Key Takeaways

- Strong growth driven by expanding XDEMVY adoption, a broader addressable market, favorable demographics, and new indications and geographies diversifying revenue streams.

- High margins and supportive capital position enable continued investment, while industry trends and regulatory receptivity enhance prospects for valuations and strategic partnerships.

- Heavy dependence on a single product, rising costs, and challenging payer dynamics threaten profit stability and limit prospects for sustained growth and diversification.

Catalysts

About Tarsus Pharmaceuticals- A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

- Robust adoption and accelerating penetration of XDEMVY are being driven by increased physician education, expanded sales force, and successful DTC campaigns, but the company is still in the early stages of penetrating a large and underserved patient population. As physician prescribing frequency increases and broader commercial/Medicare coverage lowers barriers, this is likely to drive sustained revenue and top-line growth going forward.

- Large demographic tailwinds-including the rising prevalence of ocular and parasitic conditions due to an aging population and greater patient awareness of eye health-are structurally expanding the addressable market, setting up long-term volume growth and future revenue expansion.

- The expansion into new indications and geographies, such as the planned launch of TP-04 for Ocular Rosacea (with solid physician enthusiasm and a sizeable patient population) and the anticipated entry into Japan and Europe, offer clear avenues for new revenue streams and reduced product concentration risk, supporting future earnings and margin stability.

- High gross margins (~93%) and strong payer coverage help shield against margin erosion, and the company's recent equity raise provides ample capital to sustain investments in commercialization and pipeline development, strengthening the outlook for eventual positive earnings leverage as operating spend normalizes.

- Growing acceptance and support for innovative biopharma therapies addressing previously unmet needs-reflected both in regulator openness (as seen with the EMA waiving Phase III for Europe) and in increased partnership and M&A interest in the space-may result in higher future valuations, improved net margins through non-dilutive capital, and optionality for future strategic alliances or buyouts.

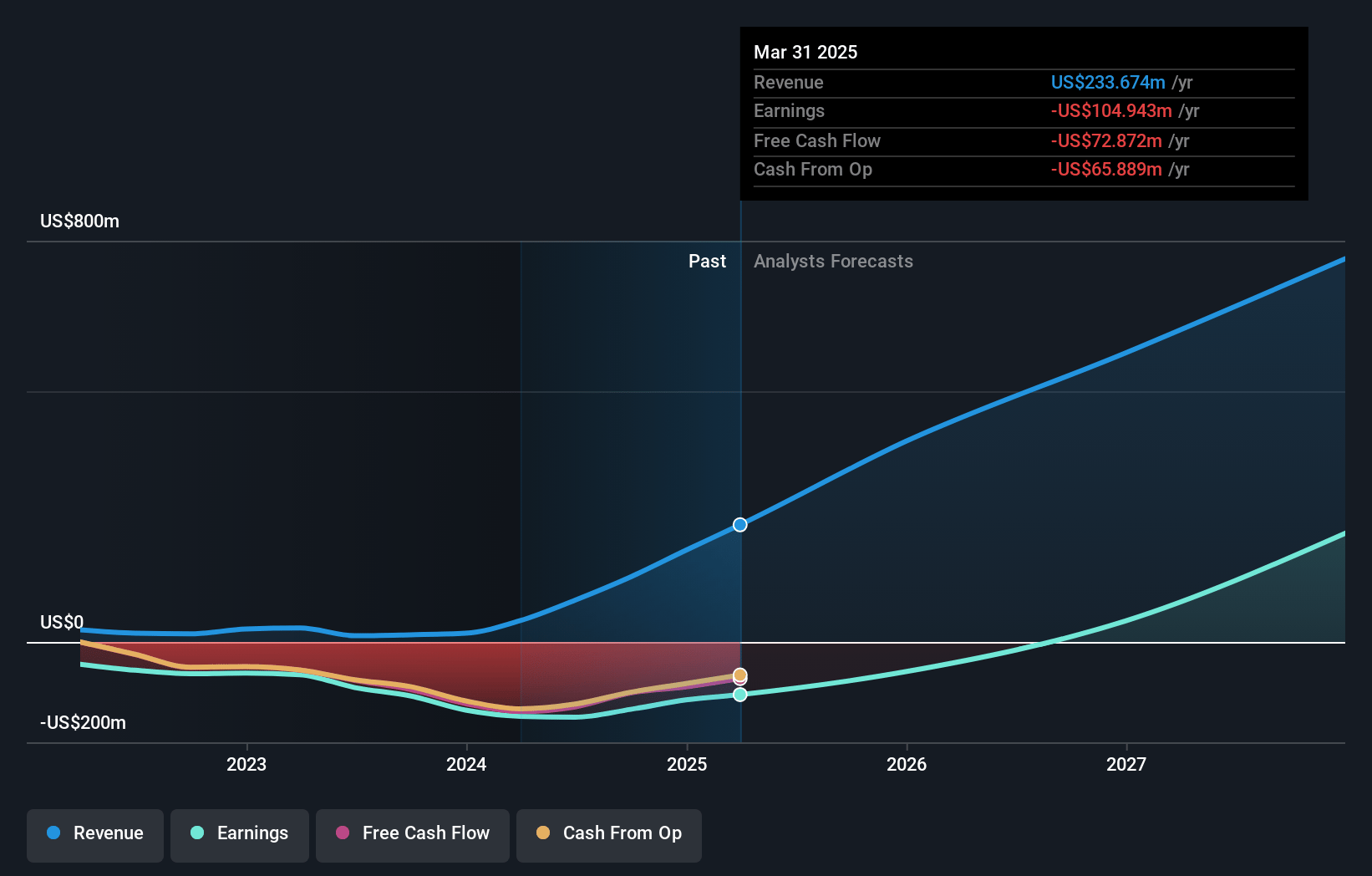

Tarsus Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tarsus Pharmaceuticals's revenue will grow by 49.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -44.9% today to 29.6% in 3 years time.

