Narratives are currently in beta

Key Takeaways

- Robust sales growth and increasing market share of HEPLISAV-B signal strong revenue potential and improved margins through economies of scale.

- Significant cash reserves and a share repurchase plan reflect financial health and enable strategic investments in product development and market expansion.

- Rising R&D expenses and regulatory risks, coupled with high competition and potential consumer habit mismatches, pose significant challenges to revenue growth and market expansion.

Catalysts

About Dynavax Technologies- A commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States.

- Dynavax is experiencing robust sales growth with its HEPLISAV-B vaccine, achieving a record $79 million in net product sales in Q3 2024. The company anticipates double-digit annual growth for HEPLISAV-B net sales through 2030, with expectations of the U.S. market opportunity peaking at over $900 million, potentially increasing revenue significantly.

- HEPLISAV-B's market share is increasing within critical segments like retail pharmacy and integrated delivery networks, supporting further expansion and potentially improving net margins due to economies of scale and optimized production efficiencies.

- Dynavax has initiated a $200 million share repurchase plan, which could enhance earnings per share by reducing the number of shares outstanding and signals confidence in the company's financial health and future growth prospects.

- The Z-1018 shingles vaccine program, currently in Phase I/II trials with expected data readouts in the second half of 2025, presents an opportunity for product pipeline expansion. Successful development and commercialization could provide new revenue streams.

- Dynavax has substantial cash reserves of approximately $764 million, allowing for strategic capital allocation toward the development of existing pipeline assets and the pursuit of external business development opportunities. This financial flexibility could support long-term earnings growth and market positioning.

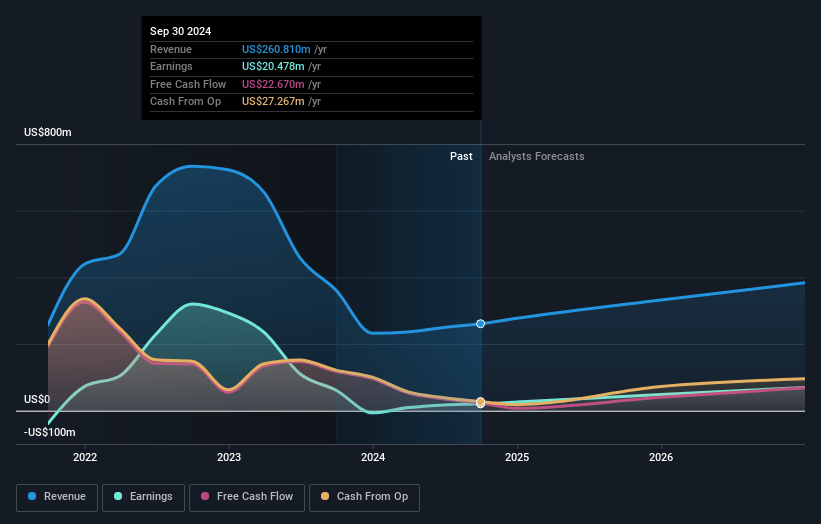

Dynavax Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dynavax Technologies's revenue will grow by 19.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.9% today to 21.2% in 3 years time.

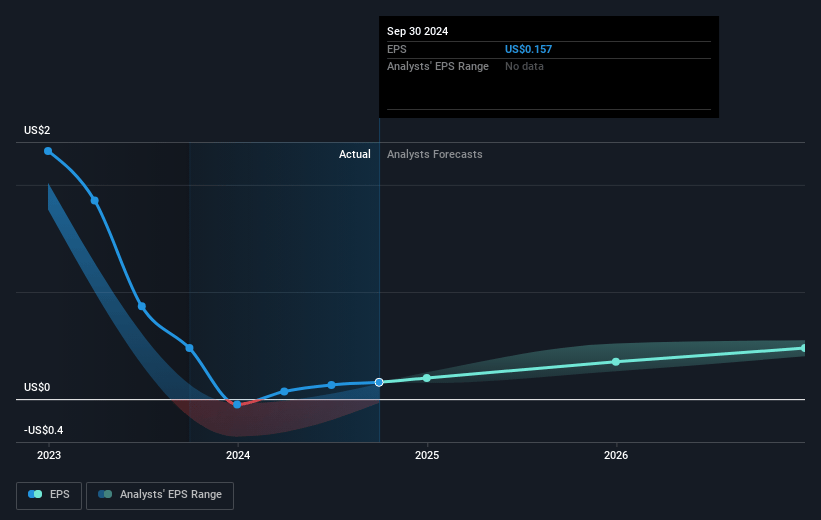

- Analysts expect earnings to reach $94.3 million (and earnings per share of $0.66) by about January 2028, up from $20.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.7x on those 2028 earnings, down from 83.1x today. This future PE is greater than the current PE for the US Biotechs industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 2.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

Dynavax Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Research and development expenses are increasing, driven by incremental headcount and marketing investments. This rise in costs could impact net margins if new products don't achieve commercial success.

- The discontinuation of the Tdap program due to insufficient differentiation highlights potential challenges in product development, which could impact future revenue streams if similar issues arise with other pipeline products.

- The need for further FDA approval for HEPLISAV-B, specifically related to the hemodialysis patient segment, presents a regulatory risk that could delay market expansion and impact revenue.

- The significant focus on retail pharmacy as a growth channel for HEPLISAV-B might not yield the expected results if consumer vaccination habits do not match the anticipated trends, potentially impacting overall revenue growth targets.

- High competition in the vaccines market means that any failures in product differentiation or efficacy could hinder revenue growth and market share, potentially affecting future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $25.0 for Dynavax Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $444.7 million, earnings will come to $94.3 million, and it would be trading on a PE ratio of 45.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $12.94, the analyst's price target of $25.0 is 48.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives