Key Takeaways

- Strong physician adoption and needle-free delivery of neffy, combined with expanded pediatric access and increased insurance coverage, position ARS for accelerated revenue growth and market leadership.

- Strategic partnerships and international regulatory progress, supported by consumer-friendly branding, unlock global expansion and diversify ARS’s revenue streams.

- Heavy reliance on a single product and narrow pipeline, combined with rising expenses and challenging payer access, heightens risk of prolonged losses and market share erosion.

Catalysts

About ARS Pharmaceuticals- A biopharmaceutical company, develops and commercializes treatments for severe allergic reactions.

- The rapid uptake of neffy among physicians, driven by its needle-free delivery and strong initial physician and patient adoption (over 50% of engaged providers prescribing, positive real-world outcomes, and high utilization in allergy clinics), positions ARS to capture growing demand as severe allergies and anaphylaxis incidence rises globally—supporting accelerated revenue growth and potential expansion in gross margins as prescription volumes scale.

- Recent FDA approval and commercial launch of the 1-milligram pediatric dose unlock a previously inaccessible segment of the epinephrine market—over 23% of total units dispensed and more than half of pediatric prescriptions—improving ARS’s total addressable market and laying the foundation for sustained topline expansion.

- Increased commercial insurance coverage for neffy (now at 57% and on track toward 80%), combined with co-pay assistance and broader payer negotiations, materially reduces access barriers and prior authorization hurdles, which is likely to drive a step-change in prescription volumes, accelerating revenue and improving collections (gross-to-net position).

- ARS’s co-promotion partnership with ALK-Abello massively expands national reach, particularly into pediatric channels, and leverages ALK’s global infrastructure as regulatory reviews are pending in major ex-U.S. markets (UK, Canada, Japan, China, Australia), catalyzing international revenue streams and diversifying earnings potential.

- Shifting consumer and caregiver preferences toward needle-free, user-friendly drug delivery, supported by a robust DTC campaign (“Hello neffy, Goodbye Needles”) and seasonal marketing push, is expected to catalyze broader market penetration and patient conversion, elevating brand market share and driving higher net revenues.

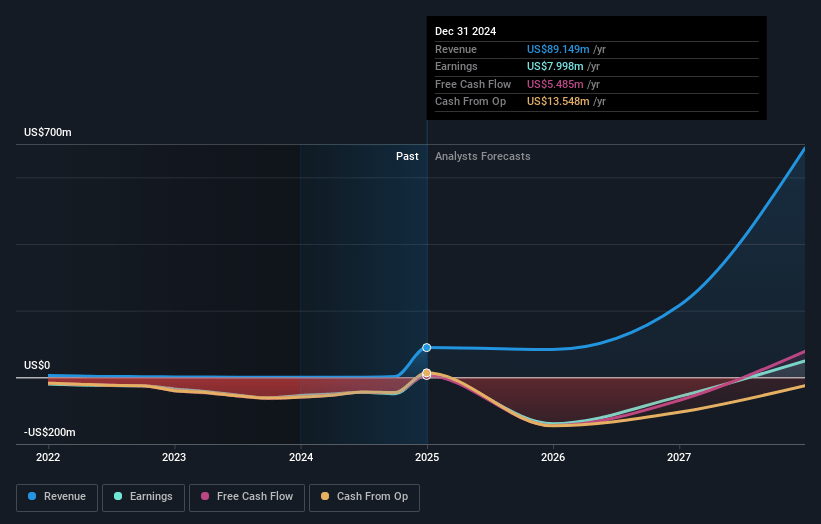

ARS Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ARS Pharmaceuticals's revenue will grow by 59.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -16.1% today to 15.0% in 3 years time.

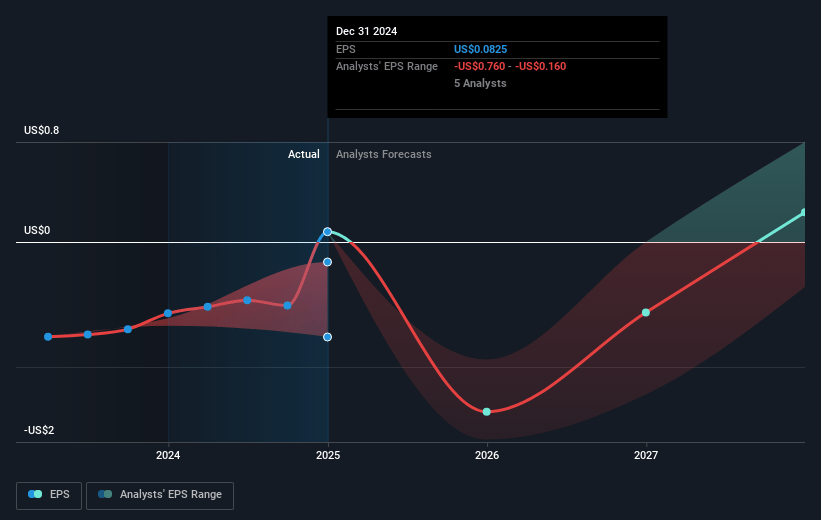

- Analysts expect earnings to reach $59.3 million (and earnings per share of $0.49) by about July 2028, up from $-15.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $110 million in earnings, and the most bearish expecting $-51.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 66.3x on those 2028 earnings, up from -110.2x today. This future PE is greater than the current PE for the US Biotechs industry at 17.0x.

- Analysts expect the number of shares outstanding to grow by 1.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

ARS Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overdependence on a single lead product (neffy®) exposes ARS Pharmaceuticals to significant product-specific risks, such as regulatory setbacks, future negative safety data, or the entry of competitive needle-free or next-generation epinephrine solutions, which could cause severe volatility in revenue and ultimately earnings.

- Heavy upfront investments in sales, marketing, and direct-to-consumer campaigns ($40–$50 million spent in 2025 alone), coupled with high operating expenses ($210–$220 million guidance), may pressure net margins and drive extended periods of net losses if adoption or market uptake is slower than expected.

- Projected revenue growth and market share increases are highly dependent on achieving broad payer/formulary access, but ongoing negotiations and prior authorization requirements with major insurers (e.g., Caremark, Aetna, certain Blue Cross plans) continue to be headwinds that could materially constrain top-line revenue growth and delay profitability.

- ARS has a limited product pipeline beyond neffy, so failure to successfully expand into new indications or markets—or delays in regulatory approvals outside the U.S.—may force additional R&D expenditures and place continued pressure on net margins and long-term earnings stability.

- The epinephrine market faces long-term challenges from generic competition, biosimilars (as exclusivity periods end), and potential disruptive innovation in drug delivery (e.g., micro-needle patches, oral biologics), any of which could erode market share, compress pricing power, and negatively impact ARS’s future revenues and EBITDA.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.0 for ARS Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $394.6 million, earnings will come to $59.3 million, and it would be trading on a PE ratio of 66.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $17.56, the analyst price target of $32.0 is 45.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.