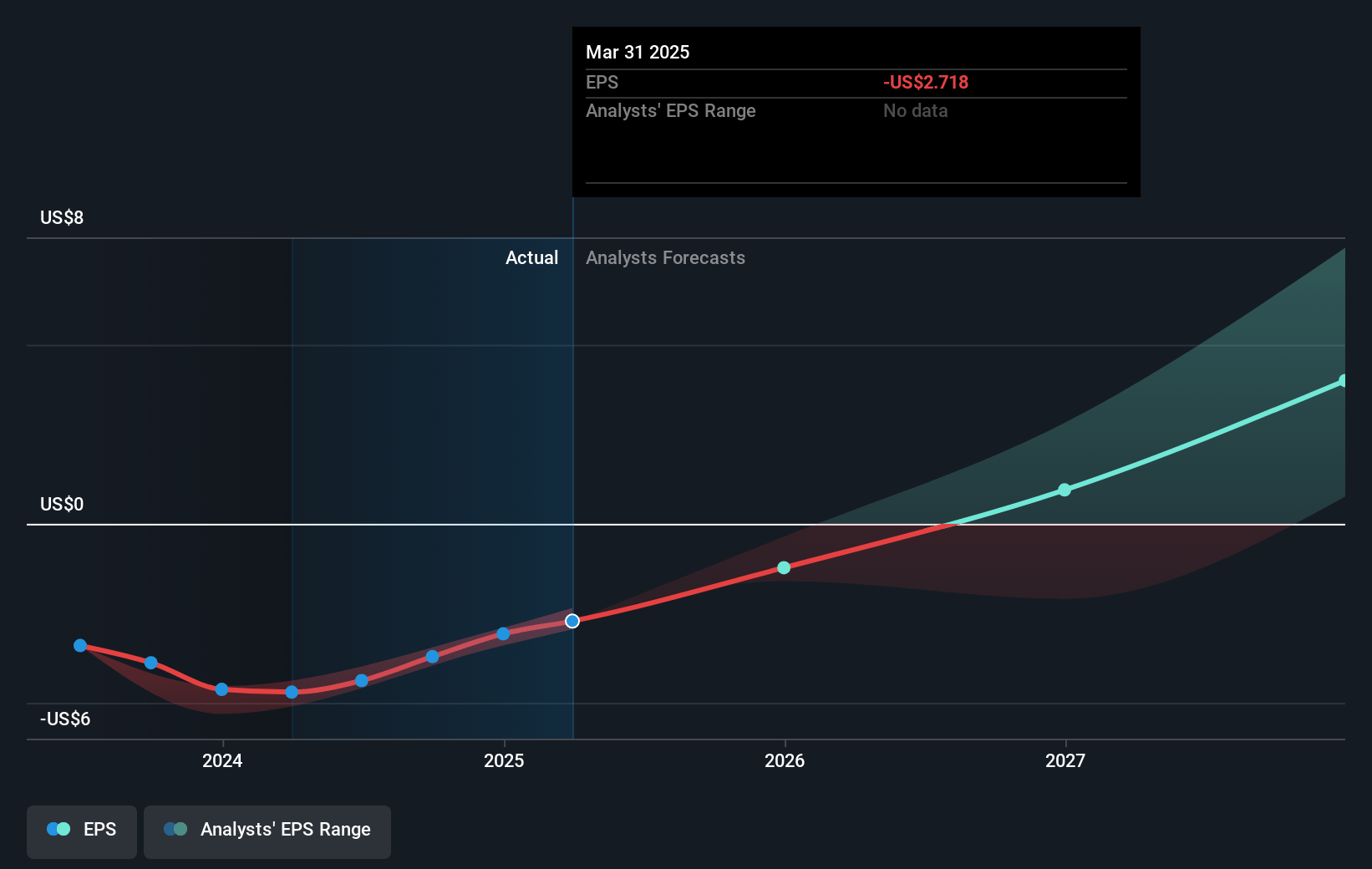

- Analysts expect earnings to reach $231.6 million (and earnings per share of $4.26) by about July 2028, up from $-104.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $390 million in earnings, and the most bearish expecting $39.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, up from -16.2x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Tarsus Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on XDEMVY as the core revenue driver creates concentration risk-any future clinical setback, adverse event, or market entrant that erodes its standard-of-care status could lead to material revenue volatility and profit decline.

- Sustained high gross-to-net discounts (~47–48%) and increasing patient reliance on Medicare or payers with strong negotiating power may compress net margins and revenue per prescription, hurting profitability even if volumes rise.

- Escalating operating expenses, particularly substantial investments in DTC advertising ($70–80 million annually and potentially more) and increased R&D costs for pipeline programs, could delay or impair the path to sustained cash flow positivity and earnings growth.

- Industry-wide shifts toward greater payer and PBM control over formularies and reimbursement levels might restrict market access, especially as prescriptions expand into Medicare and price-sensitive segments, limiting future revenue expansion and squeezing margins.

- Delays or setbacks in diversifying the pipeline beyond XDEMVY-such as slower-than-expected development or approval of TP-04 for Ocular Rosacea-would prolong product concentration and heighten risk to long-term earnings stability and market valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $72.5 for Tarsus Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $94.0, and the most bearish reporting a price target of just $44.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $783.5 million, earnings will come to $231.6 million, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $40.58, the analyst price target of $72.5 is 44.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.