Last Update01 May 25

Key Takeaways

- Recent FDA approvals and strategic collaborations position Syndax to significantly enhance revenue and address unmet clinical needs in oncology.

- Strong financial backing supports operational funding and long-term profitability, enhancing margins and enabling strategic market expansion.

- Delays in FDA approvals or payer negotiations pose financial risks, and intense R&D and competition may pressure margins and market share.

Catalysts

About Syndax Pharmaceuticals- A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

- The recent FDA approval of two first-in-class medicines, including Revuforj, provides Syndax with a significant advantage in addressing unmet needs in relapsed/refractory acute leukemia. This approval is expected to drive revenue as the medicine's launch saw $7.7 million in net revenue in just the initial 5 weeks.

- Revuforj has opportunities for future label expansions, such as the supplemental new drug application (sNDA) for mutant NPM1 AML, which could broaden its indicated population and significantly increase potential market share, potentially impacting both revenue and earnings.

- The launch of Niktimvo, in collaboration with Incyte, in chronic graft-versus-host disease (cGVHD) offers Syndax a new revenue stream. The product has a multibillion-dollar potential and ongoing trials that could expand its indications, which could enhance revenue.

- Syndax's strong financial position, bolstered by a $350 million deal with Royalty Pharma, is expected to fund operations through profitability, which can improve net margins and earnings.

- Syndax's strategic prioritization and progression in frontline settings with Revuforj, combined with strong early sales momentum and broad payer coverage, are poised to enhance long-term revenue growth and contribute to recurring earnings.

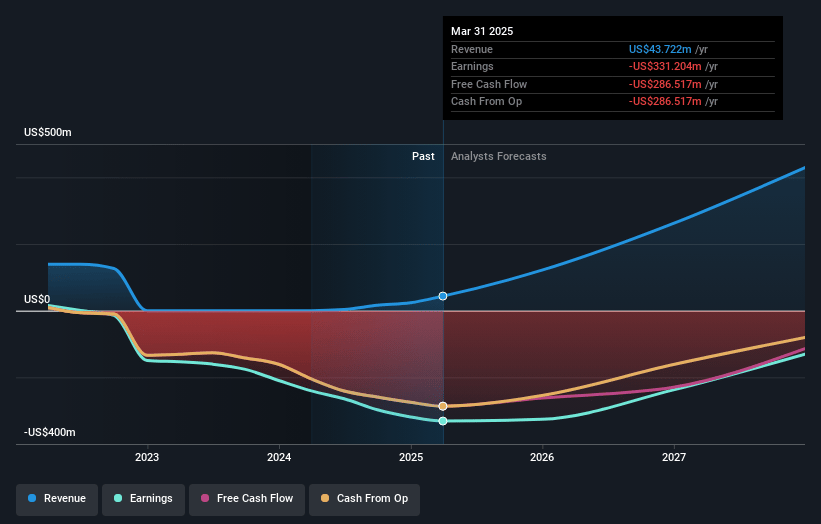

Syndax Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Syndax Pharmaceuticals's revenue will grow by 151.6% annually over the next 3 years.

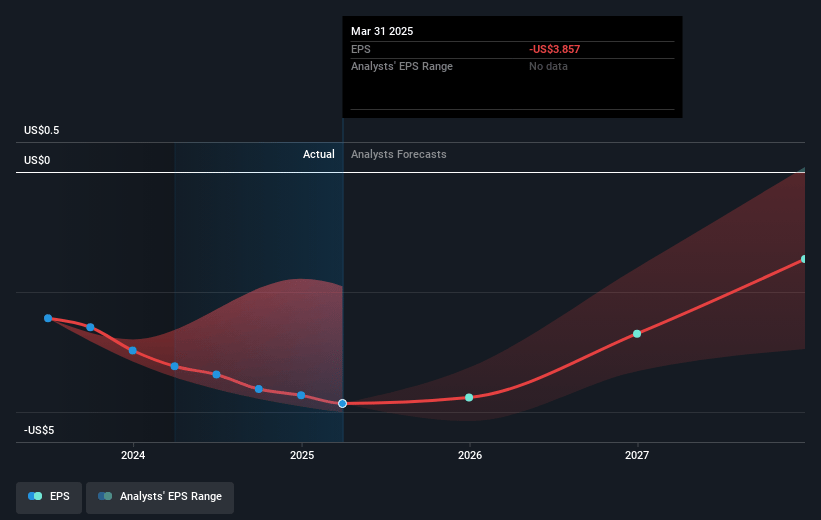

- Analysts are not forecasting that Syndax Pharmaceuticals will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Syndax Pharmaceuticals's profit margin will increase from -1346.1% to the average US Biotechs industry of 15.9% in 3 years.

- If Syndax Pharmaceuticals's profit margin were to converge on the industry average, you could expect earnings to reach $59.8 million (and earnings per share of $0.67) by about May 2028, up from $-318.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 64.1x on those 2028 earnings, up from -3.7x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 1.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

Syndax Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on a rapid FDA approval process and subsequent payer coverage might pose a risk, as any delays or setbacks in regulatory actions or negotiations with insurers could impact revenue timelines and financial stability.

- Significant R&D expenses, such as the expected $65 million to $70 million for Q1 2025, could strain financial resources if revenue growth does not meet expectations, thereby impacting net margins.

- The terms of the collaboration with Incyte, especially the sharing of commercial profits and losses, could lead to unpredictable earnings and financial outcomes, depending on the commercial success of partnered products like Niktimvo.

- The competitive landscape for targeted therapies in oncology might pressure market share and revenue, particularly if other companies develop or launch similar or superior treatments before Syndax can firmly establish its products.

- The strategy of leveraging the first-mover advantage assumes continuity in physician preferences and patient uptake, but shifts in the market dynamics or the introduction of alternative products with better profiles could challenge revenue growth assumptions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.25 for Syndax Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $377.1 million, earnings will come to $59.8 million, and it would be trading on a PE ratio of 64.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $13.7, the analyst price target of $35.25 is 61.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.