Key Takeaways

- Strategic investments and a robust pipeline are set to drive significant long-term revenue growth from new medicines and formulations.

- Operational excellence and financial discipline initiatives are expected to enhance net margins and boost earnings through increased savings and reinvestment strategies.

- Bristol-Myers Squibb's revenue and margins face pressure from generic competition, risks in new drug commercialization, operational costs, and uncertainties in Medicare pricing.

Catalysts

About Bristol-Myers Squibb- Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

- Bristol-Myers Squibb's strategic investment in Cobenfy, with ongoing and upcoming Phase III studies across various indications such as Alzheimer's disease and bipolar I disorder, is anticipated to drive substantial future revenue growth.

- The company's commitment to driving operational excellence and financial discipline, with plans to achieve an additional $2 billion in savings by 2027, is likely to improve net margins and contribute to enhanced earnings per share.

- A robust late-stage pipeline, including assets like milvexian in acute coronary syndrome and secondary stroke prevention, and mezigdomide in multiple myeloma, has the potential to deliver multiple new medicines that can significantly boost long-term revenue.

- The launch of Opdivo Qvantig, a new subcutaneous formulation, aims to extend the reach of their immuno-oncology franchise, thereby supporting further expansion of revenue from the oncology portfolio.

- Bristol-Myers Squibb plans to reinvest savings into high-growth opportunities and accelerate R&D productivity, potentially yielding faster revenue growth by reducing the time to market for several key drugs.

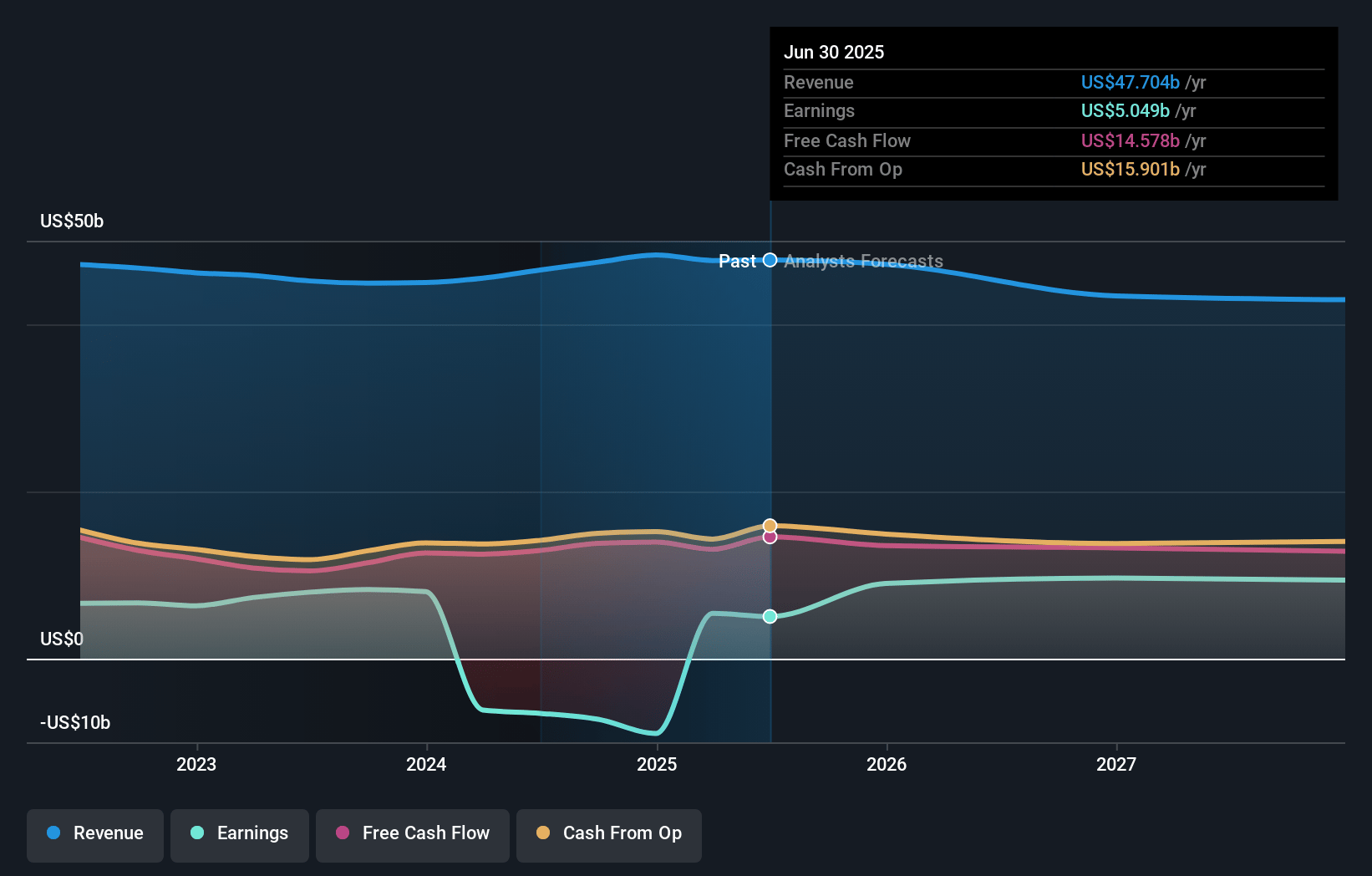

Bristol-Myers Squibb Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bristol-Myers Squibb compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bristol-Myers Squibb's revenue will decrease by 1.5% annually over the next 3 years.

