Narratives are currently in beta

Key Takeaways

- Neurocrine's focus on pipeline development and strategic drug launches aims to drive revenue growth and business diversification.

- The company's share repurchase strategy could enhance earnings per share while leveraging perceived undervaluation.

- Increased competition and reimbursement delays may challenge Neurocrine's revenue growth, while pipeline risks and regulatory impacts could affect profitability and financial stability.

Catalysts

About Neurocrine Biosciences- Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

- Neurocrine's capital allocation strategy prioritizes revenue growth with significant investments in INGREZZA and preparation for the crinecerfont launch, providing expected revenue growth and diversification. (Revenue)

- The approval and launch preparation for Crinecerfont, a first-in-class medicine for congenital adrenal hyperplasia, is expected to drive a second leg of revenue growth and diversify Neurocrine's business. (Revenue)

- The company plans to aggressively develop and advance its highest value pipeline assets, such as NBI-845 for major depressive disorder and NBI-568 for schizophrenia, positioning these as key:value drivers alongside INGREZZA and crinecerfont. (Earnings)

- Neurocrine is implementing a $300 million accelerated share repurchase transaction, leveraging what it perceives as a discount to its enterprise valuation, which could enhance earnings per share. (Earnings per Share)

- Neurocrine's psychiatry and long-term care sales force expansion, expected to show benefits starting in the first half of next year, aims to capture growth in the tardive dyskinesia market, impacting both revenue and market share. (Revenue)

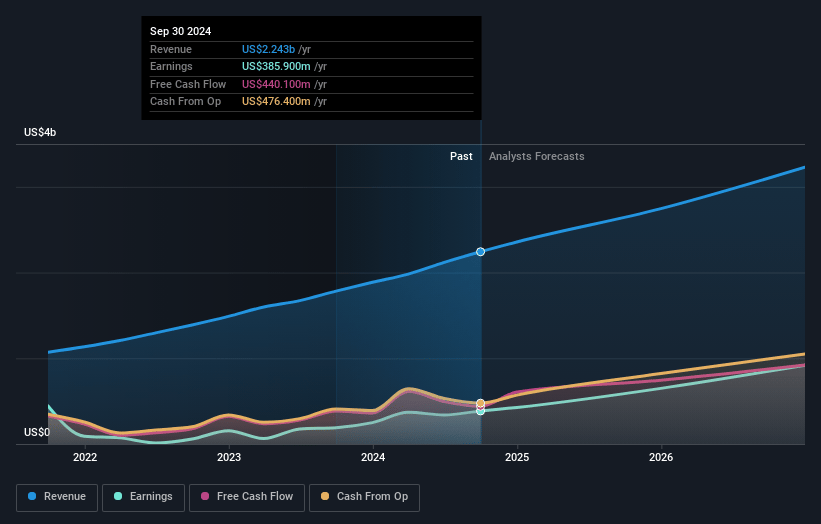

Neurocrine Biosciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Neurocrine Biosciences's revenue will grow by 17.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.2% today to 31.0% in 3 years time.

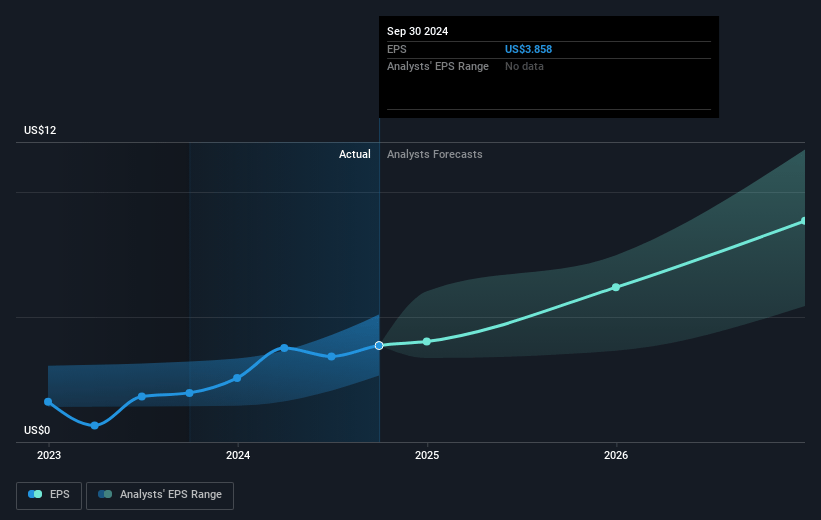

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $10.63) by about January 2028, up from $385.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.3 billion in earnings, and the most bearish expecting $625.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, down from 39.5x today. This future PE is greater than the current PE for the US Biotechs industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 1.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.23%, as per the Simply Wall St company report.

Neurocrine Biosciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive landscape for INGREZZA is becoming increasingly challenging, with Teva's deuterated tetrabenazine growing in market share, which could impact Neurocrine's revenue growth and market positioning.

- The potential delay in commercial payers' reimbursement for crinecerfont, with first-half 2025 dynamics indicating possible new-to-market coverage restrictions, might slow initial revenue uptake.

- The risk that ongoing investments in early and mid-stage pipeline programs do not lead to successful outcomes could impact long-term revenue growth and profitability if expected pipeline expansions underperform.

- The discontinuation of certain programs like luvadaxistat and NBI-104 demonstrates the inherent risks in drug development, which could impact R&D spending and future financial returns.

- Neurocrine's ability to manage pricing and access dynamics for INGREZZA in light of possible changes tied to the Inflation Reduction Act could affect net margins and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $167.71 for Neurocrine Biosciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $192.0, and the most bearish reporting a price target of just $121.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 6.2%.

- Given the current share price of $150.71, the analyst's price target of $167.71 is 10.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives