Last Update07 May 25Fair value Decreased 12%

Key Takeaways

- Near-term growth faces risks from unpredictable research funding, supply chain challenges, and heavy reliance on government and academic customers.

- Aggressive R&D and acquisitions could pressure margins if topline growth lags; regulatory hurdles and competition may slow earnings realization.

- Macroeconomic and policy challenges, higher costs, and integration risks threaten Bruker’s revenue growth, margins, and profitability despite ongoing mitigation efforts.

Catalysts

About Bruker- Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

- Although Bruker benefits from the increasing global need for advanced analytical and diagnostic tools driven by precision medicine and the aging population, its growth in the near term may be constrained by sharp reductions and unpredictability in U.S. and Chinese academic research funding, posing a risk to topline revenue and organic growth.

- While the rising tide of research funding and expanding biopharma pipelines should expand Bruker’s addressable market long-term, the company must navigate a tough environment of supply chain disruptions, new tariffs, and slower stimulus releases in key regions, all of which could compress operating margins and delay earnings growth.

- Despite strong innovation and a robust pipeline in spatial biology, NMR, and proteomics, Bruker’s ongoing dependency on government and academic customers for a substantial revenue portion leaves it vulnerable to structural shifts in public research budgets and procurement cycles, potentially resulting in near-term revenue volatility and delayed backlog conversion.

- Although Bruker’s expansion into higher-growth software and consumables segments enhances operating leverage, the company’s aggressive R&D and acquisition spending may pressure net margins if forecasted topline acceleration does not materialize quickly once global macro and policy headwinds subside.

- While the broader integration of AI and digitization into life sciences supports future demand for Bruker’s advanced systems, increasing regulatory scrutiny, data privacy mandates, and industry consolidation could prolong commercialization cycles and intensify competition, ultimately limiting the pace at which Bruker’s investments turn into accelerated earnings expansion.

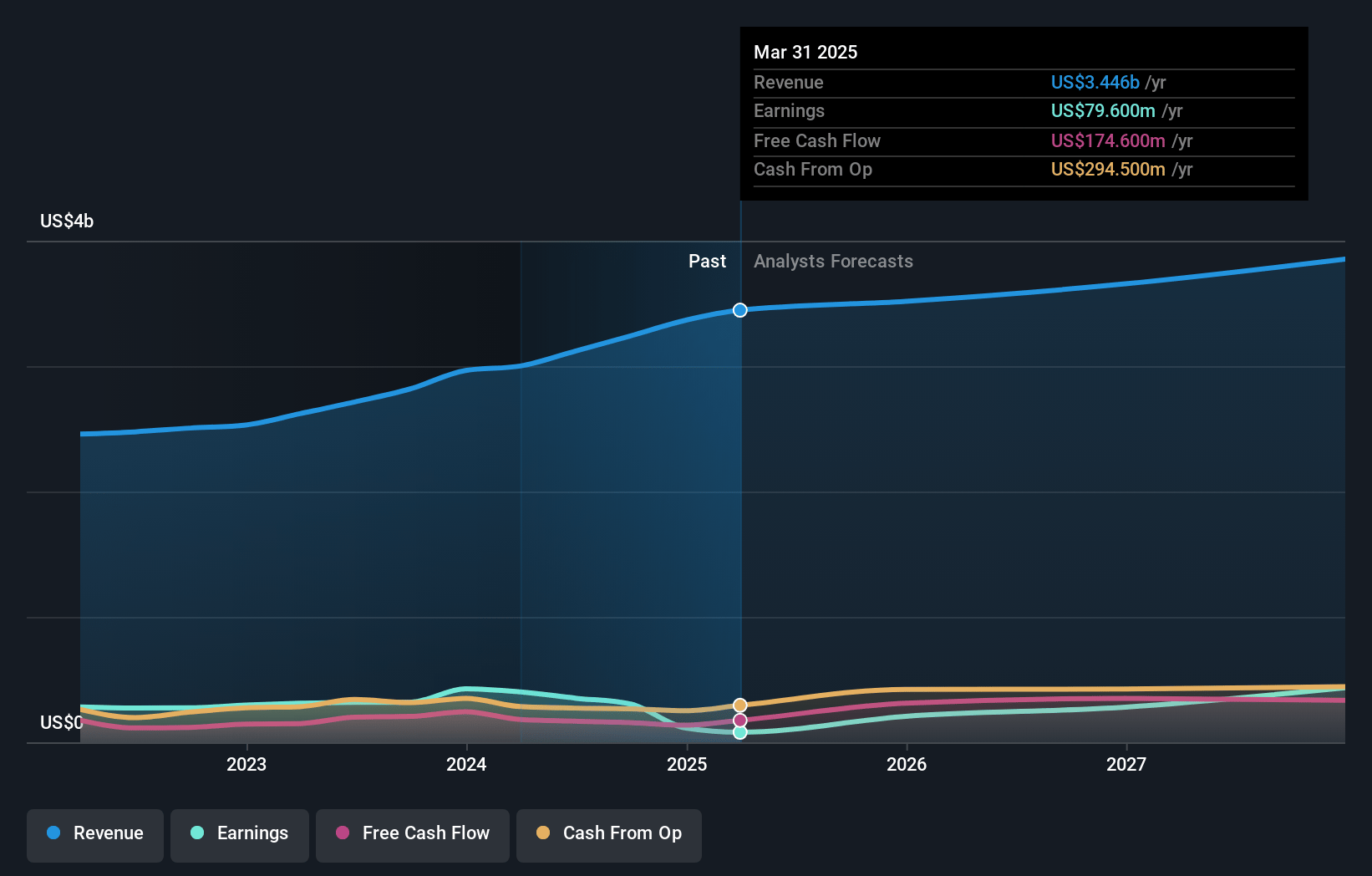

Bruker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bruker compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bruker's revenue will grow by 4.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.4% today to 11.0% in 3 years time.

