Catalysts

About Dyadic International

Dyadic International develops and commercializes fungal based protein production platforms to supply animal free enzymes and proteins for life sciences, food and nutrition, and bioindustrial markets.

What are the underlying business or industry changes driving this perspective?

- Although demand for animal free cell culture proteins and enzymes is expanding across biologics manufacturing and cell and gene therapy, Dyadic may struggle to convert sampling and early validation of products such as DNase1, FGF and transferrin into large scale OEM supply agreements quickly enough to offset current operating losses. This could delay revenue growth and earnings leverage.

- While partnerships like Proliant, Intralink and Fermbox position Dyadic to participate in growth of precision fermentation and sustainable bioindustrial processes, the company is highly dependent on counterparties for commercialization timelines and volumes. Any delays or underperformance at partners could constrain expected high margin recurring revenue and pressure cash flows.

- Although the shift toward animal free and sustainable dairy proteins supports long term adoption of alpha lactalbumin and lactoferrin, extended regulatory reviews, formulation work and consumer acceptance hurdles in infant and medical nutrition could push out commercialization beyond 2026. This could prolong the period of weak top line growth and negative net margins.

- While global health agencies are increasingly seeking lower cost platforms for vaccines and monoclonal antibodies, Dyadic’s C1 based biopharma collaborations are funded primarily by grants with uncertain paths to sizable royalty or licensing streams. As a result, revenue may remain dominated by lower scale product sales and grant income rather than high margin license and milestone payments.

- Although using external CDMOs and regional partners supports asset light expansion into Asia and Europe, capacity allocation, tariff dynamics and quality or scale up issues at third parties could limit Dyadic’s ability to meet demand as markets for cell culture media and molecular biology reagents grow. This could cap revenue and constrain improvements in operating margins.

Assumptions

This narrative explores a more pessimistic perspective on Dyadic International compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

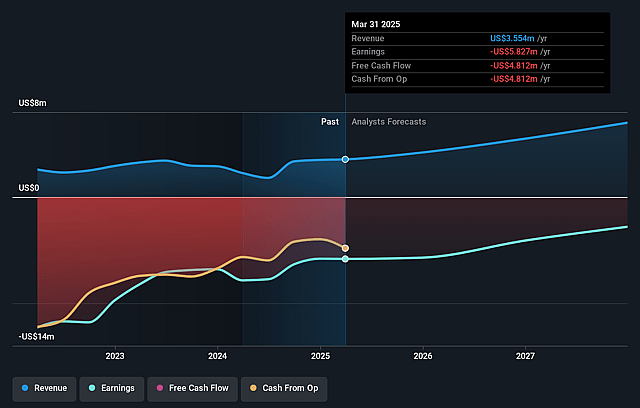

- The bearish analysts are assuming Dyadic International's revenue will grow by 46.1% annually over the next 3 years.

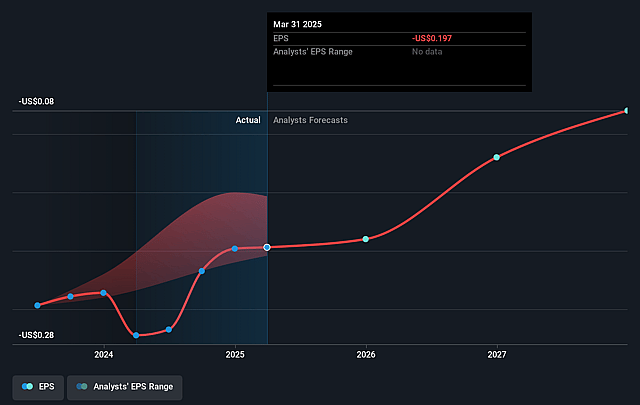

- The bearish analysts are not forecasting that Dyadic International will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Dyadic International's profit margin will increase from -219.9% to the average US Biotechs industry of 16.0% in 3 years.

- If Dyadic International's profit margin were to converge on the industry average, you could expect earnings to reach $1.7 million (and earnings per share of $0.04) by about December 2028, up from $-7.3 million today.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 164.0x on those 2028 earnings, up from -4.5x today. This future PE is greater than the current PE for the US Biotechs industry at 19.0x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.31%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Despite secular growth in demand for animal free cell culture proteins and enzymes, Dyadic is only beginning commercial bulk sales and still depends heavily on volatile license, milestone and grant income. Any delay in converting sampling and early orders into stable OEM and bulk supply contracts could keep product revenue too small to offset operating losses and could weigh on earnings and net margins over the medium term.

- Many of the largest long term opportunities, such as recombinant alpha lactalbumin and human lactoferrin in infant and medical nutrition, require lengthy regulatory reviews, partner driven development and consumer acceptance of precision fermented ingredients. Slower than expected category adoption could push meaningful sales beyond 2026 and prolong weak top line growth and negative net margins.

- Dyadic’s strategy relies on an asset light model using external CDMOs and regional partners such as Proliant, Intralink and Fermbox to access global life sciences, food and bioindustrial growth. Any capacity constraints, quality issues, partner underperformance or adverse tariff developments could limit volumes and pricing power, constraining revenue growth and dampening operating leverage.

- Biopharmaceutical programs supported by the Gates Foundation, CEPI and other collaborators provide nondilutive funding and technical validation, but they are currently structured as grants rather than commercial licenses. If these initiatives do not transition into material royalty or product streams, Dyadic may remain reliant on lower margin grant and service revenue, limiting improvements in earnings and cash generation.

- Operating expenses in R&D and G&A are rising as the company rebrands, expands business development and accelerates internal projects, while quarterly revenue has recently declined year on year. If expected product launches and market ramps in 2025 and 2026 are slower or smaller than planned, continued cash burn could force additional equity raises that dilute shareholders and pressure earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Dyadic International is $5.0, which represents up to two standard deviations below the consensus price target of $7.0. This valuation is based on what can be assumed as the expectations of Dyadic International's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $10.4 million, earnings will come to $1.7 million, and it would be trading on a PE ratio of 164.0x, assuming you use a discount rate of 7.3%.

- Given the current share price of $0.91, the analyst price target of $5.0 is 81.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Dyadic International?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.