Catalysts

About Lifecore Biomedical

Lifecore Biomedical is a differentiated injectable contract development and manufacturing organization specializing in high-grade hyaluronic acid and complex aseptic fill and finish services.

What are the underlying business or industry changes driving this perspective?

- Although the company is seeing robust demand for injectable manufacturing and has secured late-stage pipeline programs scheduled to launch between 2026 and 2029, any delays in customer regulatory approvals or lower-than-expected conversion of these programs could push out the anticipated revenue ramp and limit earnings growth.

- Despite regionalization trends that are driving more commercial site transfer opportunities into the United States, extended tech transfer timelines of 24 to 30 months for large pharma customers may create capacity bottlenecks and underutilized assets in the interim, constraining near-term revenue efficiency and EBITDA margins.

- While the adoption of injectables in the drug development pipeline and GLP 1 related opportunities are expanding Lifecore's addressable market, increased competition among CDMOs for similar programs could pressure pricing and mix, limiting gross margin expansion even as volumes rise.

- Although workforce productivity has improved with more than a 20% manufacturing headcount reduction, sustaining similar production volumes as more complex commercial programs ramp may require incremental hiring or overtime, which would dampen the expected benefits to net margins.

- Despite expectations that the new enterprise resource planning system and procurement initiatives will enhance inventory control and lower costs from 2026 onward, implementation risk and change management challenges could lead to short-term disruptions and higher operating expenses, delaying the anticipated improvement in adjusted EBITDA.

Assumptions

This narrative explores a more pessimistic perspective on Lifecore Biomedical compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

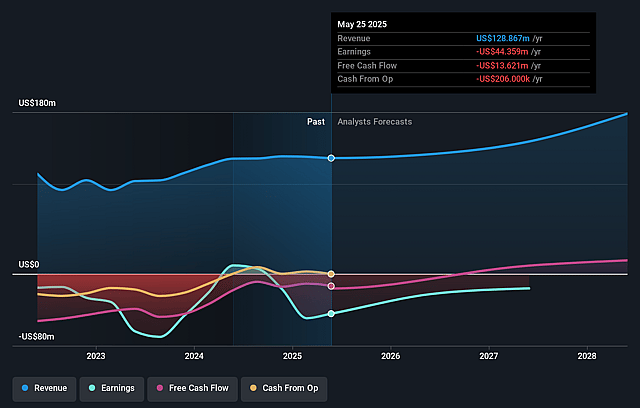

- The bearish analysts are assuming Lifecore Biomedical's revenue will grow by 6.1% annually over the next 3 years.

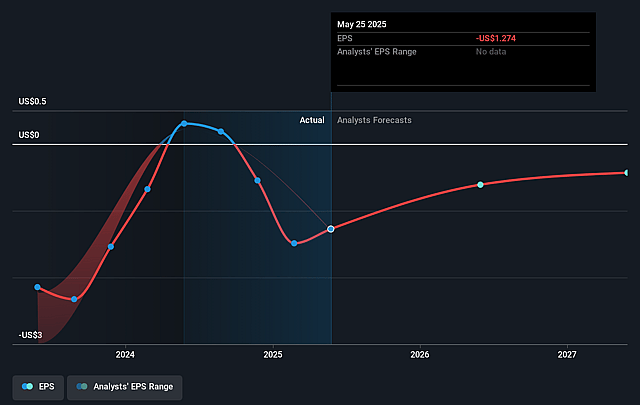

- The bearish analysts are not forecasting that Lifecore Biomedical will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Lifecore Biomedical's profit margin will increase from -34.4% to the average US Life Sciences industry of 15.5% in 3 years.

- If Lifecore Biomedical's profit margin were to converge on the industry average, you could expect earnings to reach $23.9 million (and earnings per share of $0.62) by about December 2028, up from $-44.4 million today.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from -6.4x today. This future PE is lower than the current PE for the US Life Sciences industry at 34.6x.

- The bearish analysts expect the number of shares outstanding to grow by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.78%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Sustained double digit revenue growth, evidenced by the recent 26 percent year on year increase and guidance for over 20 percent growth in the current transition period, could signal a structural acceleration in demand that drives the share price higher as investors re rate the company on faster top line expansion and improving earnings.

- The build out of a late stage pipeline of 11 programs with expected launches between 2026 and 2029, including GLP 1 and large pharma contracts, alongside commercial site transfers that are projected to create top 5 customers and consume up to 10 percent of facility capacity, could materially expand recurring revenue and EBITDA, leading to a higher valuation multiple.

- Secular tailwinds such as the regionalization of injectable manufacturing into the United States and the fact that roughly half of the US drug development pipeline is in injectables, combined with Lifecore’s specialized HA capabilities and positive regulatory audit track record, may strengthen competitive positioning and support long term revenue growth and margin expansion.

- Ongoing cost discipline, including more than a 20 percent reduction in manufacturing headcount while maintaining production volumes, sequential declines in operating expenses and targeted procurement savings, together with a midterm adjusted EBITDA margin goal of 25 percent, could significantly improve net margins and earnings and prompt a positive share price re rating.

- Operational and financial leverage from new systems and transformation initiatives, such as the enterprise resource planning implementation expected to go live in early 2026 and a dedicated Head of Business Transformation, may enhance inventory control, reduce SG and A and increase EBITDA margins over time, which could drive earnings growth and upward pressure on the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Lifecore Biomedical is $7.5, which represents up to two standard deviations below the consensus price target of $8.75. This valuation is based on what can be assumed as the expectations of Lifecore Biomedical's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $7.5.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $154.1 million, earnings will come to $23.9 million, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 8.8%.

- Given the current share price of $7.63, the analyst price target of $7.5 is 1.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Lifecore Biomedical?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.