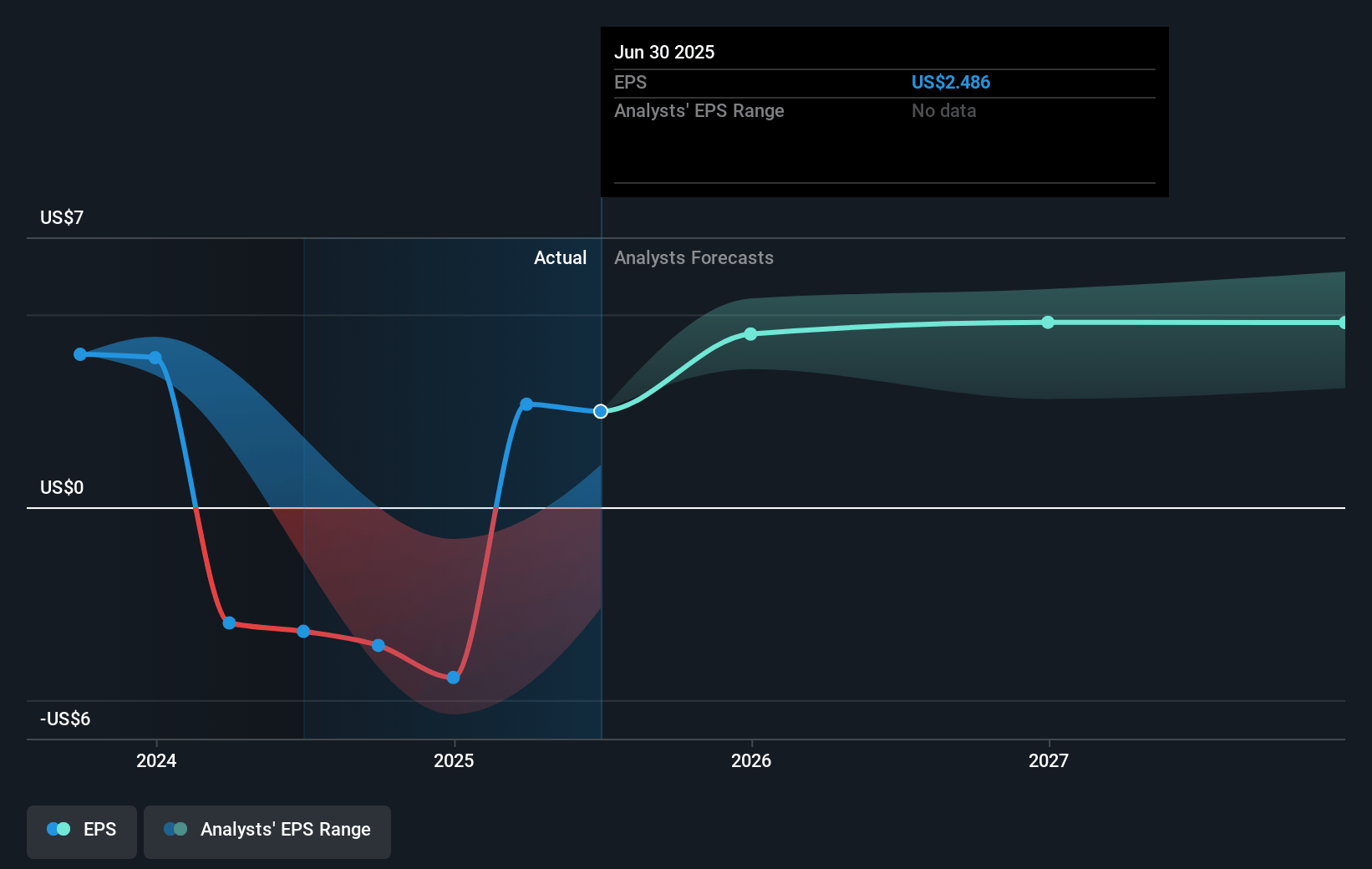

- The bullish analysts assume that profit margins will increase from -18.5% today to 28.1% in 3 years time.

- The bullish analysts expect earnings to reach $12.9 billion (and earnings per share of $6.53) by about April 2028, up from $-8.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, up from -11.4x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Bristol-Myers Squibb Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bristol-Myers Squibb faces significant revenue challenges due to the expected impact of generic drug competition impacting key products like Revlimid and Pomalyst, reducing traditional revenue streams.

- The reliance on the success and commercialization of new drugs such as Cobenfy is risky, as entrenched physician prescribing habits could potentially slow its adoption, thus affecting future revenues and market penetration.

- Operational expenses are facing pressures due to significant investments in R&D and upcoming clinical trials, impacting net margins even as they seek $2 billion in cost savings.

- The potential impact of Medicare Part D redesign introduces uncertainties around pricing and gross-to-net adjustments for products like Eliquis, which could temper earnings expectations.

- The company's ambitious pipeline and commercial strategies may face execution risks, including the timeline for pipeline catalysts, which if delayed, could affect long-term earnings projections and investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bristol-Myers Squibb is $67.46, which represents one standard deviation above the consensus price target of $59.86. This valuation is based on what can be assumed as the expectations of Bristol-Myers Squibb's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $46.1 billion, earnings will come to $12.9 billion, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 6.2%.

- Given the current share price of $50.0, the bullish analyst price target of $67.46 is 25.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:BMY. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.