Last Update01 May 25Fair value Increased 1.36%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Advances in clinical genomics and innovative sequencing platforms are expanding market reach, driving recurring revenue growth and improving margins.

- Operational improvements and broader healthcare adoption are lowering barriers, enhancing profitability, and supporting long-term growth despite near-term challenges.

- Exposure to funding cuts, trade disruptions, persistent losses, stalled product development, and mounting competition threatens PacBio’s growth prospects and ability to achieve profitability.

Catalysts

About Pacific Biosciences of California- Designs, develops, and manufactures sequencing solution to resolve genetically complex problems.

- Expansion into clinical genomics, as reflected by rising adoption among hospital and diagnostic lab customers and collaborations on population-scale initiatives (e.g., newborn screening in Thailand, dementia registries), is broadening PacBio’s market reach and is expected to drive more durable, recurring revenue and support long-term revenue growth.

- Product innovation—such as the ongoing rollout of Spark chemistry (increasing sequencing yield and lowering DNA input), launch of the versatile Vega platform, and accelerated development of the next-generation ultra-high-throughput long-read sequencer (aimed at cost parity with short reads)—positions PacBio to capture expanding demand for advanced, high-fidelity genomic data, supporting both revenue expansion and gross margin improvement.

- Strong year-over-year consumables growth, growing utilization of installed systems, and stabilizing pull-through rates—especially in clinical and commercial environments—are improving recurring high-margin revenue streams, which could drive gross margin expansion and better earnings quality over time.

- Investments in multi-use SMRT Cell innovation, cost reduction in workflows, and increased operational focus (post-restructuring) are expected to lower customer adoption barriers and operating expenses, potentially enhancing market penetration, operating leverage, and the company’s path toward positive earnings and cash flow by 2027.

- The global acceleration in adoption of precision medicine, population genomics, and data-intensive healthcare research (despite short-term academic funding headwinds and tariffs) continues to expand the total addressable market for PacBio’s differentiated long-read sequencing technologies, presenting substantial long-term growth opportunities for both revenue and earnings as macro conditions improve.

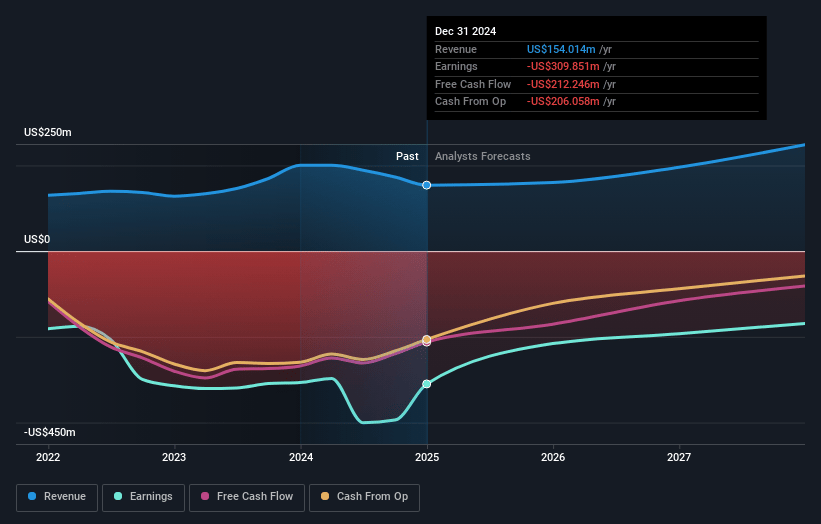

Pacific Biosciences of California Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pacific Biosciences of California's revenue will grow by 15.9% annually over the next 3 years.

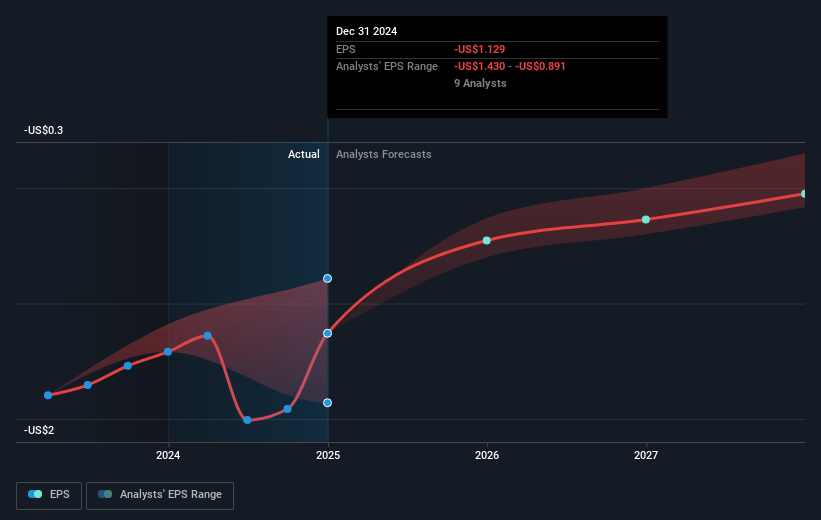

- Analysts are not forecasting that Pacific Biosciences of California will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Pacific Biosciences of California's profit margin will increase from -431.7% to the average US Life Sciences industry of 12.3% in 3 years.

- If Pacific Biosciences of California's profit margin were to converge on the industry average, you could expect earnings to reach $29.1 million (and earnings per share of $0.08) by about May 2028, up from $-657.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.1x on those 2028 earnings, up from -0.5x today. This future PE is greater than the current PE for the US Life Sciences industry at 33.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.18%, as per the Simply Wall St company report.

Pacific Biosciences of California Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing uncertainty and reductions in academic and government funding, especially potential NIH budget cuts and difficulty in U.S. academic capital purchasing, are leading to reduced demand for higher-priced instruments—directly pressuring top-line revenue and slowing future growth.

- Recently implemented tariffs, particularly between the U.S. and China, are disrupting the ability to ship instruments into a key international market and could increase cost of goods if supply chain exposure deepens, thereby impacting both revenue and gross margins.

- PacBio remains unprofitable, continues to report significant net losses, and expects continued cash burn through at least 2027; the business is dependent on achieving substantial top-line revenue growth, margin expansion, and strict cost control to reach cash flow breakeven, exposing it to risk if growth targets are missed.

- Strategic pause on development of the high-throughput short-read platform, combined with intensifying competition from established and emerging NGS providers, risks ceding market opportunity/diversification and increases vulnerability if adoption of long-read platforms underperforms—potentially limiting PacBio’s addressable market and revenue streams.

- Secular industry risks such as trade policy volatility, deglobalization, and the prospect of rapid advances in competing genomic technologies or declining sequencing prices industry-wide may erode PacBio’s long-term pricing power, compress gross margins, and lower overall earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.027 for Pacific Biosciences of California based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.0, and the most bearish reporting a price target of just $1.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $236.9 million, earnings will come to $29.1 million, and it would be trading on a PE ratio of 35.1x, assuming you use a discount rate of 11.2%.

- Given the current share price of $1.02, the analyst price target of $2.03 is 49.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.