Key Takeaways

- Geographic diversification and exposure to rising healthcare R&D and biopharma demand support above-market, resilient revenue growth.

- Expansion in spatial biology, diagnostics, and recurring revenues strengthens margins, earnings quality, and positions Bruker to benefit from industry megatrends.

- Exposure to funding cuts, integration challenges, competitive innovation, geopolitical risks, and industry shifts toward digital solutions threaten Bruker’s growth, margins, and market position.

Catalysts

About Bruker- Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

- Bruker is positioned to benefit from consistent global increases in healthcare R&D spending, especially as biopharmaceutical and academic research demand for advanced analytical instruments recovers and expands in Asia-Pacific and Europe, driving above-market revenue growth and bolstering both its top line and geographic diversification over the coming years.

- The company's expanding portfolio in spatial biology, molecular diagnostics, and automated lab platforms aligns directly with the rising adoption of data-driven and personalized medicine, unlocking significantly larger addressable markets and supporting sustained double-digit revenue growth and secular demand for next-generation instruments.

- Ongoing innovation and high-value product launches, including advancements in mass spectrometry (such as timsTOF platform upgrades) and NMR solutions, provide pricing power and margin expansion, directly impacting operating margins and supporting robust net margin improvement in the medium and long term.

- Growing recurring revenues from consumables, software, and service contracts—now surpassing 30% of BSI revenues and expanding thanks to a larger installed base—not only increase revenue predictability but also raise overall company gross margins and earnings quality, reinforcing resilient net margin growth.

- Bruker is leveraging megatrends such as multi-omics, systems biology, and semiconductor innovation (driven by high-performance computing and AI), with leadership positions in areas like semiconductor metrology and microbiology/infectious diagnostics. This ongoing exposure supports double-digit, above-industry-average growth in high-margin business segments, accelerating earnings per share and delivering higher free cash flow conversion for future capital deployment.

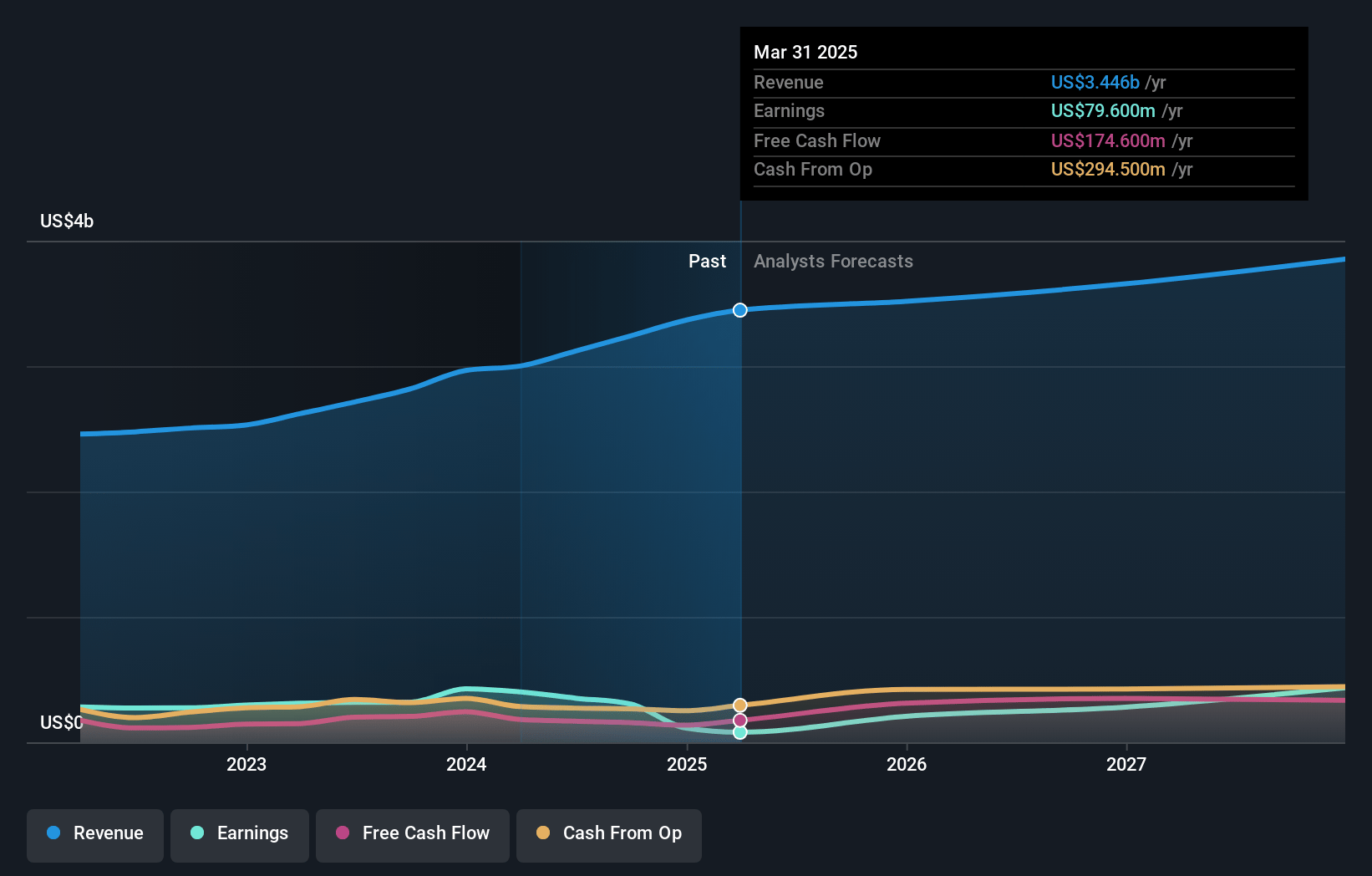

Bruker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bruker compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bruker's revenue will grow by 6.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.4% today to 10.4% in 3 years time.

