Last Update01 May 25Fair value Decreased 5.47%

AnalystConsensusTarget has decreased profit margin from 7.1% to 2.0% and increased future PE multiple from 71.0x to 227.1x.

Read more...Key Takeaways

- Expanding transplant procedures and adoption of precision diagnostics drive sustainable revenue growth and strengthen CareDx’s competitive positioning.

- Strategic investments in digital health and robust evidence generation enhance operational efficiency, recurring high-margin revenues, and payer reimbursement opportunities.

- Dependence on few core products, regulatory shifts, legal risks, and rising competition threaten CareDx’s pricing, market share, and long-term earnings stability.

Catalysts

About CareDx- Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

- The growing incidence of chronic diseases such as diabetes and hypertension, combined with ongoing expansion of transplant indications (e.g., pediatric heart and simultaneous pancreas-kidney transplants), is steadily increasing the number of organ transplant procedures, expanding CareDx’s addressable market and supporting sustainable long-term revenue growth.

- The increasing adoption of precision medicine and personalized diagnostics in standard healthcare, as evidenced by new clinical outcomes data and payer coverage gains for AlloSure and HeartCare, positions CareDx to benefit from accelerated test adoption, leading to higher testing volumes and favorable average selling price (ASP) expansion that positively impacts revenue and gross margins.

- Strategic investments in digital health infrastructure—such as Epic EHR integration, revenue cycle management improvements, and proprietary solutions like AlloCare—are expected to create operational efficiencies, reduce friction for providers, increase customer retention, and generate recurring, higher-margin revenue streams, bolstering net margins and earnings quality over time.

- Robust clinical evidence generation, including major studies (SHORE, KOAR, ACROBAT) and expanded clinical indications, strengthens CareDx’s competitive advantage, increases the likelihood of guideline inclusion and medical policy updates, and supports reimbursement expansion, all of which are catalysts for multi-year volume and revenue growth across kidney, heart, lung, and hematologic indications.

- Ongoing industry trends toward coverage of non-invasive cfDNA diagnostics, in-network payer contracting (with specific CPT codes), and healthcare digitization favor specialized providers like CareDx—increasing market share potential, recurring revenues, and supporting both operating leverage and long-term earnings expansion.

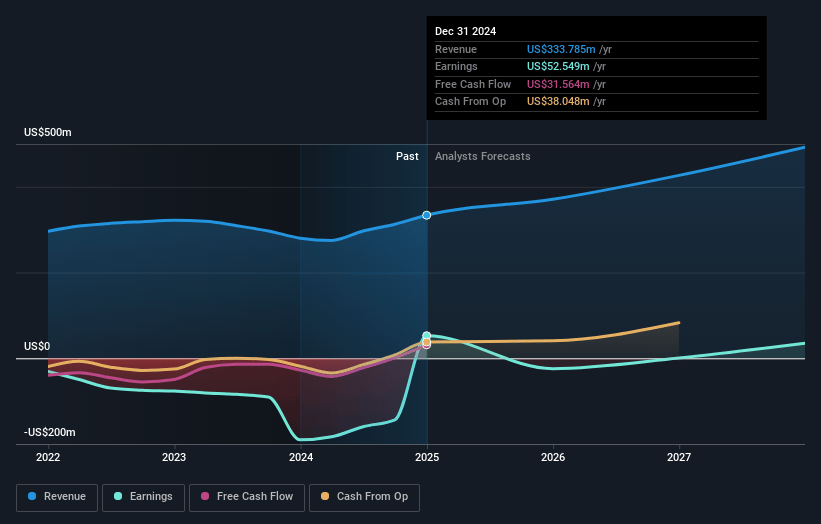

CareDx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CareDx's revenue will grow by 12.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.9% today to 2.0% in 3 years time.

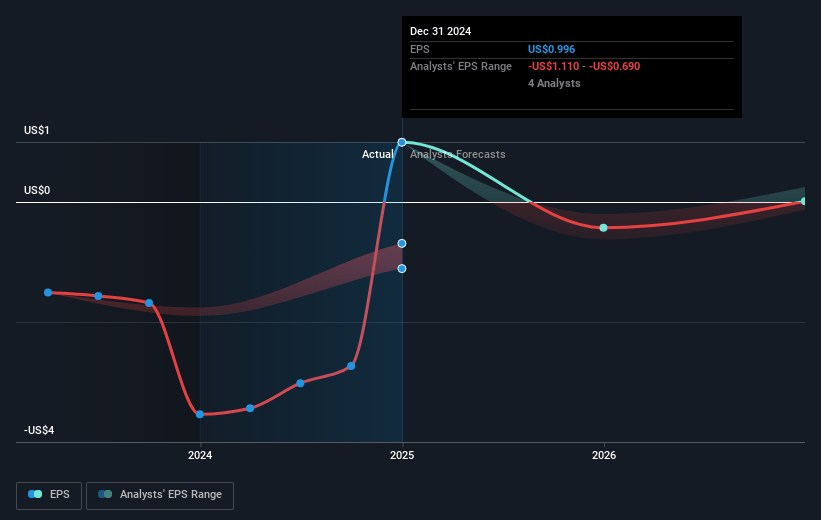

- Analysts expect earnings to reach $10.0 million (and earnings per share of $0.49) by about May 2028, down from $62.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 227.1x on those 2028 earnings, up from 15.7x today. This future PE is greater than the current PE for the US Biotechs industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 5.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

CareDx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing pressure on healthcare spending and changes in U.S. reimbursement policies could constrain CareDx’s pricing power and reduce demand for its premium diagnostic tests, directly impacting revenue and net margins.

- The company remains highly reliant on a narrow set of flagship products (AlloSure and AlloMap), exposing it to risk if competitive alternatives emerge or if reimbursement rates/coverage policies for these core diagnostics are modified, which could lead to significant revenue volatility.

- Litigation risk remains present, as evidenced by the recent $20.25 million class action settlement (with ~$5.4 million out-of-pocket), and any future legal issues—especially around intellectual property or sales practices—could generate unexpected costs and harm future earnings.

- Accelerating technological innovation in molecular diagnostics (e.g., new entrants like VitaGraft seeking Medicare expansion) threatens CareDx’s long-term relevance and competitive position, which could pressure both revenue growth rates and operating margins if they fail to sustain product differentiation.

- Value-based care initiatives and bundled payment models in transplant medicine may reduce the incentive for transplant centers to order individual diagnostic tests, putting downward pressure on volumes and average selling prices (ASPs), adversely impacting long-term revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.286 for CareDx based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $495.1 million, earnings will come to $10.0 million, and it would be trading on a PE ratio of 227.1x, assuming you use a discount rate of 6.2%.

- Given the current share price of $17.54, the analyst price target of $29.29 is 40.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.