Key Takeaways

- Advancing a key therapy in multiple cancer types and expanding its use could unlock major new markets and drive long-term revenue growth.

- Strategic cost controls and externally funded trials are minimizing cash burn while maximizing pipeline value and supporting future profitability.

- Heavy reliance on a single clinical asset and lack of approved products expose Curis to substantial risk from setbacks, competition, and challenging funding and regulatory environments.

Catalysts

About Curis- A biotechnology company, engages in the discovery and development of drug candidates for the treatment of human cancers in the United States.

- Progress toward pivotal clinical data and potential accelerated approvals for emavusertib in hematologic cancers (PCNSL, CLL, AML, and MDS) may unlock significant new market opportunities, supporting future revenue growth as global cancer incidence rises and demand for innovative therapies expands.

- Expansion of emavusertib into additional indications and combinations, including with BTK inhibitors and standard-of-care regimens, positions the company to benefit from the increasing clinical adoption of targeted/precision oncology, amplifying potential earnings and long-term addressable markets.

- Ongoing investigator-sponsored trials in various solid tumor types-funded externally-could yield additional value-creating data with minimal cash burn, thereby increasing pipeline optionality and de-risking future earnings without materially impacting current net margins or requiring large R&D expenditures.

- Sustained KOL interest, positive regulatory interactions, and the prospect of supportive expedited approval pathways in areas of high unmet need (e.g., PCNSL) may accelerate time-to-market, driving earlier revenue realization and improving operating leverage.

- Recent R&D and G&A cost reductions demonstrate strategic financial discipline, potentially extending the cash runway and limiting near-term dilution, setting the stage for improved operating margins as key pipeline assets mature and approach commercialization.

Curis Future Earnings and Revenue Growth

Assumptions

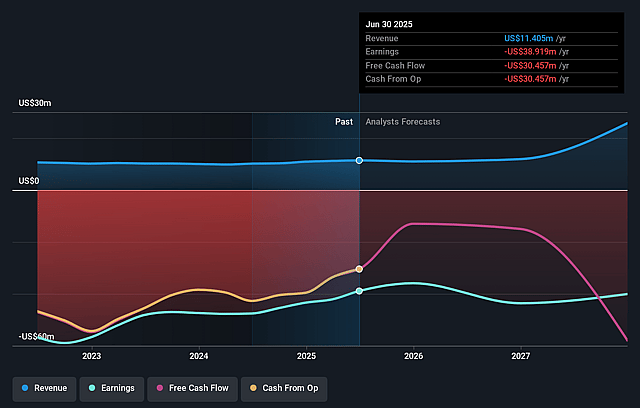

How have these above catalysts been quantified?- Analysts are assuming Curis's revenue will grow by 44.7% annually over the next 3 years.

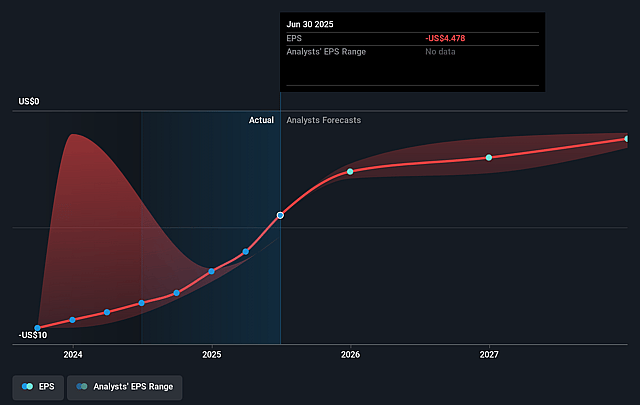

- Analysts are not forecasting that Curis will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Curis's profit margin will increase from -341.2% to the average US Biotechs industry of 14.1% in 3 years.

- If Curis's profit margin were to converge on the industry average, you could expect earnings to reach $4.9 million (and earnings per share of $0.35) by about August 2028, up from $-38.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 60.9x on those 2028 earnings, up from -0.5x today. This future PE is greater than the current PE for the US Biotechs industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.12%, as per the Simply Wall St company report.

Curis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Curis's heavy reliance on a single lead asset, emavusertib, with nearly all clinical and business updates centered around its progress, exposes the company-and thus its future revenues-to significant binary risk if clinical, regulatory, or competitive setbacks occur in any of its targeted indications.

- The persistent lack of commercial-stage or approved products, coupled with ongoing net losses and limited cash runway (estimated to last only into Q1 2026), increases the likelihood of secondary equity offerings or dilutive financing, which can pressure future earnings per share and depress share price.

- Increasing competition in Curis's key markets-such as CLL, NHL, and AML-from emerging therapies (BTK degraders, next-gen BCL2 inhibitors, and newer BTKis like tirabrutinib)-raises the risk that Curis's products, even if approved, will struggle to achieve meaningful market share, limiting long-term revenue growth.

- The highly challenging regulatory environment in oncology-characterized by evolving FDA standards, uncertainty in accelerated approval pathways, and greater requirements for demonstrating clinical benefit-could delay product approvals and force costly additional studies, extending timelines to revenue generation and straining net margins.

- Macro trends such as rising R&D costs, ongoing industry-wide financial constraints, and the need to prioritize trials with limited internal capital may constrain Curis from fully exploiting its pipeline, leading to slow pipeline advancement, chronic negative net margins, and delayed or reduced revenue realization.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.333 for Curis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $34.6 million, earnings will come to $4.9 million, and it would be trading on a PE ratio of 60.9x, assuming you use a discount rate of 9.1%.

- Given the current share price of $1.72, the analyst price target of $16.33 is 89.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.