Key Takeaways

- Expansion of SoHo platform and BTX systems could drive revenue growth in industrial and academic markets through broader applications and bioproduction processes.

- Cost-reduction and debt refinancing strategies are expected to enhance earnings and financial stability despite higher rates, improving the company's net margins and liquidity.

- Revenue declines, margin reductions, and tariff challenges in key markets pose significant threats to Harvard Bioscience's financial health and investor confidence.

Catalysts

About Harvard Bioscience- Develops, manufactures, and sells technologies, products, and services for life science applications in the United States, Germany, and internationally.

- Harvard Bioscience's expansion of the SoHo platform for implanted telemetry devices to cover cardiac and neuromonitoring applications is poised to drive future growth in industrial and academic markets. This expansion is likely to enhance revenue by broadening the market base.

- The BTX systems, particularly for bioproduction applications like CAR-T therapy, show potential for revenue growth as they enter the biopharmaceutical production process. This could positively impact revenue and margins due to consumable usage scaling with customer production volume.

- The Mesh MEA organoid platform is positioned to capitalize on emerging policy changes promoting human-derived organoids in drug development, indicating potential growth in industrial applications, which could improve revenue and gross margin.

- Implementation of cost-reduction actions is expected to decrease operating expenses by an additional $1 million per quarter starting Q2 2025. This reduction could enhance net margins and potentially improve earnings.

- The company's efforts to refinance its debt facility, despite incurring higher rates, aim to strengthen the financial position and liquidity, potentially improving future earnings stability.

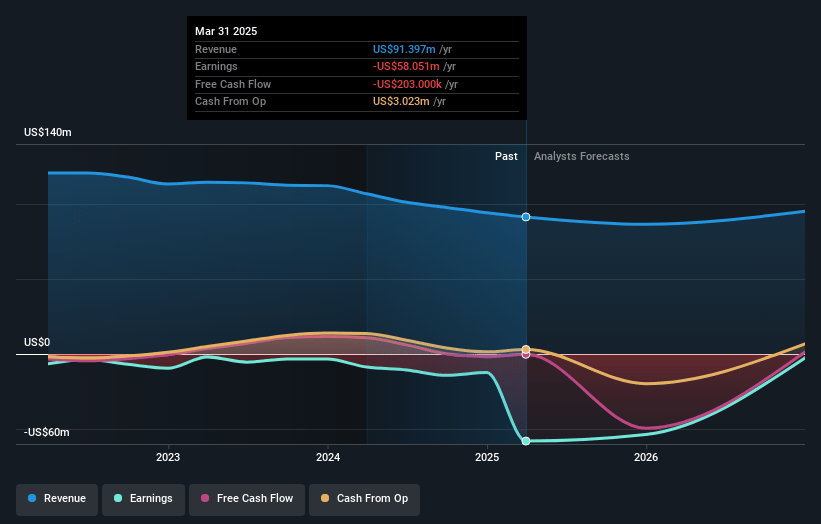

Harvard Bioscience Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Harvard Bioscience's revenue will decrease by 0.8% annually over the next 3 years.

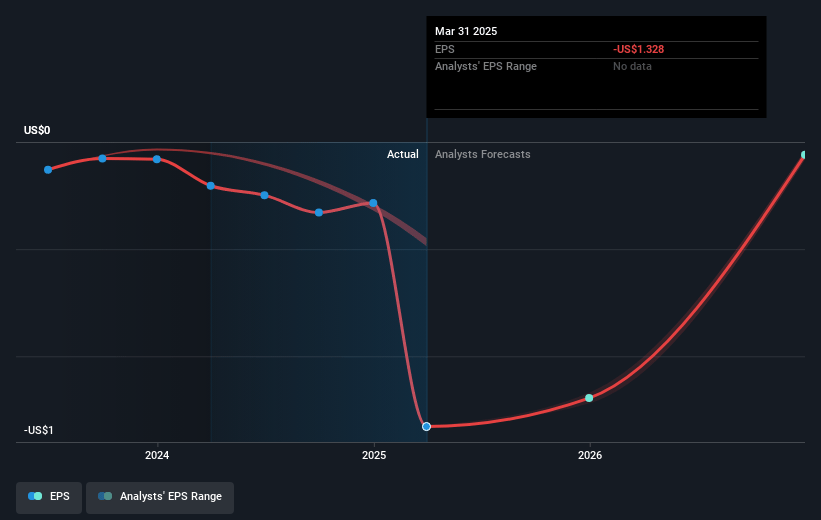

- Analysts are not forecasting that Harvard Bioscience will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Harvard Bioscience's profit margin will increase from -63.5% to the average US Life Sciences industry of 13.8% in 3 years.

- If Harvard Bioscience's profit margin were to converge on the industry average, you could expect earnings to reach $12.9 million (and earnings per share of $0.28) by about July 2028, up from $-58.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, up from -0.3x today. This future PE is lower than the current PE for the US Life Sciences industry at 35.3x.

- Analysts expect the number of shares outstanding to grow by 1.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.3%, as per the Simply Wall St company report.

Harvard Bioscience Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a year-over-year revenue decline from $24.5 million to $21.8 million in the first quarter of 2025, indicating challenges in maintaining sales growth, which may impact future earnings.

- Gross margin decreased from 60.3% in the first quarter of 2024 to 56% in the same period of 2025, due to lower absorption of fixed manufacturing overhead, which could affect net margins.

- A noncash goodwill impairment charge of $48 million was recorded due to a decrease in market capitalization, leading to an operating loss, which reflects negatively on the financial health and could influence investor perceptions.

- Revenue declines in key markets, such as a 9% decrease in Europe and a 17% drop in Asia-Pacific from the previous year, could undermine revenue growth if the downturns persist or worsen.

- Tariff-related challenges in China, which is a significant market for Harvard Bioscience, could lead to revenue softening, especially if tariffs impact sales, thereby affecting overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.0 for Harvard Bioscience based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $93.5 million, earnings will come to $12.9 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 11.3%.

- Given the current share price of $0.4, the analyst price target of $3.0 is 86.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.