Key Takeaways

- Growth in Asia-Pacific and strong recurring revenues from services and reagents offset weaker performance in the US and Europe, supporting long-term stability.

- Product innovation and an expanding global customer base drive sustainable top-line growth, improved margins, and resilience against supply chain or geopolitical risks.

- Weakness in core markets, uncertain funding, operational inefficiencies, and increased losses heighten risk to profitability and expose Cytek to volatile, unpredictable revenue cycles.

Catalysts

About Cytek Biosciences- A cell analysis solutions company, provides cell analysis tools that facilitates scientific advances in biomedical research and clinical applications.

- Strong growth in APAC and other emerging markets, supported by rising R&D investments and government stimulus programs (e.g., China), is offsetting weakness in US and EMEA, positioning Cytek to capitalize on increased life sciences research activity and fuel long-term revenue expansion.

- Strategic expansion of the recurring service and reagent revenue streams-now accounting for 31% of total revenue (up from 26% a year ago) and growing at 17%-enhances revenue stability and provides higher-margin, more predictable earnings, reducing dependency on cyclical instrument sales.

- Launch of the affordable Muse Micro System and ongoing product innovation (including next-gen Aurora Cell Sorter and Northern Lights platforms) expands Cytek's addressable market, particularly among smaller labs and emerging applications like cell and gene therapy, supporting sustainable top-line growth and improved margins.

- Large and expanding global installed base (3,149+ units) increases customer lock-in, enabling greater cross-sell/upsell of reagents, services, and software, which drives recurring revenue growth and future net margin improvement as these businesses scale.

- Continued investment in regional manufacturing (US, China, Singapore) and supply chain resilience mitigates exposure to tariffs and geopolitical risk, limiting gross margin impact and preserving earnings even in volatile trade environments.

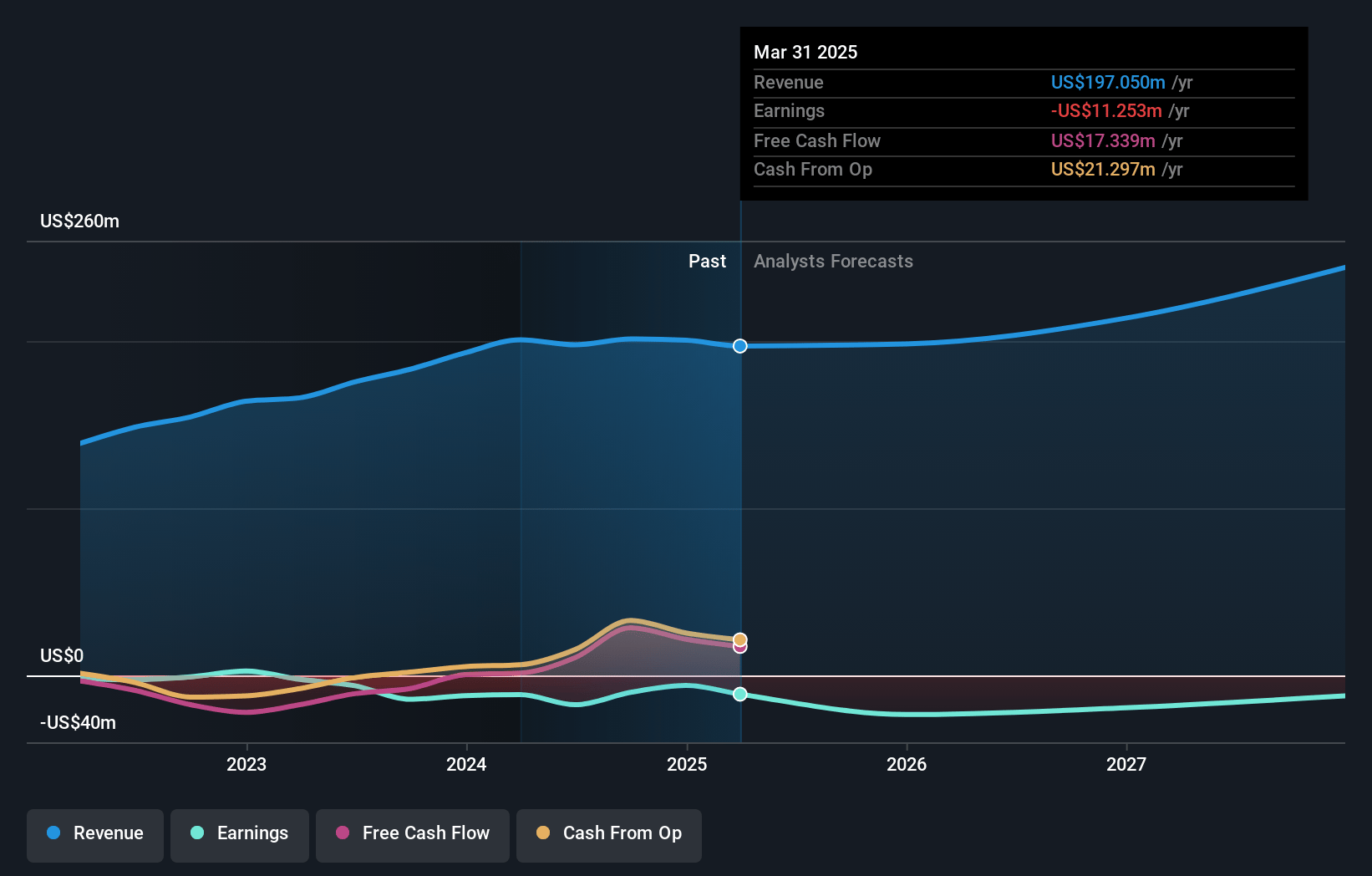

Cytek Biosciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cytek Biosciences's revenue will grow by 6.5% annually over the next 3 years.

- Analysts are not forecasting that Cytek Biosciences will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cytek Biosciences's profit margin will increase from -5.7% to the average US Life Sciences industry of 13.8% in 3 years.

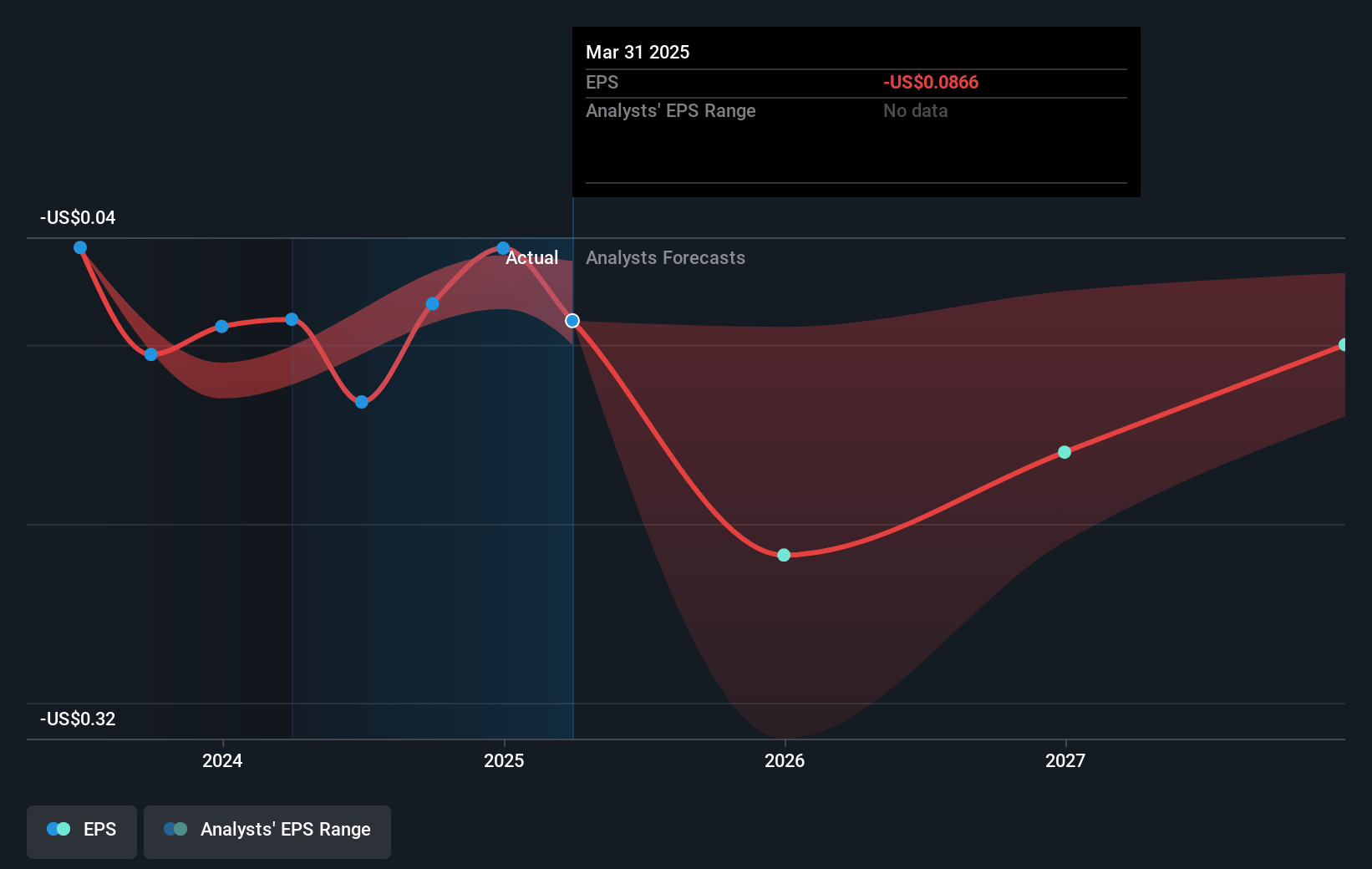

- If Cytek Biosciences's profit margin were to converge on the industry average, you could expect earnings to reach $32.8 million (and earnings per share of $0.29) by about July 2028, up from $-11.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.2x on those 2028 earnings, up from -36.6x today. This future PE is lower than the current PE for the US Life Sciences industry at 35.3x.

- Analysts expect the number of shares outstanding to decline by 3.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.87%, as per the Simply Wall St company report.

Cytek Biosciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Recent year-over-year revenue decline (-7.6%), particularly driven by weakness in instrument sales in the U.S. and EMEA, reflects underlying challenges in core markets that, if sustained, could put longer-term pressure on total revenue growth and future earnings.

- Academic and government end markets in the U.S. are experiencing significant funding uncertainties and potential budget cuts (e.g., a proposed 40% cut to NIH), heightening risk of prolonged or structural softness in one of Cytek's major customer bases, negatively impacting instrument revenue and overall net margins.

- A cautious capital spending environment across the biopharma, biotech, and CRO sectors-exacerbated by policy/funding uncertainties, tariffs, and drug pricing concerns-may cause order postponements and sluggish recovery, leading to unpredictable revenue streams and longer cycles to margin improvement.

- Decline in gross margin (to 49% GAAP/52% non-GAAP, from 51%/55% last year) due to lower product revenues and higher manufacturing overhead suggests the risk that sustained revenue weakness or operational inefficiency could further erode profitability and compress net margins.

- Increased operating losses and a higher net loss compared to the prior year ($11.4M net loss vs. $6.2M prior year), combined with ongoing reliance on seasonal, back-end loaded growth, expose Cytek to further volatility in quarterly results and growing risk that operating expenses may outpace revenue growth and delay return to profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.75 for Cytek Biosciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $237.9 million, earnings will come to $32.8 million, and it would be trading on a PE ratio of 24.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $3.25, the analyst price target of $5.75 is 43.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.