Key Takeaways

- Robust pipeline and product launches are expected to drive substantial revenue growth and expand market presence over the coming years.

- Strong cash position enables further pipeline expansion and business development to enhance long-term earnings and shareholder value.

- Financial dependency on WAKIX and risks from new drug development, competitive treatments, and complex strategies may strain margins and revenue stability.

Catalysts

About Harmony Biosciences Holdings- A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

- Harmony Biosciences has a robust late-stage pipeline expected to deliver one or more new product or indication launches each year over the next five years, potentially driving substantial revenue growth.

- The company plans to submit an sNDA for pitolisant for idiopathic hypersomnia before the end of this year, which could expand the market for WAKIX and increase revenue.

- The development of pitolisant GR and HD formulations, with potential PDUFA dates in 2026 and 2028 respectively, aims to grow and extend the pitolisant franchise, potentially expanding revenue and sustaining net margins.

- The EPX-100 and EPX-200 compounds, with a focus on rare childhood epilepsies, offer significant market opportunity in developmental epileptic encephalopathies, potentially boosting future revenue.

- Strong cash position of $505 million supports further business development and pipeline expansion, which could enhance long-term earnings growth and shareholder value.

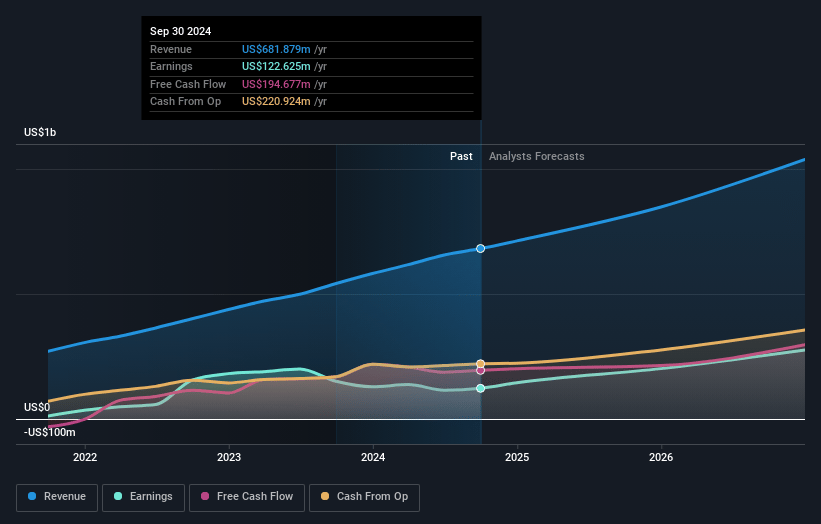

Harmony Biosciences Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Harmony Biosciences Holdings's revenue will grow by 22.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.0% today to 29.2% in 3 years time.

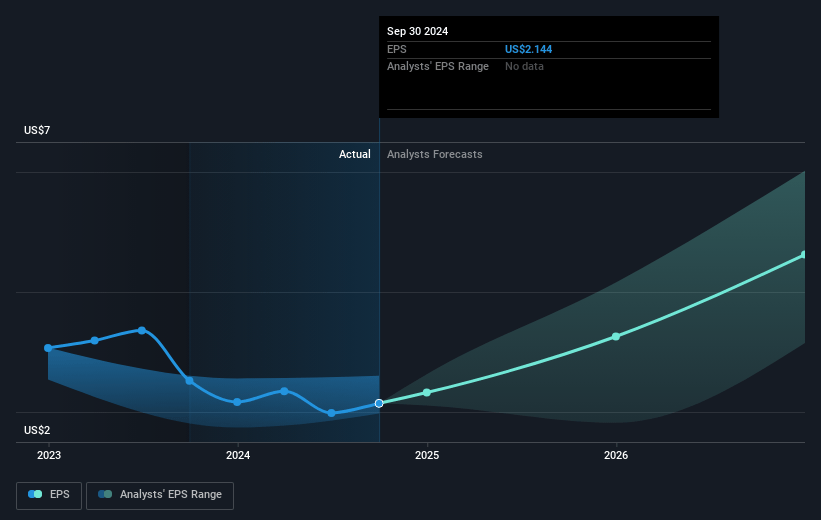

- Analysts expect earnings to reach $362.7 million (and earnings per share of $6.12) by about January 2028, up from $122.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, down from 17.9x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 1.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Harmony Biosciences Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a risk associated with the development of new drugs in the late-stage pipeline that could face regulatory hurdles or fail to demonstrate efficacy or safety, which would negatively impact future revenue and earnings projections tied to these anticipated product launches.

- Launching multiple new product formulations, such as pitolisant GR and HD, alongside existing products risks market cannibalization or confusing the marketplace, potentially affecting adoption rates and net margins due to increased marketing and education expenses.

- The potential emergence of new competitive treatments targeting similar CNS conditions could erode market share for Harmony's products, impacting projected revenue growth and creating pressure on pricing strategies and net margins.

- Financial dependency on the continued success of WAKIX and the ability to manage price pressures from insurance and competition could affect revenue consistency if insurance reimbursements become more stringent or generic alternatives gain market foothold.

- Execution risk in delivering on a complex, multi-asset development strategy could strain financial resources and operational focus, leading to increased operational costs and volatility in earnings if simultaneous advancements do not meet timelines or expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.25 for Harmony Biosciences Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $362.7 million, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 5.9%.

- Given the current share price of $38.42, the analyst's price target of $54.25 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives