Key Takeaways

- Adoption of FUROSCIX is accelerating due to improved patient access, expanded indications, and positive trends in home-based care, enhancing long-term revenue prospects.

- Enhanced commercial strategies and upcoming product innovation are boosting prescription rates, market penetration, and margins, driving sustained business growth.

- Heavy reliance on a single product, evolving payer dynamics, operational risks, and competitive pressures threaten profitability, margin expansion, and future revenue growth.

Catalysts

About scPharmaceuticals- A pharmaceutical company, focuses on developing and commercializing products to optimize the delivery of infused therapies and patient care.

- Acceleration in adoption of FUROSCIX driven by expanded access through Medicare Part D redesign and rising enrollment in copay smoothing programs is lowering patient out-of-pocket costs, directly boosting prescription fill rates and expected to fuel strong revenue growth.

- Expansion of the FUROSCIX label into chronic kidney disease, in addition to heart failure, is opening up a significantly larger addressable market (estimated 700,000 new patients), positioning the company for increased revenues and broader long-term growth.

- Ongoing shift towards at-home, self-administered therapies and value-based care is increasing healthcare system demand for cost-efficient solutions like FUROSCIX, improving the likelihood of widespread reimbursement and sustained product adoption-supporting topline and margin expansion.

- Commercial execution improvements-including larger sales forces, increased prescriber engagement, and penetration into integrated delivery networks (IDNs)-are translating to new account openings, higher reorder rates, and faster uptick in unique prescribers, elevating revenue and earnings visibility.

- Upcoming launch of the FUROSCIX Autoinjector is projected to reduce cost of goods sold (COGS) by 70%–75%, driving substantial improvements in net margins and operational leverage as volumes grow.

scPharmaceuticals Future Earnings and Revenue Growth

Assumptions

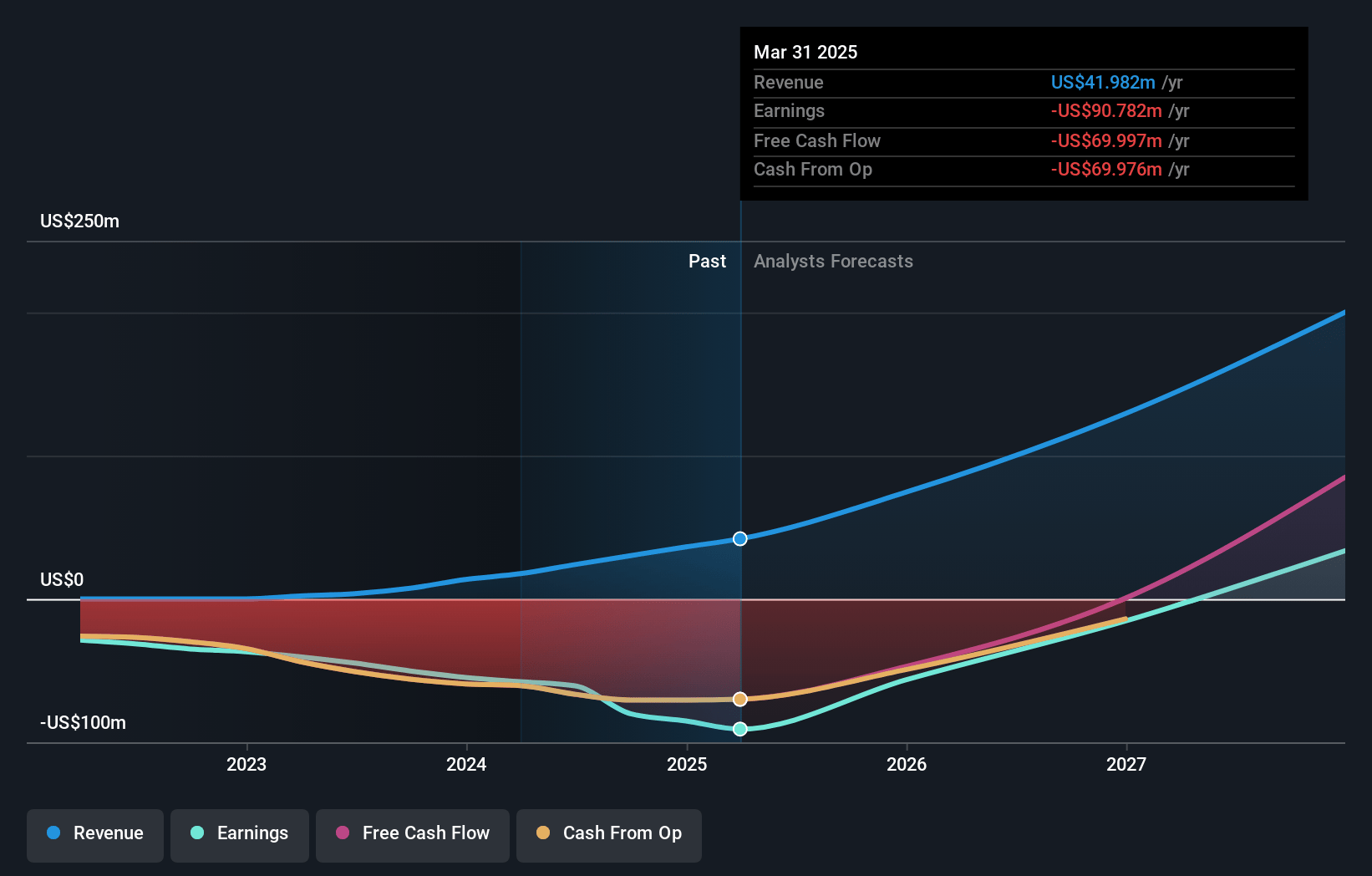

How have these above catalysts been quantified?- Analysts are assuming scPharmaceuticals's revenue will grow by 72.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -216.2% today to 20.6% in 3 years time.

- Analysts expect earnings to reach $44.2 million (and earnings per share of $0.78) by about July 2028, up from $-90.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $83.3 million in earnings, and the most bearish expecting $11.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.4x on those 2028 earnings, up from -2.6x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 5.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

scPharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- scPharmaceuticals' heavy dependence on the success of FUROSCIX, with minimal diversification in its product pipeline, means that any underperformance, adverse regulatory developments, or unforeseen safety/efficacy issues with FUROSCIX will directly pressure both revenue and net margins.

- The anticipated increase in gross-to-net (GTN) discount from 23% to approximately 30% in 2025, driven by Medicare Part D redesign and mandatory manufacturer rebates, will create ongoing margin compression and limit the company's ability to translate sales growth into improved earnings.

- Despite the rapid initial uptake in the chronic kidney disease indication, the company's future growth relies on sustained physician adoption and payer reimbursement; any reimbursement challenges, increased payer scrutiny, or future changes in Medicare/copay policies could restrain topline revenue and impair earnings visibility.

- Scaling manufacturing and distribution for new forms such as the Autoinjector introduces operational complexity; any inefficiencies, supply constraints, or delays in reducing COGS as projected may result in higher than expected costs and negative impacts on profitability.

- Long-term, the pharmaceutical industry faces heightened competition from generics, biosimilars, and alternative drug delivery technologies; if such competitors provide comparable or superior treatments at lower cost, scPharmaceuticals could experience loss of market share, revenue stagnation, and lower net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.6 for scPharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $214.5 million, earnings will come to $44.2 million, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of $4.39, the analyst price target of $15.6 is 71.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.