Key Takeaways

- Imminent launch of UGN-102 and demographic trends are set to drive substantial revenue and market expansion for UroGen Pharma.

- Diversification of pipeline assets and favorable clinical outcomes enhance stability, pricing power, and reduce reliance on a single product.

- Heavy dependence on a single drug approval, possible physician and payer hesitancy, rising costs, and execution risk threaten growth prospects and financial stability.

Catalysts

About UroGen Pharma- Engages in the development and commercialization of solutions for urothelial and specialty cancers.

- Imminent FDA approval and commercial launch of UGN-102 in recurrent low-grade intermediate risk non-muscle invasive bladder cancer (NMIBC) position UroGen to tap into a significantly underserved, growing patient population (~60,000 patients in the U.S. annually), nearly 10x larger than the current addressable market for Jelmyto—directly supporting a step-change in long-term revenue growth.

- Tailwinds from demographic shifts, notably the aging population, are expanding the prevalence of urologic cancers and chronic urinary conditions, ensuring sustained high demand for innovative therapies such as UGN-102 and Jelmyto and boosting the company’s longer-term total addressable market (impacting multi-year revenue potential).

- The push within healthcare toward minimally invasive, non-surgical cancer treatments and therapies with improved quality-of-life outcomes aligns well with UroGen's RTGel technology and intravesical delivery platforms, which are easier to administer in community settings, supporting rapid physician adoption and improved gross to net margins over time.

- Expansion of next-generation pipeline assets (UGN-103, UGN-104, UGN-301, and UGN-501), along with strategic research collaborations, signals diversification of the product portfolio—a move that should stabilize and ultimately expand earnings and reduce single-product dependency risk as late-stage assets progress toward commercialization.

- Robust clinical data and positive engagement from the urologic community (e.g., strong complete response and durability metrics for UGN-102, as well as emerging real-world evidence for Jelmyto) reinforce UroGen's position as a leader in uro-oncology innovations, supporting favorable payer coverage, pricing power, and ultimately healthier long-term net margins.

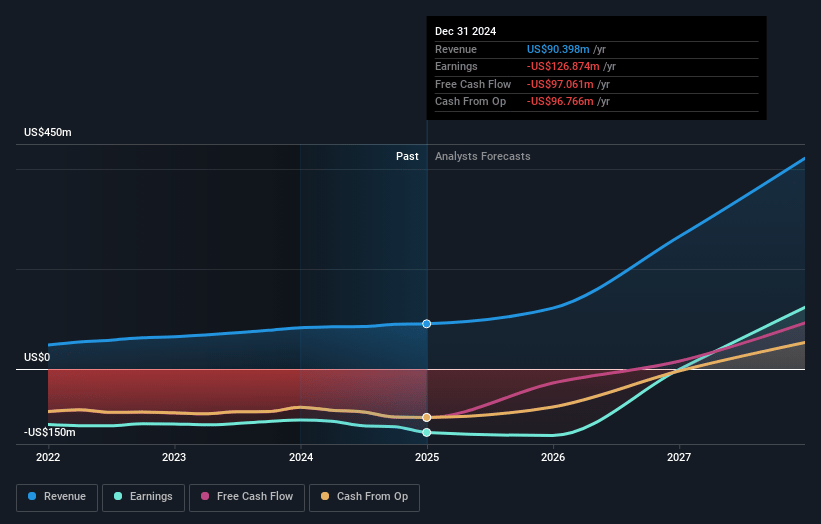

UroGen Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UroGen Pharma's revenue will grow by 64.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -150.7% today to 24.3% in 3 years time.

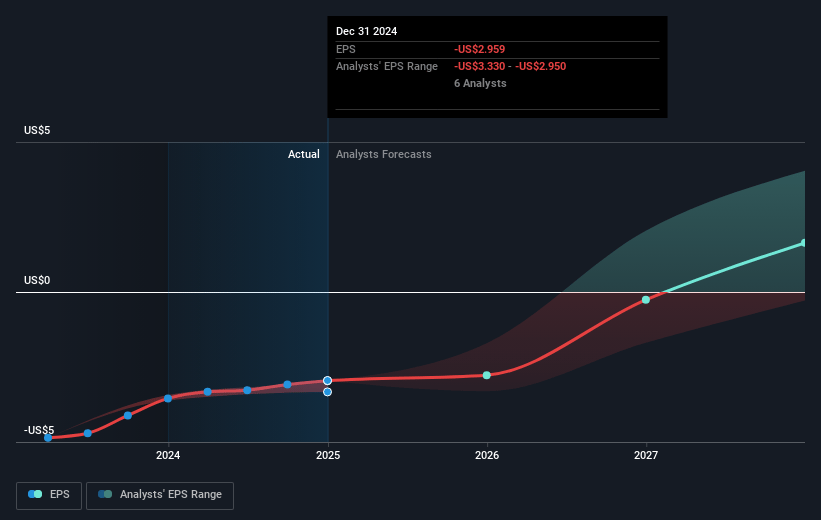

- Analysts expect earnings to reach $99.9 million (and earnings per share of $1.34) by about May 2028, up from $-138.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $368 million in earnings, and the most bearish expecting $-26.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, up from -2.7x today. This future PE is greater than the current PE for the US Biotechs industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.67%, as per the Simply Wall St company report.

UroGen Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UroGen Pharma’s high reliance on the successful approval and commercial launch of UGN-102 creates significant concentration risk; if FDA approval is delayed, denied, or if the single-arm trial design receives pushback for insufficient comparative efficacy, both revenue growth and margins could be heavily impacted.

- The company projects a large market opportunity for UGN-102, but real-world adoption could lag expectations due to initial physician caution with new therapies (especially those based on single-arm trials) and the need for payer reimbursement confidence, delaying revenue ramp and increasing risk of missed sales targets.

- With 70% of the target market covered by Medicare, UroGen faces exposure to potential U.S. government pricing pressures, possible future reimbursement headwinds, and higher-than-expected gross-to-net discounts, all of which could erode net revenue and compress earnings.

- Operating expenses are rising rapidly (notably SG&A and R&D), with escalating losses quarter over quarter; failure to achieve rapid, high adoption of UGN-102 or pipeline setbacks could prolong the company’s path to profitability and threaten future financial stability, especially if access to capital tightens.

- UroGen’s ongoing need for positive data in newer pipeline programs (UGN-103, UGN-301, UGN-501) to diversify its product base exposes it to R&D and execution risk—if these assets fail to progress or differentiate amidst advances by larger pharma or novel competitors (e.g., immunotherapies)—leading to future market share losses and revenue contraction.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.625 for UroGen Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $411.5 million, earnings will come to $99.9 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 6.7%.

- Given the current share price of $7.97, the analyst price target of $32.62 is 75.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.