Key Takeaways

- Vertex's expansion of CFTR modulators, non-opioid pain treatments, and therapies for diabetes and kidney diseases aims to diversify products and increase market share.

- Strategic share buybacks and successful drug rollouts in key regions are expected to enhance EPS and financial performance, strengthening stock value.

- Rising operating expenses, regulatory challenges, and pipeline setbacks strain Vertex's growth prospects and could delay revenue from new therapies.

Catalysts

About Vertex Pharmaceuticals- A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

- Vertex's launch of ALYFTREK, a CFTR modulator, and its upcoming approval in various regions such as the EU, Canada, Australia, and Switzerland, are expected to drive revenue growth by expanding the patient base and offering a more convenient, once-daily dosing option.

- The commercialization and uptake of JOURNAVX, a novel non-opioid for acute pain, with expanding payer coverage and retail availability, are set to bolster revenue and diversify the company's portfolio, leading to enhanced earnings potential.

- The strategic focus on advancing pivotal development programs, including those for diabetic peripheral neuropathy, type 1 diabetes, and kidney diseases, is likely to positively impact future earnings by broadening the therapeutic areas and increasing market share.

- The successful rollout of CASGEVY, with expanding ATC activations and reimbursement access, particularly in sickle cell disease and beta-thalassemia, is anticipated to significantly boost revenue as treatment momentum accelerates across regions.

- The continuation of share buybacks, as demonstrated by the repurchase of over 930,000 shares, suggests an emphasis on enhancing EPS, which could influence perceived stock value positively.

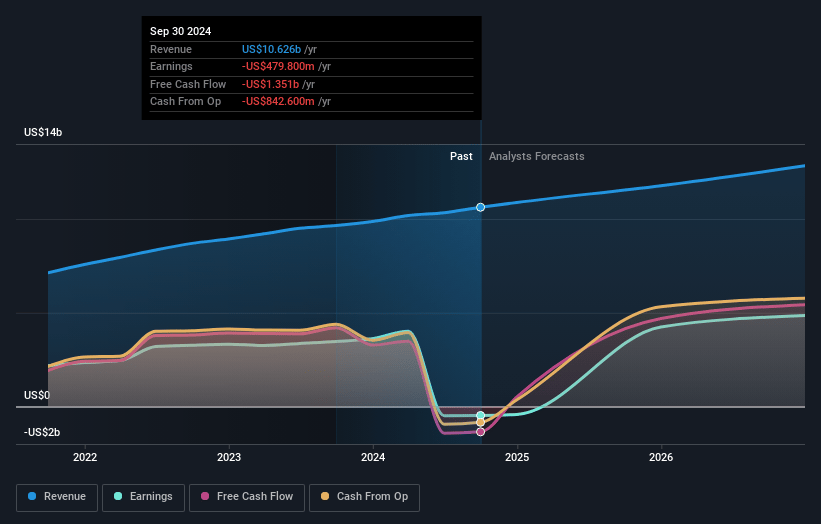

Vertex Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vertex Pharmaceuticals's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.9% today to 38.0% in 3 years time.

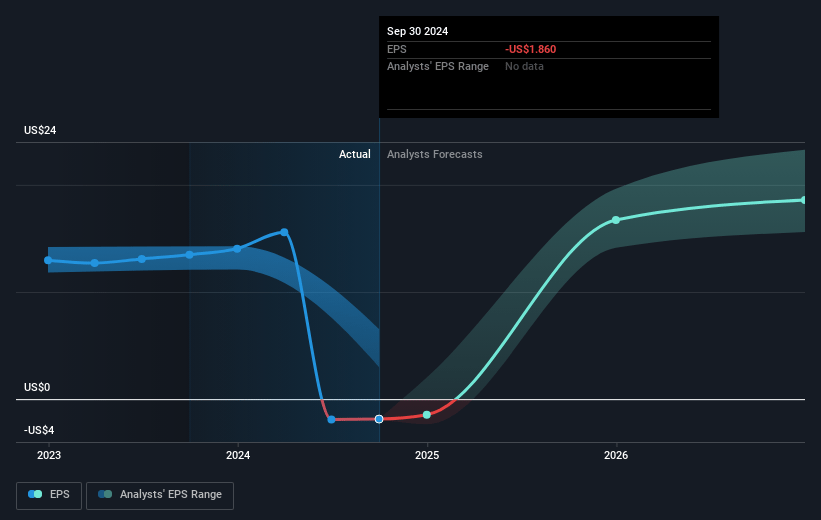

- Analysts expect earnings to reach $5.6 billion (and earnings per share of $21.38) by about May 2028, up from $-988.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $8.0 billion in earnings, and the most bearish expecting $4.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.9x on those 2028 earnings, up from -117.0x today. This future PE is greater than the current PE for the US Biotechs industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Vertex Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ex-U.S. revenue declined by 5% year-on-year due to issues in Russia related to the availability of an illegal copy product, negatively impacting revenue growth prospects in the region.

- There is a noted increase in operating expenses, rising 21% year-over-year, driven by pipeline advancements and commercial build-outs, which could pressure net margins and operating income.

- Non-GAAP operating income decreased from $1.34 billion in Q1 2024 to $1.18 billion in Q1 2025, primarily due to increased operating expenses and lower interest income, potentially impacting earnings.

- There is an ongoing temporary pause in the VX-522 CF study due to a tolerability issue, which could hinder pipeline progress and delay potential revenue from new CF therapies.

- Although JOURNAVX received a strong initial reception, significant payer coverage and permanent market positioning are still being negotiated, which could affect revenue recognition and market adoption timelines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $501.357 for Vertex Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $621.0, and the most bearish reporting a price target of just $330.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.8 billion, earnings will come to $5.6 billion, and it would be trading on a PE ratio of 26.9x, assuming you use a discount rate of 6.2%.

- Given the current share price of $450.03, the analyst price target of $501.36 is 10.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.