Key Takeaways

- Market leadership in cell and gene therapy, combined with expanded high-value product offerings, drives strong revenue and margin growth opportunities.

- Acquisition-fueled innovation and resilient commercial revenue provide stability against biotech funding risks while improved pricing boosts profitability.

- Heavy reliance on a small customer base and cell and gene therapy sectors exposes BioLife to significant revenue, margin, and execution risks amid market, regulatory, and integration challenges.

Catalysts

About BioLife Solutions- Develops, manufactures, and markets bioproduction products and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally.

- Revenue growth and earnings potential are supported by BioLife's deep integration and market leadership in cell and gene therapy workflows: 70%+ share in relevant clinical trials and expanding use of proprietary biopreservation products in 17 approved therapies, positioning the company to benefit from the accelerating adoption of cell and gene therapies globally.

- Expansion and cross-sell of higher-value consumables (e.g., CellSeal, hPL) into approved commercial therapies are expected to increase per-dose revenue by 2–3x compared to legacy products, driving higher margins and top-line growth as more therapies reach commercialization.

- Continued innovation through acquisitions like PanTHERA CryoSolutions strengthens BioLife's proprietary portfolio, supporting its differentiated, high-margin offerings and reinforcing gross margin expansion as next-generation products are developed and commercialized.

- Strong visibility and resilience of commercial revenue streams-anchored by commercial-stage customers less sensitive to funding shocks-mitigate risks tied to early-stage biotech funding volatility, supporting more predictable cash flow and operating margin improvement.

- Pricing power is being reclaimed as legacy discounts phase out over the next three years, creating a multi-year tailwind for gross and net margins as new contract terms take hold with key customers.

BioLife Solutions Future Earnings and Revenue Growth

Assumptions

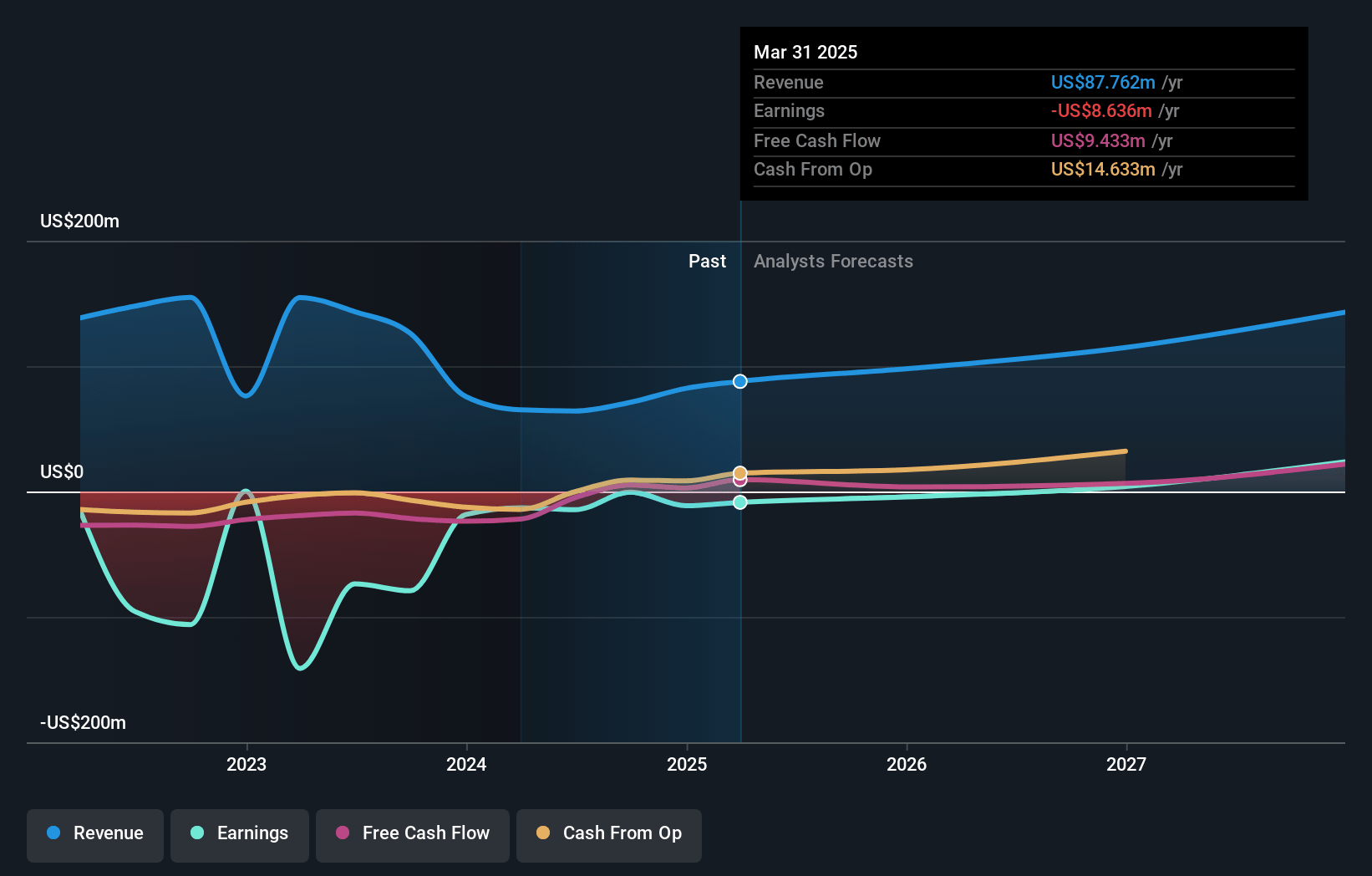

How have these above catalysts been quantified?- Analysts are assuming BioLife Solutions's revenue will grow by 20.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -9.8% today to 19.1% in 3 years time.

- Analysts expect earnings to reach $29.0 million (and earnings per share of $0.61) by about July 2028, up from $-8.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 67.9x on those 2028 earnings, up from -118.6x today. This future PE is greater than the current PE for the US Life Sciences industry at 36.0x.

- Analysts expect the number of shares outstanding to grow by 3.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

BioLife Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- BioLife's concentration of revenue-approximately 80% of BPM segment sales coming from its top 20 customers and significant reliance on commercial therapies-places it at risk should any key customer reduce orders, shift to alternatives, or experience setbacks in cell and gene therapy commercialization, which could negatively impact recurring revenue growth and overall revenue stability.

- The heavy orientation toward cell and gene therapy markets exposes BioLife to sector-specific downturns; if regulatory uncertainty (e.g., NIH funding reductions, FDA leadership changes) or clinical setbacks slow the rate of new therapy approvals or reduce investment in these therapies, ongoing demand for its biopreservation products could be curtailed, pressuring both top-line revenue and longer-term growth.

- Expectations of higher-margin recurring revenue via integration of new acquisitions (like PanTHERA) come with execution risks-if integration falters, scientific development lags, or new products fail to achieve commercial adoption (especially since barriers to switching are high for established therapy customers), projected net margin expansion and earnings growth could be undermined.

- Increasing R&D expenses, coupled with the company's ongoing need for facility expansion and CapEx (e.g., new manufacturing space, clean room build-out), may exert sustained margin pressure; if revenue growth slows or one-time costs from acquisitions accumulate, this could erode improvements in EBITDA and net margins.

- Although management currently perceives tariff, supply chain, and raw material risk as low, longer-term shifts (such as increased global trade barriers, changes in Chinese/EU policy, or rising input costs) may amplify costs or reduce competitiveness-especially if customer price sensitivity in a commoditizing market increases-potentially constraining future revenue and gross margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.1 for BioLife Solutions based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $152.1 million, earnings will come to $29.0 million, and it would be trading on a PE ratio of 67.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $21.41, the analyst price target of $31.1 is 31.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.