Narratives are currently in beta

Key Takeaways

- Successful BRIUMVI launch, strong data, and label updates could boost revenue and positioning in the MS market.

- Development of subcutaneous BRIUMVI and CAR-T therapy may drive market expansion and portfolio diversification.

- Heavy dependence on BRIUMVI for growth and competitive threats could pressure revenue, while increased operational costs risk diminishing net margins.

Catalysts

About TG Therapeutics- A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

- The successful launch and strong market reception of BRIUMVI, coupled with robust clinical data, indicate potential future revenue growth as the company aims to become the top prescribed anti-CD20 therapy in the MS market.

- Expansion into the hospital setting, which accounts for the majority of MS patients, can drive increased revenue and market share given the large patient base in such settings.

- Potential label updates resulting from shorter infusion times and streamlined dosing could enhance BRIUMVI's market appeal, reducing patient burden and potentially increasing revenue through higher adoption rates.

- Development of a subcutaneous version of BRIUMVI could tap into the at-home, self-administered market, representing a new revenue stream and market expansion opportunity.

- Initiatives like the azer-cel allogeneic CD19 CAR-T cell therapy for autoimmune diseases could diversify TG Therapeutics’ portfolio, impacting future earnings through new market opportunities.

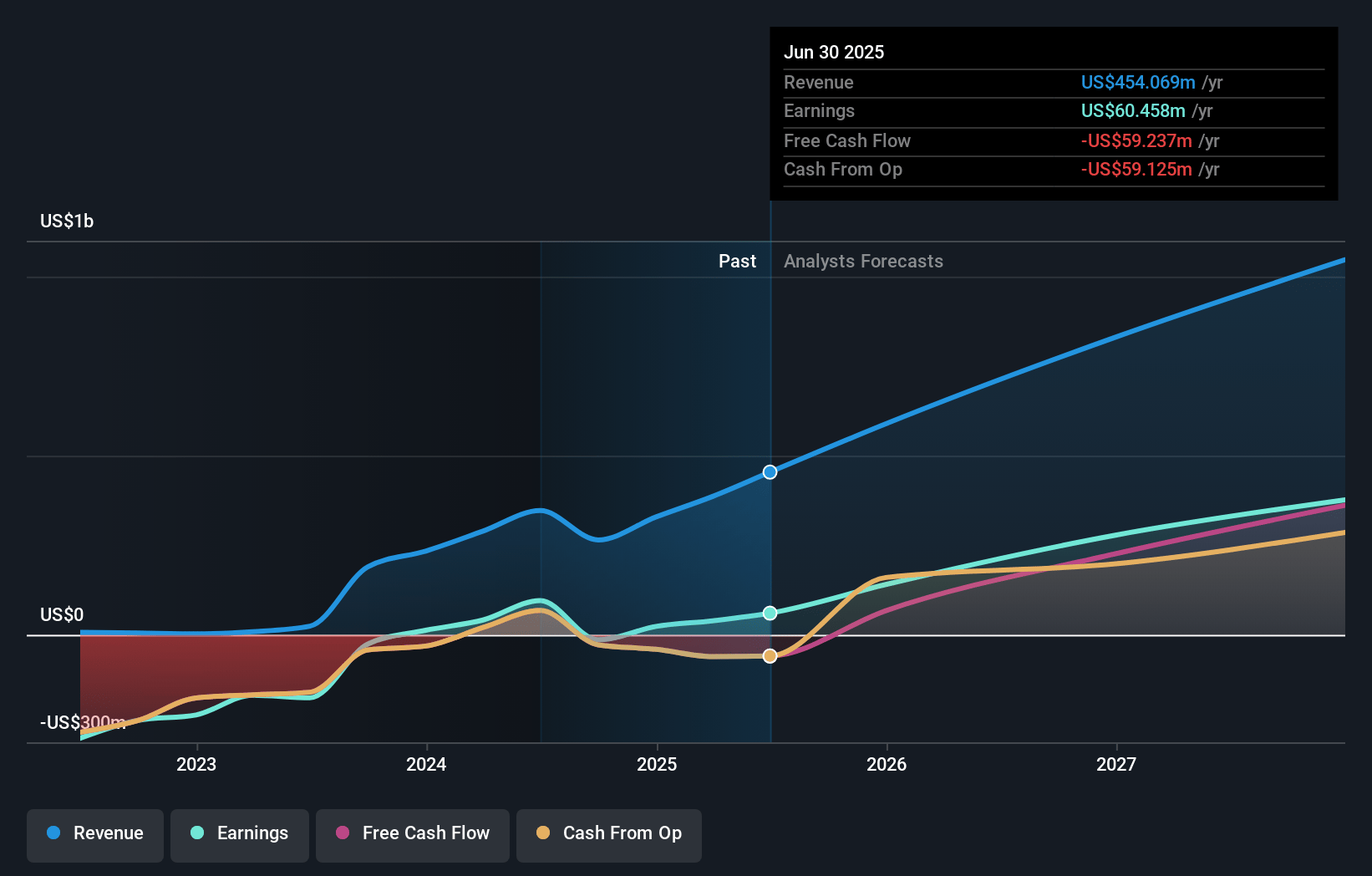

TG Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TG Therapeutics's revenue will grow by 53.8% annually over the next 3 years.