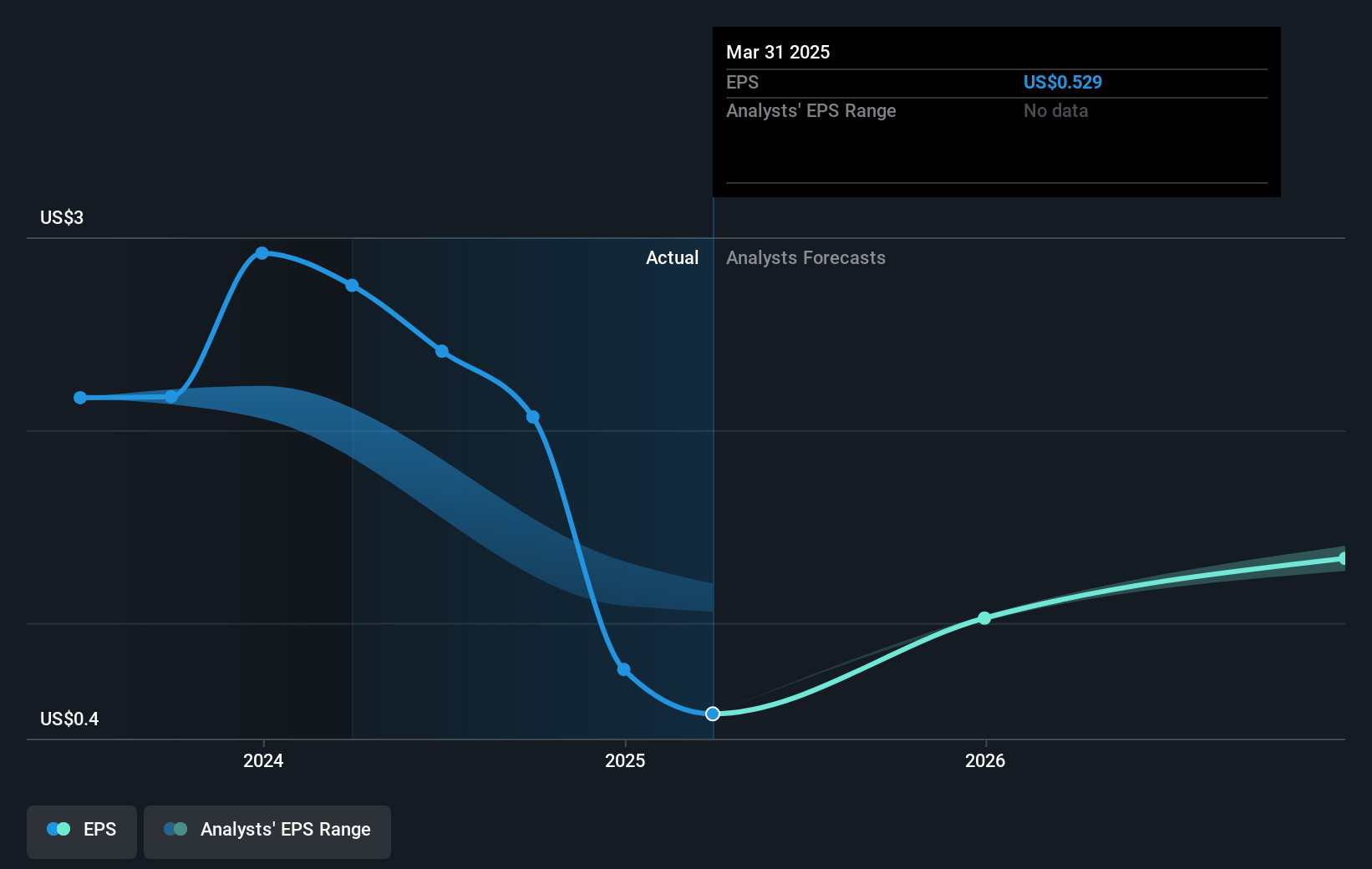

- The bearish analysts expect earnings to reach $423.1 million (and earnings per share of $3.17) by about May 2028, up from $113.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.7x on those 2028 earnings, down from 52.9x today. This future PE is lower than the current PE for the US Life Sciences industry at 36.1x.

- Analysts expect the number of shares outstanding to grow by 4.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Bruker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weakness in US and China academic and government funding, driven by policy changes and tariff impacts, is resulting in a substantial and potentially structural decline in organic revenues from these traditionally stable end markets, suppressing top-line growth and creating headwinds for operating margins and earnings.

- Ongoing and elevated global tariff regimes, as well as policy-driven trade conflicts, are leading to increased costs of imported materials and products, necessitating expensive supply chain and manufacturing reengineering; if these costs cannot be fully offset by pricing or cost actions, Bruker’s net margins will remain pressured over the medium term, limiting earnings growth.

- Slower-than-expected release of government stimulus in China and delayed or uncertain academic infrastructure investments in multiple geographies reduce near-term visibility on order flow, which threatens sustained revenue momentum and increases the risk of future periods with weak or declining backlog and order book.

- Integration and performance risks stemming from recently acquired businesses, especially in newer strategic areas like spatial biology and high-content cell analysis, are leading to near-term margin dilution; if these businesses do not achieve operational break-even or revenue synergies as expected, Bruker’s profitability and return on invested capital may deteriorate.

- Current mitigation initiatives—such as cost reductions, pricing actions, and manufacturing changes—are only expected to offset margin and earnings headwinds over an extended timeframe, meaning any further deterioration in macro conditions, additional currency headwinds, or regulatory setbacks could materially impact net earnings growth and delay a return to robust margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bruker is $45.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bruker's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.9 billion, earnings will come to $423.1 million, and it would be trading on a PE ratio of 22.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of $39.45, the bearish analyst price target of $45.0 is 12.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.