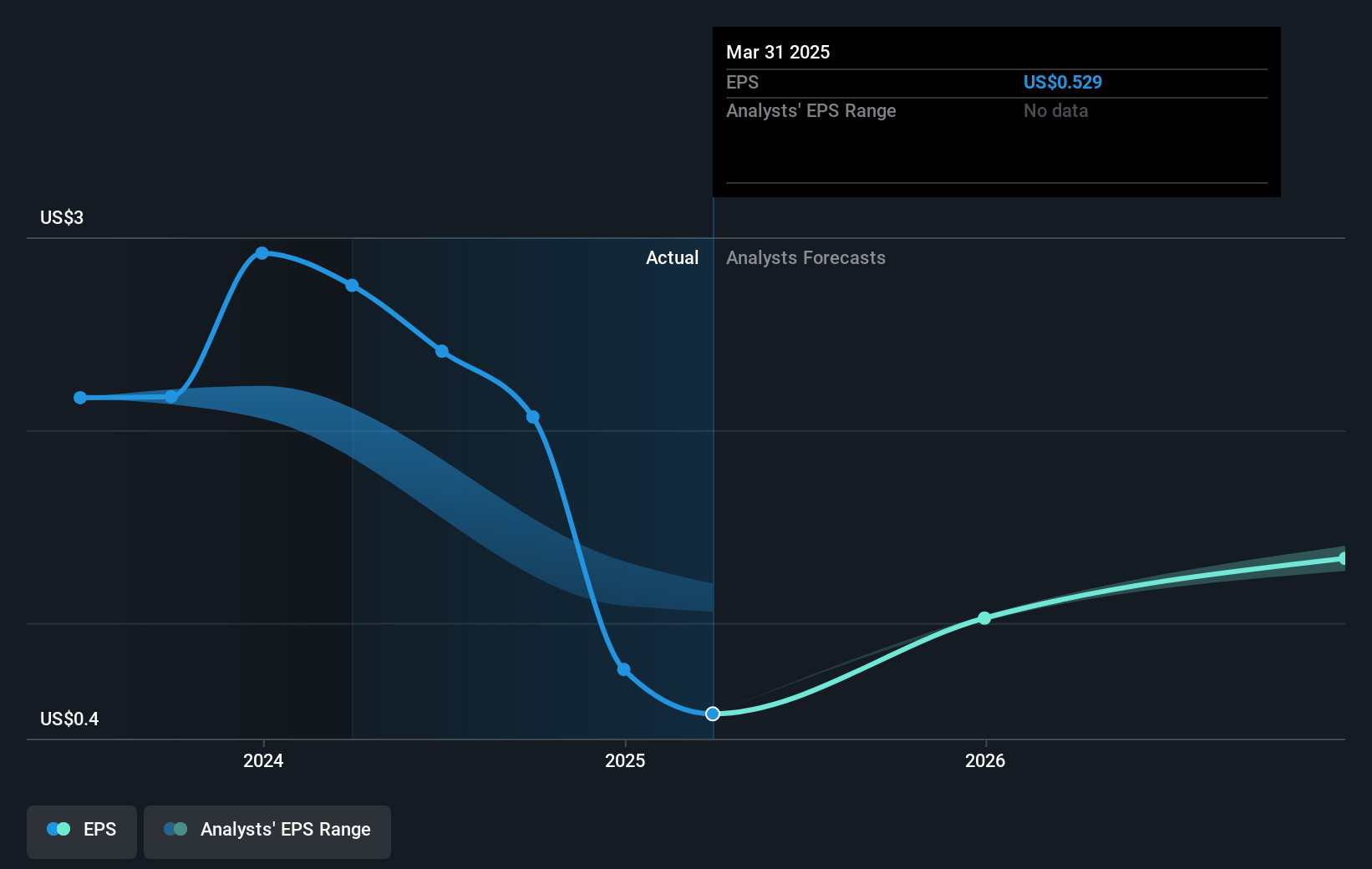

- The bullish analysts expect earnings to reach $423.1 million (and earnings per share of $3.17) by about April 2028, up from $113.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 40.5x on those 2028 earnings, down from 49.6x today. This future PE is greater than the current PE for the US Life Sciences industry at 36.5x.

- Analysts expect the number of shares outstanding to grow by 4.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.58%, as per the Simply Wall St company report.

Bruker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing uncertainty and potential reductions in US NIH and other academic/government research funding pose a material risk to Bruker’s order flow, especially since a significant portion of instrumentation revenue depends on institutions vulnerable to such cyclical budget shifts, leading to unpredictable revenue and margin fluctuations.

- Recent acquisitions, while aimed at long-term growth, have created near-term EPS and margin dilution, and any further delays or failures in integrating these acquisitions or in realizing anticipated synergies could prolong pressure on operating margins and overall earnings.

- The company acknowledges that some of its core technology segments, such as mass spectrometry and NMR, have faced competitive pressures with growth muted due to new competitor products and reliance on ongoing innovation; failure to accelerate the pace of new product development may erode market share and limit long-term revenue expansion.

- Bruker operates in markets increasingly influenced by geopolitical tensions, protectionist measures, and changing global trade policies, particularly affecting manufacturing and export of scientific instruments; any escalation in tariffs or restrictions could increase costs or reduce overseas sales, negatively impacting both revenues and net margins.

- As the life sciences and diagnostic equipment sectors shift toward software-driven workflows and digital/AI solutions, there is risk that research budgets and capital investments could migrate away from traditional instruments toward automation and computational approaches, limiting Bruker’s addressable market and constraining long-term topline growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bruker is $80.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bruker's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $423.1 million, and it would be trading on a PE ratio of 40.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of $36.96, the bullish analyst price target of $80.0 is 53.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:BRKR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives