Last Update01 May 25Fair value Increased 3.80%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Positive trial outcomes in myelofibrosis and endometrial cancer could significantly boost revenue and redefine care standards.

- Cost reduction efforts and expanding international reimbursements are expected to enhance net margins and overall earnings.

- Karyopharm faces revenue challenges from market competition, liquidity concerns, delayed data reporting, and pressure on product revenue affecting overall profitability and future growth.

Catalysts

About Karyopharm Therapeutics- A commercial-stage pharmaceutical company, discovers, develops, and commercializes drugs directed against nuclear export for the treatment of cancer and other diseases in the United States.

- Successful completion and positive data from the Phase III SENTRY trial in myelofibrosis in the second half of 2025 could significantly increase revenue and market opportunity, with the potential to redefine the standard of care and an estimated peak revenue of approximately $1 billion in the U.S. alone.

- Modifications to the Phase III trial in endometrial cancer and the anticipated reporting of top-line data in mid-2026 could provide opportunities for new regulatory approvals and increased revenue if the data demonstrates significant benefit, particularly in the p53 wild-type and pMMR patient population.

- Continued focus on cost reduction initiatives, particularly in SG&A expenses, is expected to further improve net margins by lowering operating expenses while advancing clinical trials and commercial performance.

- Expanding international reimbursement approvals for XPOVIO is expected to contribute to growing royalty revenues, complementing U.S. product revenue and providing a boost to overall earnings.

- Potential for business development activities, financing options, and partnerships focused on early-stage programs could extend the cash runway and improve financial stability, allowing for continued investment in growth opportunities.

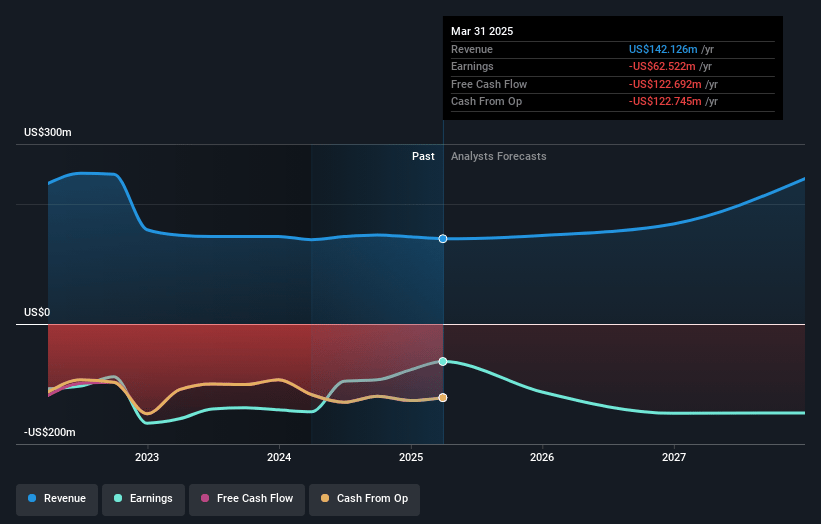

Karyopharm Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Karyopharm Therapeutics's revenue will grow by 18.5% annually over the next 3 years.

- Analysts are not forecasting that Karyopharm Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Karyopharm Therapeutics's profit margin will increase from -52.6% to the average US Biotechs industry of 15.9% in 3 years.

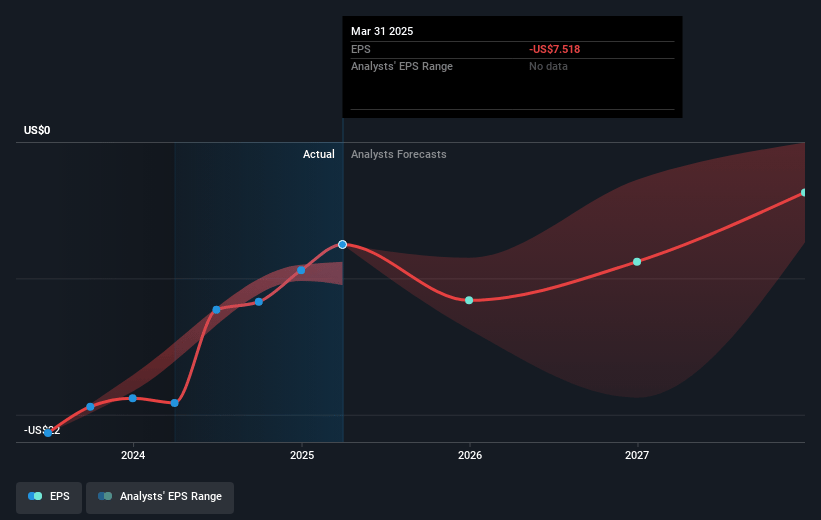

- If Karyopharm Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $38.3 million (and earnings per share of $3.83) by about May 2028, up from $-76.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.5x on those 2028 earnings, up from -0.7x today. This future PE is lower than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Karyopharm Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Karyopharm's financial guidance indicates a decline in total revenue and continuing pressure from increased competition, particularly in the multiple myeloma market, signaling potential challenges in maintaining or growing revenue.

- The company's cash position showed a decrease from $192.4 million to $109.1 million over the year, raising concerns about liquidity risks and the ability to sufficiently fund operations beyond late 2025 without additional financing, affecting net margins and earnings.

- Modifications to the endometrial cancer Phase III trial, as guided by the FDA, could delay top-line data reporting until mid-2026, which may postpone potential revenue streams from this program, impacting future revenue growth.

- Increased gross to net discounts, especially related to 340B utilization and Medicare rebates, could continue to put pressure on net product revenue from XPOVIO, affecting overall profitability.

- The reliance on successful outcomes from ongoing Phase III trials for future growth presents execution risks, as any adverse clinical trial outcomes could significantly affect anticipated revenues from potential new approvals.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $48.643 for Karyopharm Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $241.7 million, earnings will come to $38.3 million, and it would be trading on a PE ratio of 17.5x, assuming you use a discount rate of 11.4%.

- Given the current share price of $6.35, the analyst price target of $48.64 is 86.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.