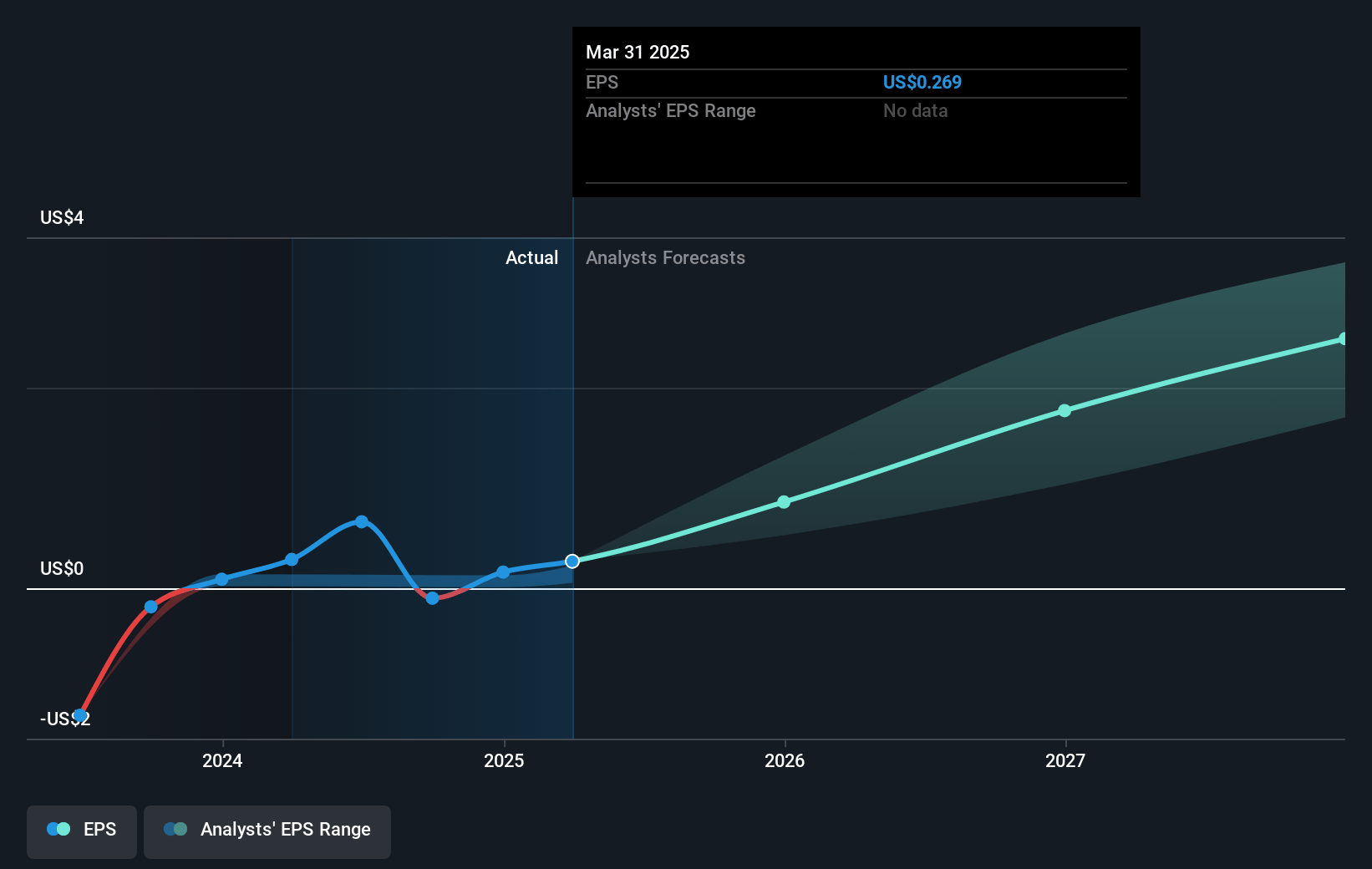

- Analysts assume that profit margins will increase from -5.4% today to 44.0% in 3 years time.

- Analysts expect earnings to reach $424.0 million (and earnings per share of $2.6) by about January 2028, up from $-14.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from -334.2x today. This future PE is greater than the current PE for the US Biotechs industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 4.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

TG Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on a single major product, BRIUMVI, for revenue growth creates vulnerability to fluctuations in sales performance, which could impact overall revenue if market expectations are not consistently met.

- The increased investment in marketing and commercial field expansion could lead to higher operational expenses, potentially reducing net margins if these efforts do not translate into proportional revenue growth.

- Uncertainty surrounding the successful development and integration of a subcutaneous version of BRIUMVI and faster infusion labels could delay anticipated revenue streams from these offerings, affecting future earnings.

- The manufacturing reliance on Samsung Biologics and the recent shift to add FUJIFILM Diosynth Biotechnologies as a secondary manufacturer involves significant upfront R&D and operational costs, which could pressure net margins if economies of scale are not achieved.

- The entry of subcutaneous OCREVUS and possibly other competitive products in the market could limit BRIUMVI’s market share growth, thereby impacting both revenue and earnings if TG Therapeutics cannot effectively differentiate its product.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.0 for TG Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $963.4 million, earnings will come to $424.0 million, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 6.3%.

- Given the current share price of $33.45, the analyst's price target of $41.0 is 18.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives