Last Update01 May 25

Key Takeaways

- Advancements in TSHA-102 trials and regulatory discussions could expedite approval and boost future revenue and investor confidence.

- Strategic alignment with regulatory and market priorities could enhance trial success, market adoption, and long-term revenue growth.

- Regulatory approval risks, ongoing net losses, and clinical trial dependency may affect revenue, while competition and manufacturing challenges threaten market share and margins.

Catalysts

About Taysha Gene Therapies- A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

- Progress in the clinical development of TSHA-102, particularly moving towards the pivotal phase of the REVEAL trials with promising safety and efficacy data, could enhance investor confidence and potentially lead to future revenue growth once regulatory approval is achieved.

- Ongoing constructive discussions with the FDA about the regulatory pathway for TSHA-102, including potential expedited approval mechanisms like the RMAT designation, may accelerate product approval and market entry, thereby impacting future earnings positively.

- Completion of patient dosing in the high-dose cohort and the encouraging safety profile of TSHA-102, with no treatment-related SAEs or DLTs observed, improves the likelihood of successful clinical trial outcomes, supporting future revenue expectations.

- The potential to harmonize trial design and endpoints with other gene therapy trials for Rett syndrome may streamline regulatory processes and enhance competitive positioning, influencing long-term revenue growth.

- The strategic focus on demonstrating clinically meaningful functional gains aligns with both regulatory expectations and caregiver priorities, potentially leading to strong market adoption post-approval, thereby impacting future net margins and earnings.

Taysha Gene Therapies Future Earnings and Revenue Growth

Assumptions

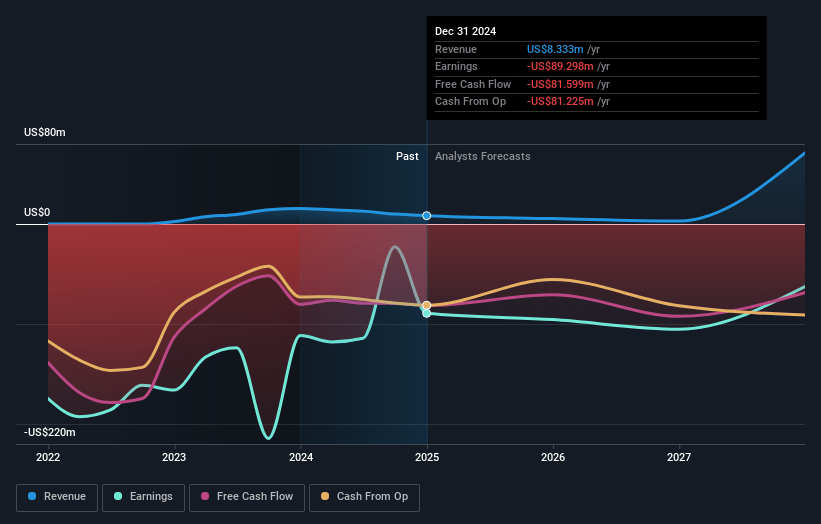

How have these above catalysts been quantified?- Analysts are assuming Taysha Gene Therapies's revenue will grow by 120.1% annually over the next 3 years.

- Analysts are not forecasting that Taysha Gene Therapies will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Taysha Gene Therapies's profit margin will increase from -1071.6% to the average US Biotechs industry of 15.9% in 3 years.

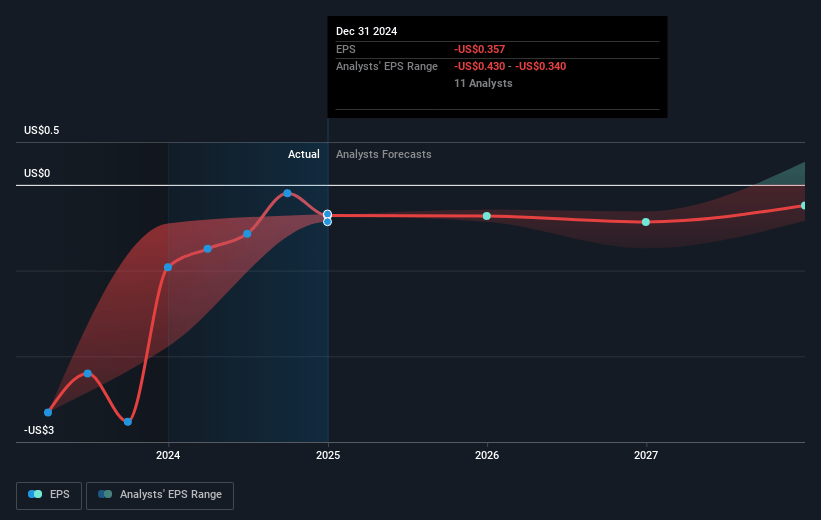

- If Taysha Gene Therapies's profit margin were to converge on the industry average, you could expect earnings to reach $14.1 million (and earnings per share of $0.06) by about May 2028, up from $-89.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $127.2 million in earnings, and the most bearish expecting $-142.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 141.6x on those 2028 earnings, up from -4.2x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.7%, as per the Simply Wall St company report.

Taysha Gene Therapies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a substantial risk associated with the need for regulatory approvals from agencies like the FDA, which could impact revenue timelines if delays or additional requirements arise.

- The company has a history of net loss, which, if not addressed by increased revenue from successful commercialization, could continue to negatively impact net margins.

- The dependence on long-term and costly clinical trials, as evidenced by rising R&D expenses, could stretch cash reserves and impact future earnings if outcomes do not lead to successful product commercialization.

- The potential market competition and the need for differentiation from other gene therapies for Rett syndrome could impact Taysha's ability to capture market share and maintain revenue.

- Manufacturing and scaling challenges, indicated by increased expenses related to GMP batch activities, could affect production efficiency and impact net margins if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.55 for Taysha Gene Therapies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $88.9 million, earnings will come to $14.1 million, and it would be trading on a PE ratio of 141.6x, assuming you use a discount rate of 6.7%.

- Given the current share price of $1.82, the analyst price target of $6.55 is 72.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.