Key Takeaways

- Expansion into patient-friendly chronic disease treatments and proprietary technology supports higher sales, operational efficiency, and ongoing market differentiation.

- Focused commercial outreach, disciplined cost management, and non-dilutive growth strategy drive margin improvement and set the stage for sustainable, profitable growth.

- Heavy reliance on a narrow product lineup, rising costs, and intensifying competition threaten revenue stability, margin sustainability, and the realization of long-term growth ambitions.

Catalysts

About Xeris Biopharma Holdings- A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

- Robust revenue growth in core chronic disease markets (e.g., Cushing’s syndrome, diabetes) positions Xeris to benefit from the growing population of patients with chronic conditions that require ongoing treatment, supporting outsized future revenue and earnings growth.

- Product line innovation and expansion—especially with the supplemental FDA approval and hospital partnership for Gvoke VialDx, and progress toward XP-8121—align with the healthcare industry shift toward patient-friendly, self-administered, and differentiated formulations, potentially increasing both topline sales and operational leverage through premium pricing and new market segments.

- Sustained increases in patient adoption driven by expanded commercial infrastructure and targeted outreach, especially for Recorlev and Gvoke, should further accelerate utilization and lift net revenue while improving gross and net margins as fixed costs are leveraged.

- Strong financial discipline with clear commitment to non-dilutive growth and effective cost management (e.g., positive adjusted EBITDA, debt reduction, and modest expense increases) positions the company for improved future net margins and earnings per share.

- The proprietary XeriSol platform and pipeline expansion (e.g., XP-8121 targeting a large hypothyroidism segment with unmet need) set the stage for long-term market differentiation, additional high-margin licensing revenue, and sustainable, above-market growth in both revenue and profitability.

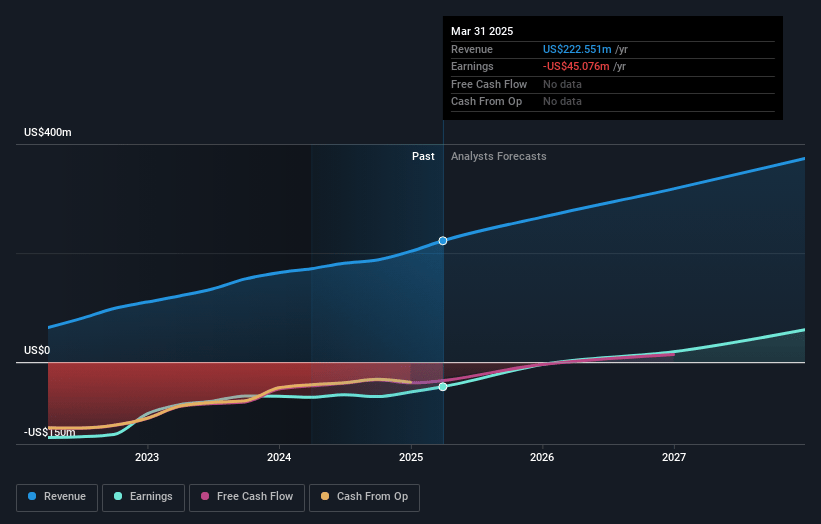

Xeris Biopharma Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Xeris Biopharma Holdings's revenue will grow by 20.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -20.3% today to 16.3% in 3 years time.

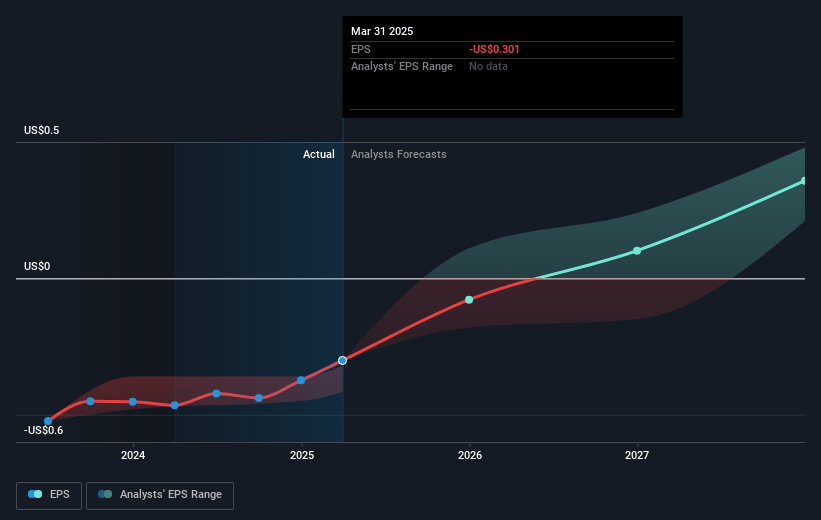

- Analysts expect earnings to reach $63.9 million (and earnings per share of $0.4) by about July 2028, up from $-45.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $46.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.3x on those 2028 earnings, up from -18.8x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Xeris Biopharma Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Xeris’s commercial portfolio remains highly concentrated in a few products (Recorlev, Gvoke, Keveyis), which exposes the company to significant revenue volatility if any of these faces increased competition, reimbursement headwinds, or fails to achieve/maintain expected market share, thereby risking future revenue stability and growth.

- Company’s growth and operational efficiency improvements are currently driven by stringent cost containment and sales force expansion, but rising SG&A and R&D expenses, along with the need for further commercial infrastructure growth to match competitors, may pressure net margins and long-term earnings if topline growth falters.

- Delayed or unsuccessful development, approval, or commercialization of pipeline assets like XP-8121, which currently lacks clear development and regulatory milestones, could result in under-realization of future revenue streams and put additional strain on the company’s long-term financial prospects.

- The emerging pricing pressures, risk of increased adoption of biosimilars/generics, and trend toward value-based reimbursement pose threats to Xeris’s ability to maintain premium pricing and realize projected revenue per prescription, thereby negatively impacting net margins and overall profitability.

- Industry consolidation and aggressive commercial expansion by larger competitors (e.g., Corcept) could hinder Xeris’s ability to maintain or grow market share, further intensifying competition, and increasing the risk of slower revenue growth and diminished long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.3 for Xeris Biopharma Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $391.5 million, earnings will come to $63.9 million, and it would be trading on a PE ratio of 23.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $5.29, the analyst price target of $6.3 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.