Key Takeaways

- Successful trial outcomes and strategic expansions for Zepzelca, Zanidatamab, and Xywav drive expectations of significant revenue growth and market strength.

- Strategic investments and commercial execution enhance global presence, supporting sustained earnings growth and strong cash flow for Jazz Pharmaceuticals.

- Protocol changes and trial failures could disrupt revenue growth; competitive pressure and R&D investment may challenge profitability and market expansion.

Catalysts

About Jazz Pharmaceuticals- Jazz Pharmaceuticals plc identifies, develops, and commercializes pharmaceutical products for unmet medical needs in the United States, Europe, and internationally.

- The positive results from the Phase III IMforte trial evaluating Zepzelca in first-line maintenance therapy for extensive stage small cell lung cancer present an opportunity to expand its label, increasing the eligible patient population and potentially extending treatment duration, which would contribute to revenue growth.

- The upcoming PDUFA date for Zanidatamab in second-line biliary tract cancer and the ongoing trials in various HER2-positive tumors offer potential new indications. Success in these areas could significantly enhance revenue and solidify Zanidatamab's position in the market.

- The growth potential of Xywav in idiopathic hypersomnia, with continued positive feedback and increased patient additions, supports expectations for ongoing demand and revenue growth in the neuroscience therapeutic area.

- The market expansion of Epidiolex, nearing blockbuster status, through focused data generation and geographic expansion beyond the current 35 countries, is expected to increase revenue and strengthen Jazz’s global market presence.

- The strong commercial execution, which includes record revenues and strategic investment in high-potential products, alongside robust cash flow, positions Jazz Pharmaceuticals well to enhance earnings through strategic corporate development opportunities.

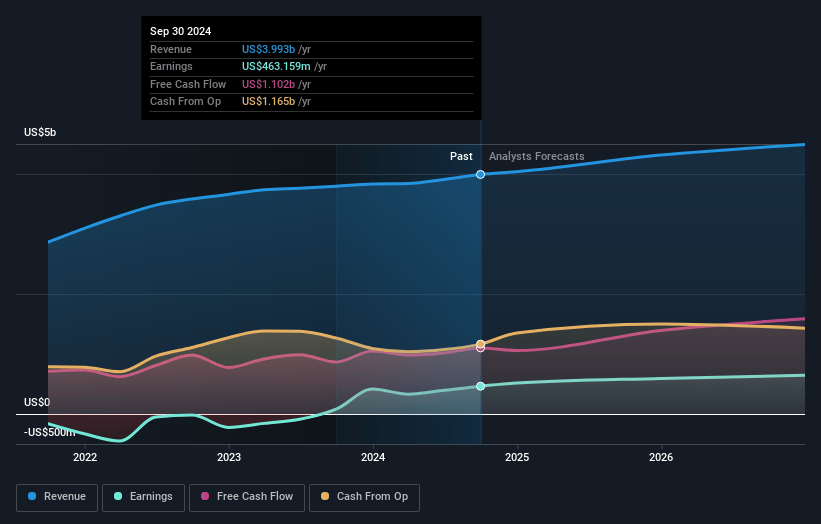

Jazz Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jazz Pharmaceuticals's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.6% today to 16.8% in 3 years time.

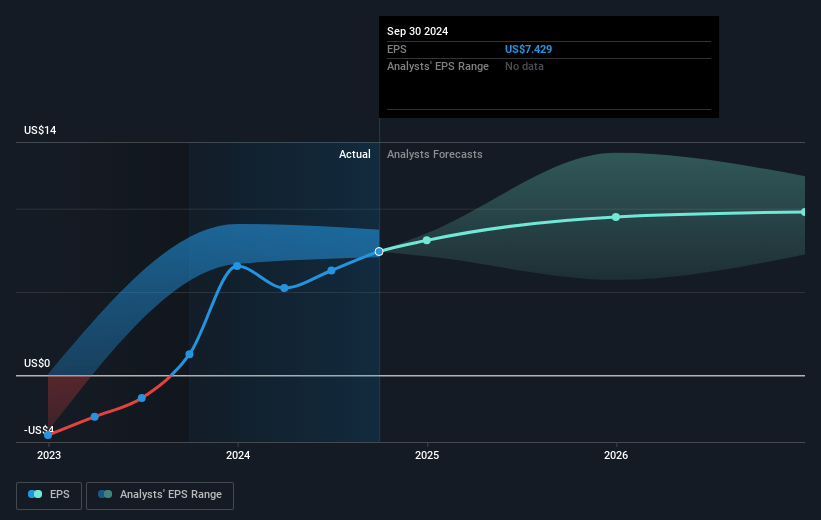

- Analysts expect earnings to reach $791.7 million (and earnings per share of $12.32) by about January 2028, up from $463.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $502.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, up from 16.1x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 2.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.69%, as per the Simply Wall St company report.

Jazz Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The upcoming protocol changes for Rylaze in pediatric treatments could temporarily impact revenue, as this may cause short-term disruption before demand normalizes. This directly relates to potential fluctuations in short-term revenue and cash flow.

- The failure of the Phase III trial in Japan for Epidiolex to meet its primary efficacy endpoint could hinder approval and limit expansion into the Japanese market, which impacts future revenue growth and market penetration.

- Increased competitive pressure in the small cell lung cancer space due to new entrants could limit the growth opportunity for Zepzelca, potentially impacting market share and revenue.

- Pricing and reimbursement challenges, especially in international markets like Japan, could affect the rollout and revenue generation for new drugs such as Epidiolex and Zanidatamab.

- The ongoing need for substantial investments in R&D, as seen with the portfolio prioritization for products like Zanidatamab, could pressure net margins and impact overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $181.05 for Jazz Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $128.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.7 billion, earnings will come to $791.7 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of $123.53, the analyst's price target of $181.05 is 31.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives