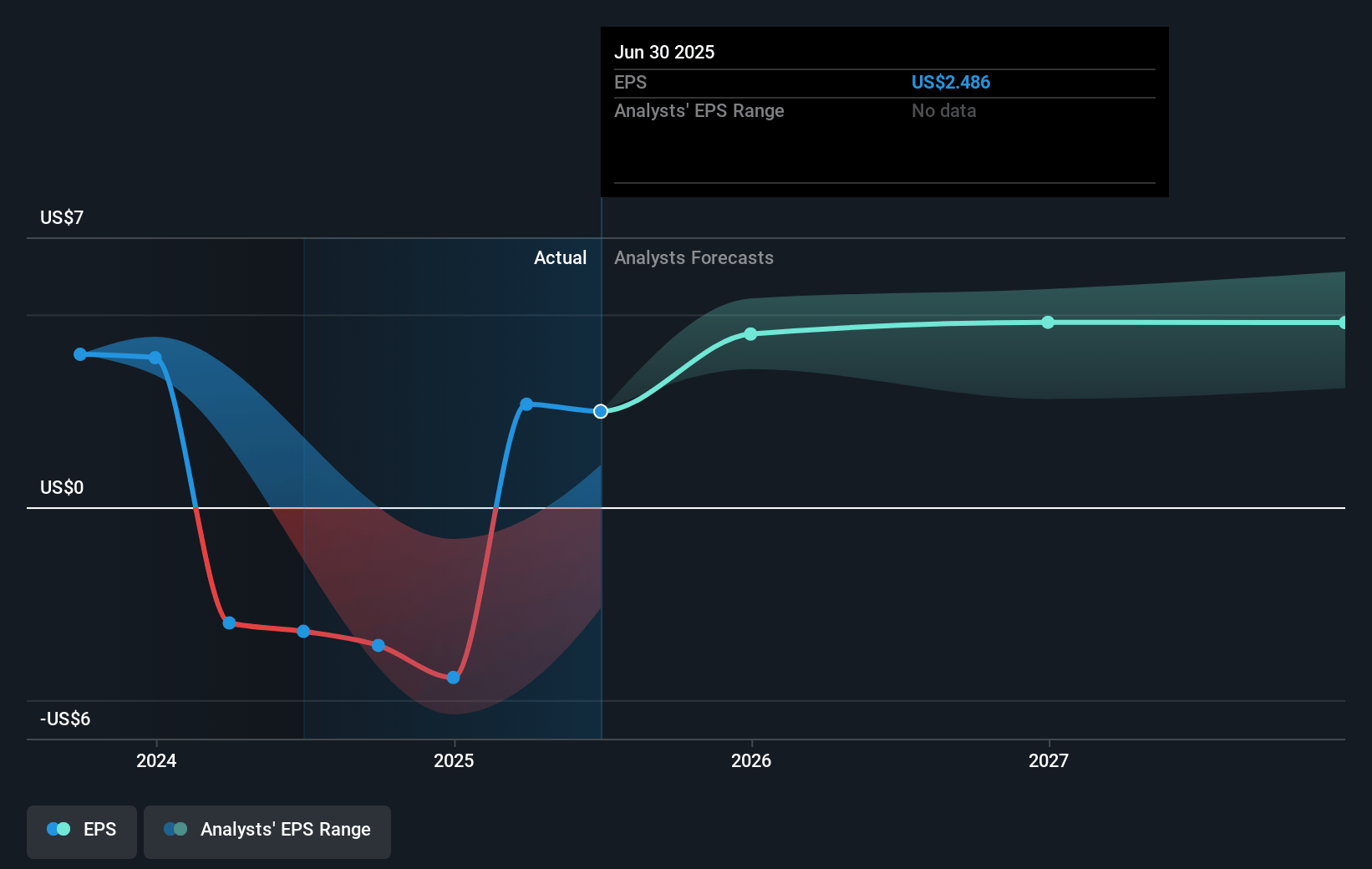

- The bearish analysts expect earnings to reach $6.3 billion (and earnings per share of $3.09) by about April 2028, up from $-8.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.4x on those 2028 earnings, up from -11.2x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Bristol-Myers Squibb Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The approval and successful launch of Cobenfy for schizophrenia, along with significant strategic investments in additional indications like Alzheimer's disease and bipolar disorder, position Bristol-Myers Squibb to potentially achieve substantial revenue growth from this therapeutic area in the coming years.

- The company is entering a data-rich period, anticipating multiple registrational data readouts and potential launches of over ten new medicines within the next five years, which could drive revenue growth and enhance the company's growth portfolio.

- Bristol-Myers Squibb has undertaken strategic initiatives and cost-savings measures, projecting $3.5 billion in savings over several years, which are expected to improve net margins and contribute to financial flexibility.

- The significant focus on operational excellence and increased R&D productivity, as evidenced by accelerated timelines in key studies like the ODYSSEY trial, suggests potential for pioneering therapy advancements, which could lead to higher earnings from new and existing products.

- The approval of Opdivo Qvantig and advancements in the company's cardiovascular and hematology segments suggest strong growth potential from these established areas, projected to bolster overall revenue and profit margins as the portfolio diversifies and grows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bristol-Myers Squibb is $52.26, which represents one standard deviation below the consensus price target of $59.86. This valuation is based on what can be assumed as the expectations of Bristol-Myers Squibb's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $40.4 billion, earnings will come to $6.3 billion, and it would be trading on a PE ratio of 20.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $49.36, the bearish analyst price target of $52.26 is 5.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:BMY. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.