*DISCLAIMER:

*This article is NOT financial advice of any kind, i am NOT a financial adviser, this content should NOT be construed as an offer, recommendation or inducement to buy or sell Greenwich Lifesciences $GLSI stock. Do yor own Due diligence with this type of products before taking from granted any of these opinions. These are different opinions from this company and they can be wrong in any moment in the near future*

*Every information displayed in this article is public information from Greenwich Lifesciences website or interviews*

- SUMMARY:

Greenwich LifeSciences (Nasdaq: GLSI) is a public clinical-stage biopharmaceutical company focused on the development of an immunotherapy to prevent breast cancer recurrences in patients who have previously undergone surgery.

Greenwich LifeSciences’ lead product is GP2, an immunotherapy derived from the HER2/neu protein that is expressed in breast cancer and many other common cancers like gastric cancer, ovarian cancer, lung (with very poor prognosis) and endometrial cancer.

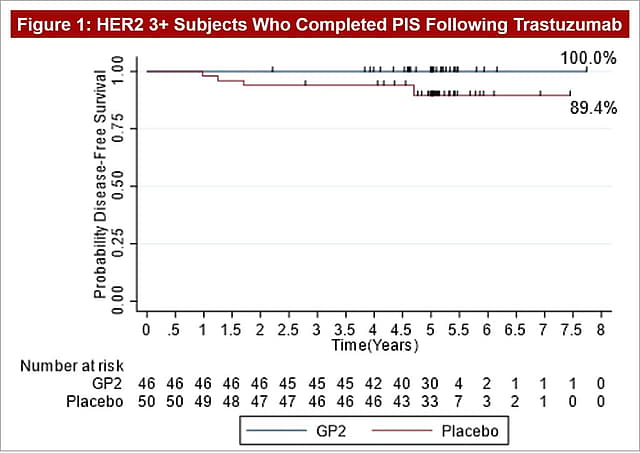

In the Phase IIb clinical trial, led by MD Anderson, a 0% recurrence rate was observed in the HER2/neu 3+ adjuvant setting after median 5 years of follow-up if the patient received the 6 primary intradermal injections of GP2 immunotherapy over the first 6 months (p = 0.0338), and a robust immune response, a well-tolerated safety profile, and no serious adverse events were reported.

Their phase III clinical trial, started on august 2022 at the EE.UU and since then, their clinical trial has expanded to Europe (Germany, Spain, Italy, Poland and France and recently to other countries, which are about to be announced.

- NEXT STEPS:

As Snehal Patel (CEO, Greenwich Lifesciences) said in some interviews a few years ago, this Phase III clinical trial will not be 5 years long until investors get some public data, There is a interim analysis planned when 14 events occur out of 28.

https://www.youtube.com/watch?v=WjDvHNRG9HU&t=1081s (Min 34:32) (Verifed lik)

In the interim analysis the P value will have to be very low, somewhere around >0.01 with a normal level of significance of 0.05 in clinical trials. Greenwich Lifesciences will have to be able to reject the null hypothesis with an extremelly amount of certenty in this interim analysis.

The Kaplan Meier curve then will show something similar to this if clinical trial goes as planned:

*Placebo was a Herceptin (Roche) treatment*

Results of the interim analysis MIGHT OR MIGHT NOT COME this year 2025, as the company maybe approaches the 14 events. (This information has not been discloused Yet).

- HIGH INSIDER OWNERSHIP >50%:

In the BioPharma space we usually have a lot of examples of what a bad Board of directors might be. Usually a bad biopharma, has a stock graph where 6 or 9 years ago the stock was at prices like 1,000$ or even 5,000$. Reverse splits are usually a bad thing (your price is 0,2$, you do a reverse split of 1:20 and then the price is 4$) The price has reached 0,2$ most probably because of bad decisions from the board or because the drug simply does NOT work at that moment.

Bad decisions include: several offerings in the same year which dilute the stockholder but NOT the directors (because they have their stocks options ready to unload once the company have achivied some milestones (determined by them of course).

A high insider ownership prevents Directors from doing such things.

$GLSI has more than a 50% insider ownership ( >6Million) of shares outstanding ( which are 13.14 Million in total), and directors (6 in total) have barely stock options (most of them expire in 2032).

(*$GLSI has not options available to negotiate to the public, probably due to its poor liquidity*)

NOT a single share has been sold in the last 5 years (IPO september 2020), actually insiders have been buying since then small amounts. (due to the market liquidity they can not buy 500,000$ worth of shares in just one day, or even one week. *Link below*

(Verifed lik)

Summit Therapeutics is a great example of what a high insider ownership means in this world.

Confidence like this is not usually display in the biopharma sector, so take your own conclusions.

- POTENCIAL MARKET:

Snehal himself has reiterated in several interviews, that the potencial market for GP2 is somewhere around 2 Billion to 5 Billion dollars PER YEAR. *link below*

https://www.youtube.com/watch?v=WjDvHNRG9HU&t=1081s (Min 23:10)

https://www.youtube.com/watch?v=P--GSgcTWoQ (Min 5:24)

GP2 works synergetic with Herceptin as he said also; that means if Herception market grows, GP2 will grow with it.

Breast Cancer market is about to reach 80.34 Billion by 2033.

GP2 has also the potencial not to only treat breast cancer, but also other types of cancer, Snehal said.

- PRICE TARGET:

Due to this kind of revenue potencial, market share price could move up in a big way. By doing some assumptions if GP2 gets to the market, it could make a revenue of about 2 Billion per year (at least).

So 460$ a share is a 6 Billion market cap company seems not remote. A 3700% possible price increase.

*Do your own due diligence before taking from granted any of this last points.*This is not financial advise*

- POSSIBLE ACQUISITION FROM BIG PHARMA:

Once again Snehal has talked also about this point:

https://www.youtube.com/watch?v=P--GSgcTWoQ (Min 8:17)

Investors will have to wait maybe to see the interim results of phase III and then, maybe the interest will begin from this big players.

- FINAL THOUGHTS:

No company goes up a 3000% in a sigle day (December 9th 2020) just by luck or chance. Their results with GP2 could be disruptive not only in the breast cancer industry but maybe in cancer industry itself.

Have other thoughts on Greenwich LifeSciences?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user White_valkyrie holds no position in NasdaqCM:GLSI. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.