Narratives are currently in beta

Key Takeaways

- Acquiring royalty-generating assets like QARZIBA and CAPVAXIVE is expected to provide predictable revenue growth and expand revenue streams.

- Investing in scalable, low-OpEx assets with strategies like ZELSUVMI launch is anticipated to improve margins and drive strong earnings growth.

- Heavy reliance on key products and partners poses risks, while strategic acquisitions and royalty focus require substantial investment potentially impacting margins and future earnings.

Catalysts

About Ligand Pharmaceuticals- A biopharmaceutical company, engages in the development and licensing of biopharmaceutical assets worldwide.

- Ligand Pharmaceuticals' strategy of acquiring high-value royalty-generating assets, such as APEIRON Biologics' QARZIBA, is expected to provide predictable and growing royalty revenue, which will positively impact future revenue growth.

- The approval and launch of Merck's CAPVAXIVE, recommended by the CDC for a broader age group, is expected to expand the patient population and significantly increase royalty revenue in the coming years.

- The full FDA approval and potential indication expansion of Travere's FILSPARI is positioned as a foundational therapy for IgA nephropathy, with potential further approval for FSGS, which would significantly boost royalty revenue.

- Ligand's scalable and differentiated investment strategy in life sciences, targeting high-growth low-OpEx assets with a compounding growth model, is expected to improve net margins through operational leverage.

- The ongoing investment and commercialization strategy, such as the upcoming launch of ZELSUVMI for Molluscum contagiosum, are anticipated to drive strong earnings growth and adjusted EPS increases, supporting future earnings potential.

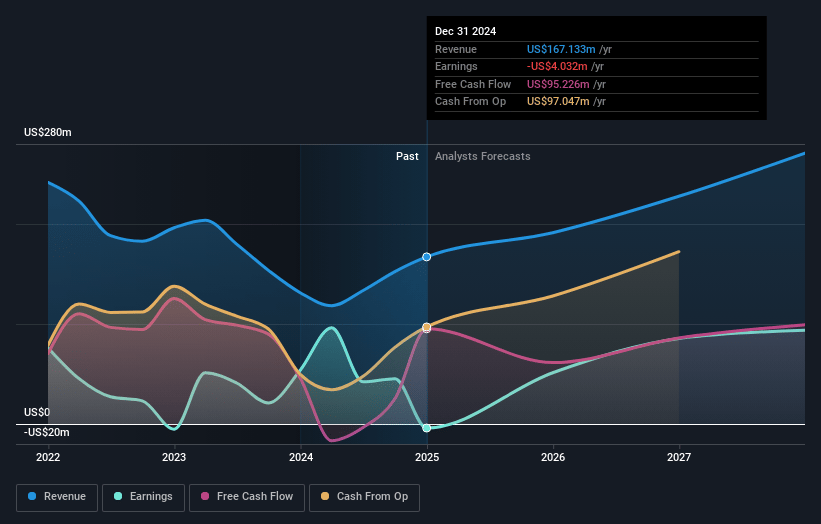

Ligand Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ligand Pharmaceuticals's revenue will grow by 18.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.7% today to 40.0% in 3 years time.

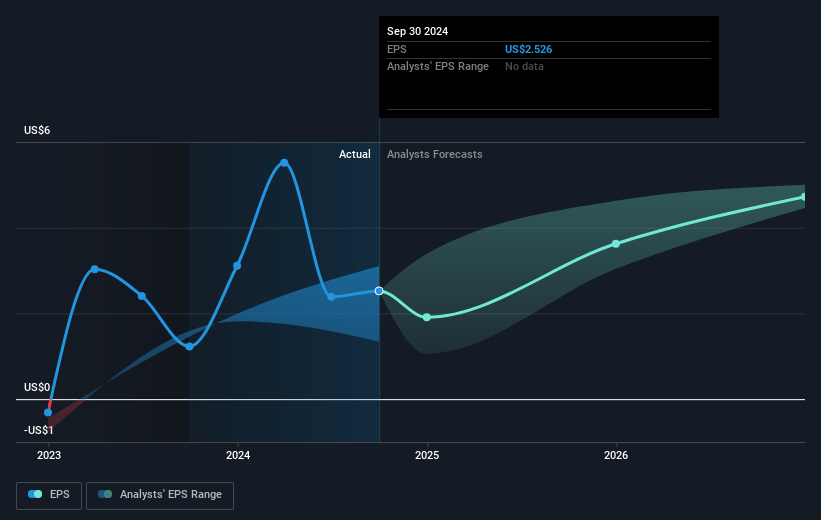

- Analysts expect earnings to reach $100.1 million (and earnings per share of $4.87) by about January 2028, up from $45.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.2x on those 2028 earnings, down from 49.3x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 2.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Ligand Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential risks include heavy reliance on selected products like FILSPARI, where any adverse regulatory or competitive market developments could negatively affect royalty revenue projections.

- The potential complications from FDA interactions or trial outcomes, especially for pipeline products like FILSPARI in FSGS or Ohtuvayre in COPD, could affect future earnings expectations.

- Increased competition in targeted treatment areas such as IgAN or molluscum contagiosum could undermine predicted revenue growth from these therapies.

- Volatility in Captisol material sales and dependence on major partners like Amgen could lead to fluctuations in revenue.

- The company’s strategic focus on royalty engagements and acquisitions requires significant capital investment, which could impact net margins if expected returns are delayed or lower than anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $144.0 for Ligand Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $125.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $250.4 million, earnings will come to $100.1 million, and it would be trading on a PE ratio of 34.2x, assuming you use a discount rate of 5.9%.

- Given the current share price of $118.11, the analyst's price target of $144.0 is 18.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives