Key Takeaways

- Expanding sales force, new clinics, and software adoption are set to accelerate nationwide growth, improve patient retention, and boost recurring revenues and profitability.

- Vertical integration and dietary supplement momentum drive better margins, operating leverage, and increased share of consumer health and wellness spending.

- Heavy reliance on key clinic partnerships, intensifying competition, rising expenses, and regulatory pressures threaten Biote’s revenue growth, pricing power, and long-term profitability.

Catalysts

About biote- Operates in practice-building business within the hormone optimization space.

- The rapid expansion of Biote’s sales force by 25% and aggressive realignment toward new clinic growth is expected to accelerate provider additions nationwide, allowing the company to capitalize on increasing demand from an aging population and drive top-line revenue growth.

- Growing consumer adoption of personalized medicine and preventative care is likely to increase uptake of Biote’s individualized, physician-led therapy model, leading to higher patient retention and potentially higher average selling prices, positively impacting both recurring revenue and net margins over time.

- Enhanced clinical decision support software, now fully implemented across the provider base, is anticipated to lower barriers for mainstream physicians to adopt hormone optimization therapies, supporting accelerated clinic onboarding and procedure volume growth, which would benefit overall revenue and earnings.

- Vertical integration of the 503(b) manufacturing facility is already delivering gross margin improvements and, as integration progresses further, is expected to provide durable cost advantages and improved operating leverage, enhancing overall profitability and cash flow.

- Momentum in Biote’s dietary supplement and e-commerce channel, which posted strong double-digit growth, demonstrates effective cross-sell strategy and ability to capture more of the consumer-driven health and wellness spend, contributing to higher revenue per patient and improved operating margins.

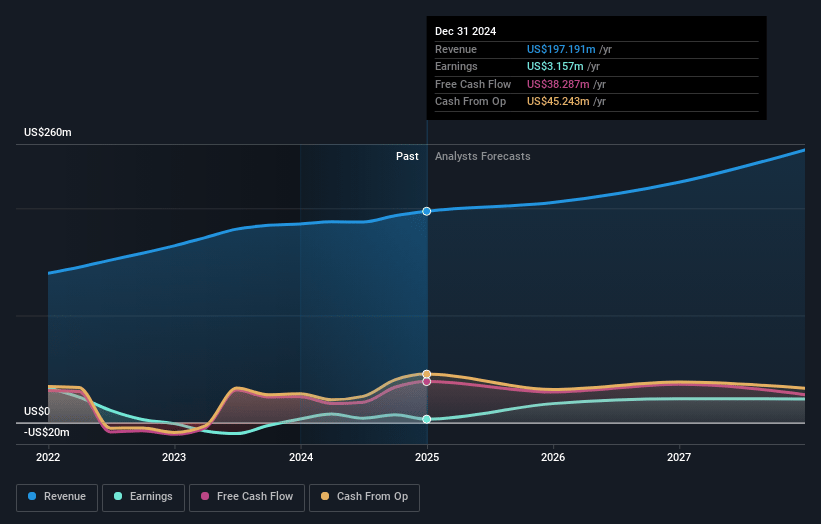

biote Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on biote compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming biote's revenue will grow by 11.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 10.6% today to 8.3% in 3 years time.

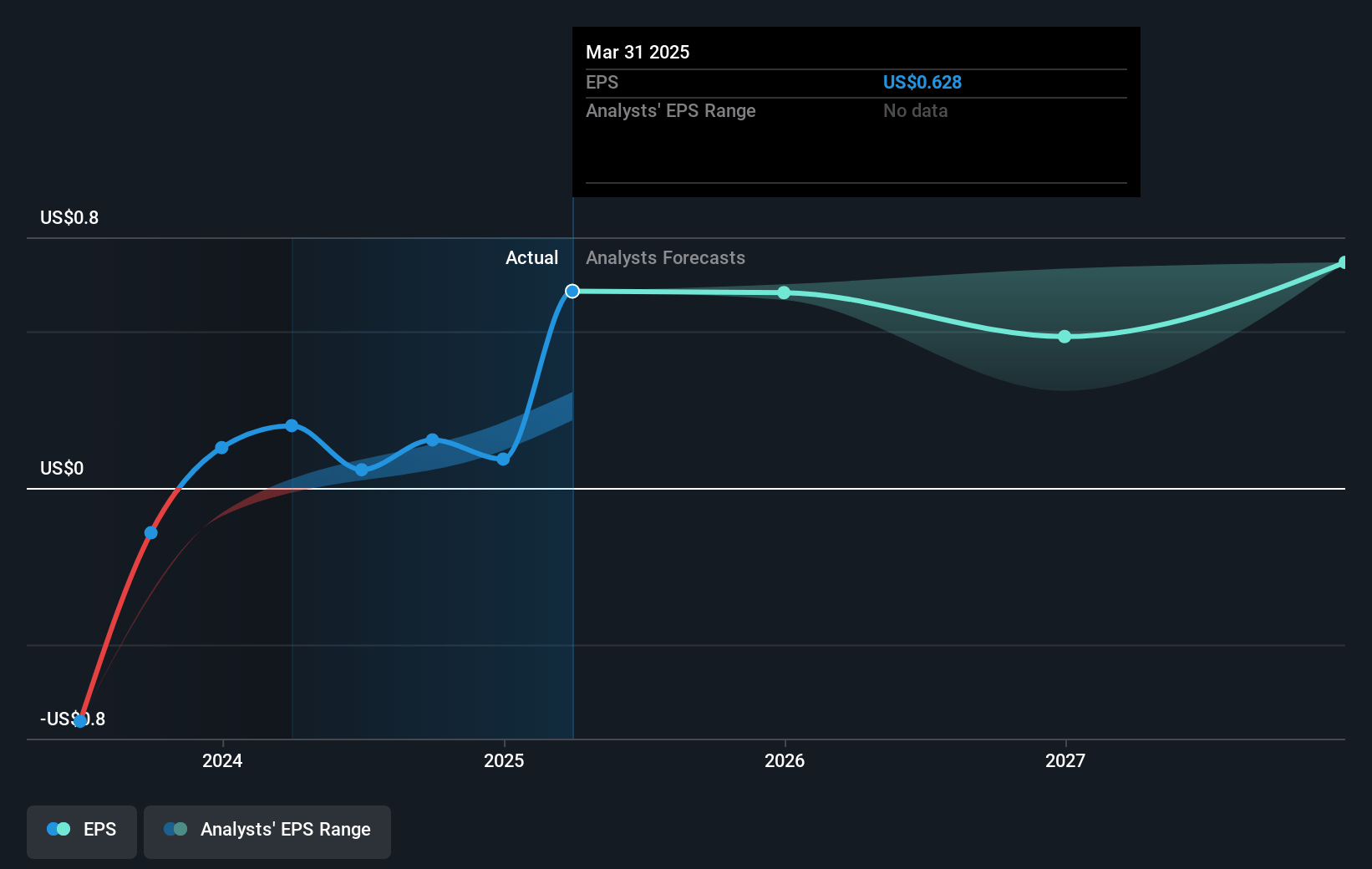

- The bullish analysts expect earnings to reach $23.0 million (and earnings per share of $0.71) by about July 2028, up from $21.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 6.2x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 18.1x.

- Analysts expect the number of shares outstanding to grow by 1.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

biote Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Biote’s heavy reliance on a concentrated base of providers and clinics for procedure revenue exposes the company to risks from potential partnership losses or competitive displacement, which could result in stagnant or declining revenue over the long term.

- Ongoing and intensifying competitive pressures in the hormone optimization and therapeutic wellness market, including the threat of lower-cost overseas and telemedicine providers, could erode Biote’s pricing power and market share, ultimately placing downward pressure on both revenue and net margins.

- The company’s core hormone therapy business faces commoditization and stagnation risks as new alternative therapies, generics, and innovative wellness interventions emerge, potentially reducing demand, shrinking margins, and depressing future earnings growth.

- High and rising selling, general, and administrative expenses—mainly driven by continuous investments in a larger sales force and marketing to combat slowing clinic additions and reduced procedure volumes—may not scale efficiently, dampening operating leverage and constraining long-term profit growth.

- Secular headwinds such as increased regulatory scrutiny on hormone therapies, pricing pressures across the healthcare sector, and shifting demographics with slower population growth in developed markets could limit patient pool expansion and revenue opportunities, making sustained top-line growth more challenging for Biote in future years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for biote is $8.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of biote's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $276.2 million, earnings will come to $23.0 million, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $4.12, the bullish analyst price target of $8.0 is 48.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.