Last Update 20 Nov 25

Fair value Increased 11%PRTA: Upcoming Partnered Pipeline Milestones Will Drive Substantial Upside Over Next Year

Analysts have increased their price target for Prothena, raising it from $16.50 to $18.33. They cite optimism about the company's partnered pipeline and upcoming catalysts as key drivers for this upward revision.

Analyst Commentary

Bullish analysts have raised price targets for Prothena, highlighting several positive aspects of the company’s outlook.

Bullish Takeaways- The partnered pipeline is viewed as a major strength, offering attractive long-term revenue potential from royalties and milestone payments.

- Upcoming catalysts over the next year and beyond are expected to drive meaningful value creation for shareholders.

- There is an expectation of substantial upside, given the company’s positioning within high-growth therapeutic areas and strong partnerships.

- Optimism around execution and delivery on pipeline milestones supports an increased valuation outlook.

- Analysts remain cautious about the company’s ability to consistently deliver on key pipeline milestones, which could impact future valuation if delayed.

- Potential risks include reliance on partnered programs and external milestone achievements, which may introduce uncertainty into revenue projections.

- Market competition in the relevant therapeutic segments could temper long-term growth if Prothena faces setbacks in product differentiation or commercialization.

What's in the News

- Publication of Phase 2 clinical trial data for coramitug (formerly PRX004) in ATTR amyloidosis with cardiomyopathy, including presentation at the American Heart Association's Scientific Sessions and publication in Circulation. Novo Nordisk has initiated the Phase 3 CLEOPATTRA trial, and Prothena is eligible for up to $1.2 billion in milestone payments (Key Developments).

- Prothena released results from the Phase 1 ASCENT clinical program for PRX012 in early symptomatic Alzheimer's disease, demonstrating meaningful reductions in amyloid plaque and outlining future partnership opportunities for further development (Key Developments).

- A Special/Extraordinary Shareholders Meeting is scheduled for November 19, 2025, in Dublin to consider a reduction in company capital to facilitate the creation of distributable reserves (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has increased from $16.50 to $18.33. This reflects greater confidence in Prothena's future prospects.

- Discount Rate has risen slightly from 7.24% to 7.39%. This indicates a marginally higher perceived risk or required return.

- Revenue Growth projection has fallen significantly, declining from 89.76% to 74.72%.

- Net Profit Margin estimate has improved modestly, moving from 16.28% to 16.98%.

- Future P/E has expanded from 93.77x to 112.74x. This suggests a higher valuation relative to anticipated future earnings.

Key Takeaways

- Successful clinical trials for Birtamimab and Alzheimer's treatments could significantly boost Prothena's revenue through large market opportunities.

- Strategic partnerships and a strong financial position support pipeline advancement and potential long-term earnings growth.

- Uncertainty in FDA approval and potential competition may delay birtamimab commercialization and impact Prothena's financial resources and revenue growth prospects.

Catalysts

About Prothena- A late-stage clinical biotechnology company, focuses on discovery and development of novel therapies to treat diseases caused by protein dysregulation in the United States.

- Prothena's wholly-owned drug candidate, Birtamimab, is nearing a significant inflection point with expected top-line results from the Phase III AFFIRM-AL trial in mid-2025. If successful, it could lead to a substantial revenue boost upon its potential U.S. launch in the second half of 2026 due to its large multi-billion dollar market opportunity for treating Mayo Stage IV AL amyloidosis patients.

- The potential first-in-class treatment for Alzheimer's disease, PRX012, might offer a unique once-monthly subcutaneous administration, reducing treatment burden and potentially gaining market share upon effective Phase I trial results in 2025. This innovation could lead to substantial revenue increases given the large, underserved Alzheimer's market.

- Prothena's second Alzheimer's program, PRX123, a dual A-beta and tau vaccine, has the potential of targeting the large presymptomatic segment of the Alzheimer's market, potentially accelerating future revenue growth if it progresses successfully through clinical stages.

- Strategic partnerships with major pharmaceutical companies, including BMS and Roche, leverage resources and expertise to advance Prothena's pipeline, potentially increasing long-term earnings through shared profits from partnered programs' successes, particularly in diseases like Parkinson's and ATTR amyloidosis.

- Prothena's solid financial position, with $472.2 million in cash and no debt as of 2024, provides a strong foundation for advancing its clinical trials and supporting future earnings growth through successful product launches and commercialization efforts.

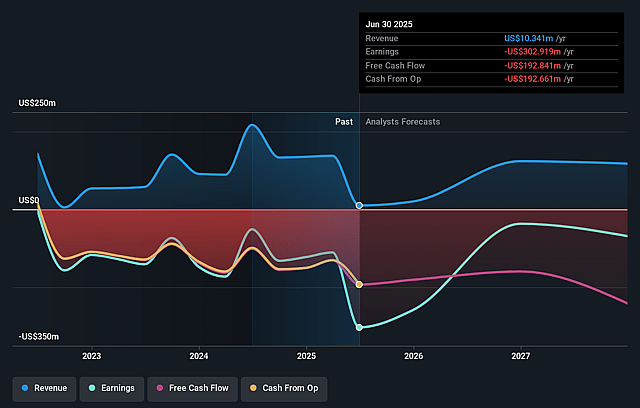

Prothena Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Prothena's revenue will grow by 14.8% annually over the next 3 years.

- Analysts are not forecasting that Prothena will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Prothena's profit margin will increase from -79.9% to the average US Biotechs industry of 10.5% in 3 years.

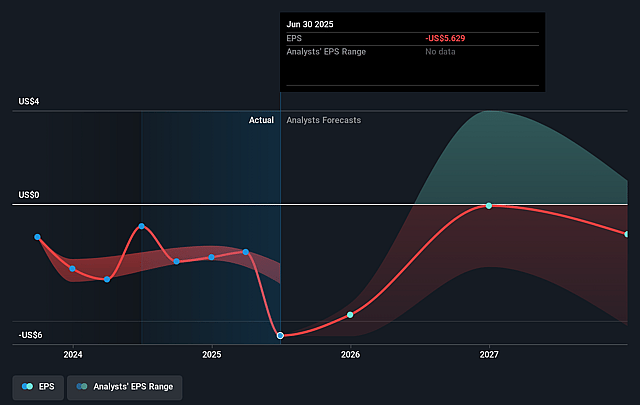

- If Prothena's profit margin were to converge on the industry average, you could expect earnings to reach $22.0 million (and earnings per share of $0.42) by about July 2028, up from $-110.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 71.7x on those 2028 earnings, up from -3.2x today. This future PE is greater than the current PE for the US Biotechs industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Prothena Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Uncertainty around FDA approval for birtamimab, particularly if Phase III AFFIRM-AL results do not meet predefined statistical significance, could delay commercialization and impact Prothena's future revenue projections.

- Potential competition in the treatment of AL amyloidosis from other emerging therapies, like daratumumab, might limit birtamimab’s market share, affecting anticipated revenue growth.

- Relatively high clinical development costs and net losses projected for 2025 could strain financial resources before birtamimab or other therapies can generate significant earnings.

- The lack of demonstrated early mortality impact by existing plasma cell-targeting therapies like daratumumab sets a high bar for proving the market need and commercial viability of birtamimab, potentially impacting its uptake and, subsequently, net margins.

- Dependence on successful partnerships with large pharmaceutical companies and the outcome of clinical trials involving partnered products, such as prasinezumab and coramitug, introduces execution and collaboration risks that could influence long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.286 for Prothena based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $81.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $208.8 million, earnings will come to $22.0 million, and it would be trading on a PE ratio of 71.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of $6.53, the analyst price target of $24.29 is 73.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.