Key Takeaways

- Escalating competition and regulatory pressures threaten margins and revenue growth, especially for legacy neurology products and premium-priced therapies.

- Heavy reliance on a limited neurology pipeline magnifies risks tied to clinical outcomes and increased challenges from larger pharmaceutical rivals.

- Diversified new product launches, strategic global expansion, and operational discipline are strengthening revenue resilience and positioning the company for sustained long-term earnings growth.

Catalysts

About Biogen- Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

- Biogen faces mounting pressure from increased biosimilar and generic competition, particularly for its legacy MS franchises such as Tysabri and Tecfidera, with further revenue declines expected as additional generics enter Europe and potential biosimilar entry for Tysabri in the U.S., leading to accelerating erosion of branded revenues and contraction of net margins.

- Intensifying global scrutiny on drug pricing, especially in the United States and Europe, is likely to limit Biogen’s ability to achieve price increases or maintain premium pricing for its high-cost, innovative therapies, directly squeezing long-term revenue growth and restricting margin expansion.

- The company’s heavy dependence on a relatively narrow pipeline focused on neurology exposes future growth and earnings to outsized risk from clinical or regulatory setbacks, as evidenced by the costly need for multiple high-risk Phase III trials and reliance on challenging neuroscience indications with uncertain probability of success.

- Ongoing structural shifts in healthcare systems toward cost containment and value-based care are expected to diminish the demand for expensive specialty drugs, making payer reimbursement more restrictive and reducing overall market opportunities for Biogen’s pipeline and current premium therapies, thereby impacting both top-line revenue and operating profitability.

- Increasing investments from larger pharmaceutical competitors targeting neuroscience and immunology threaten Biogen’s market share and pricing power in its core areas, driving up customer acquisition costs and likely leading to margin compression as the competitive landscape becomes more challenging in key late-stage indications.

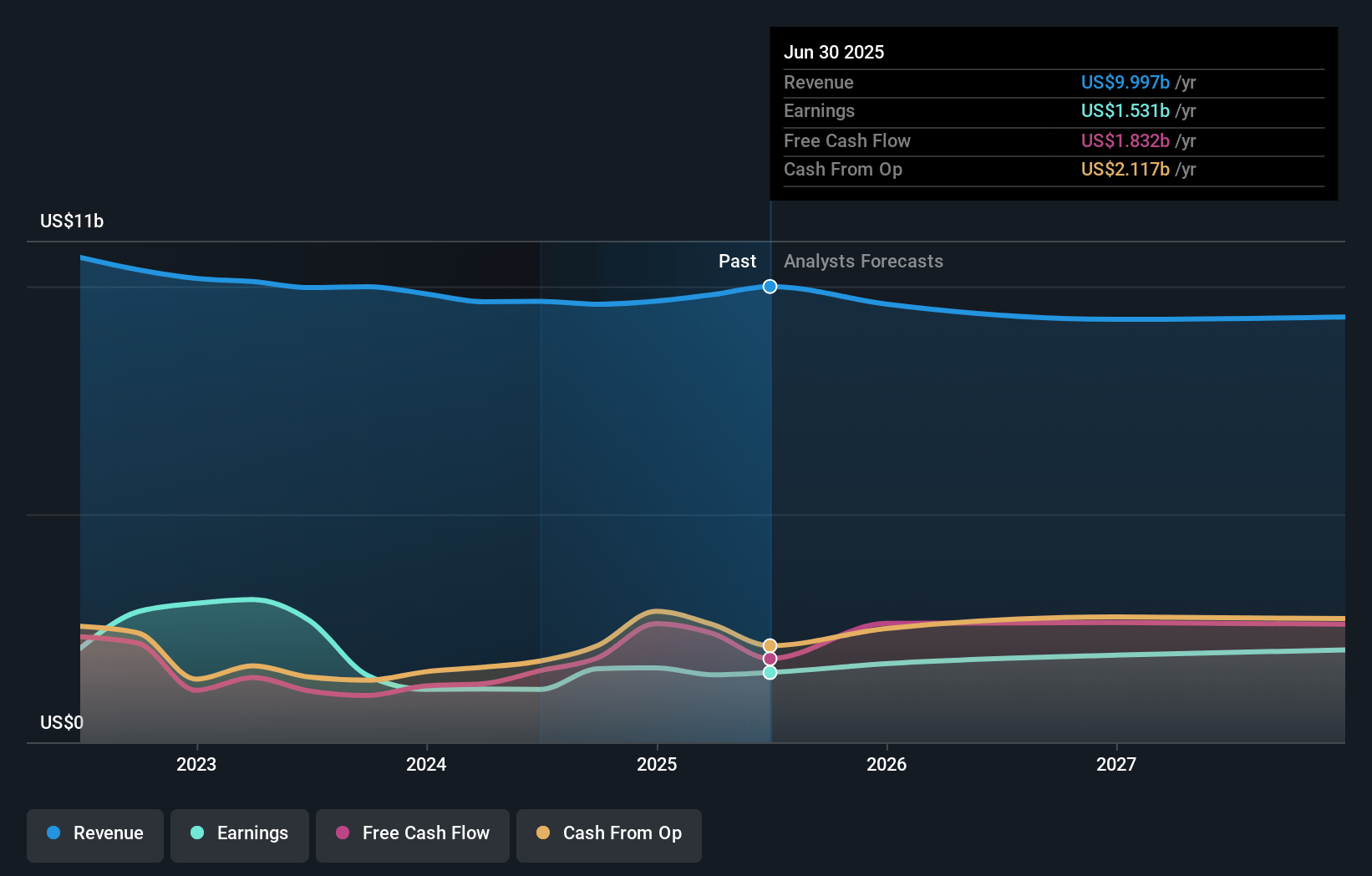

Biogen Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Biogen compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Biogen's revenue will decrease by 5.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.1% today to 19.1% in 3 years time.

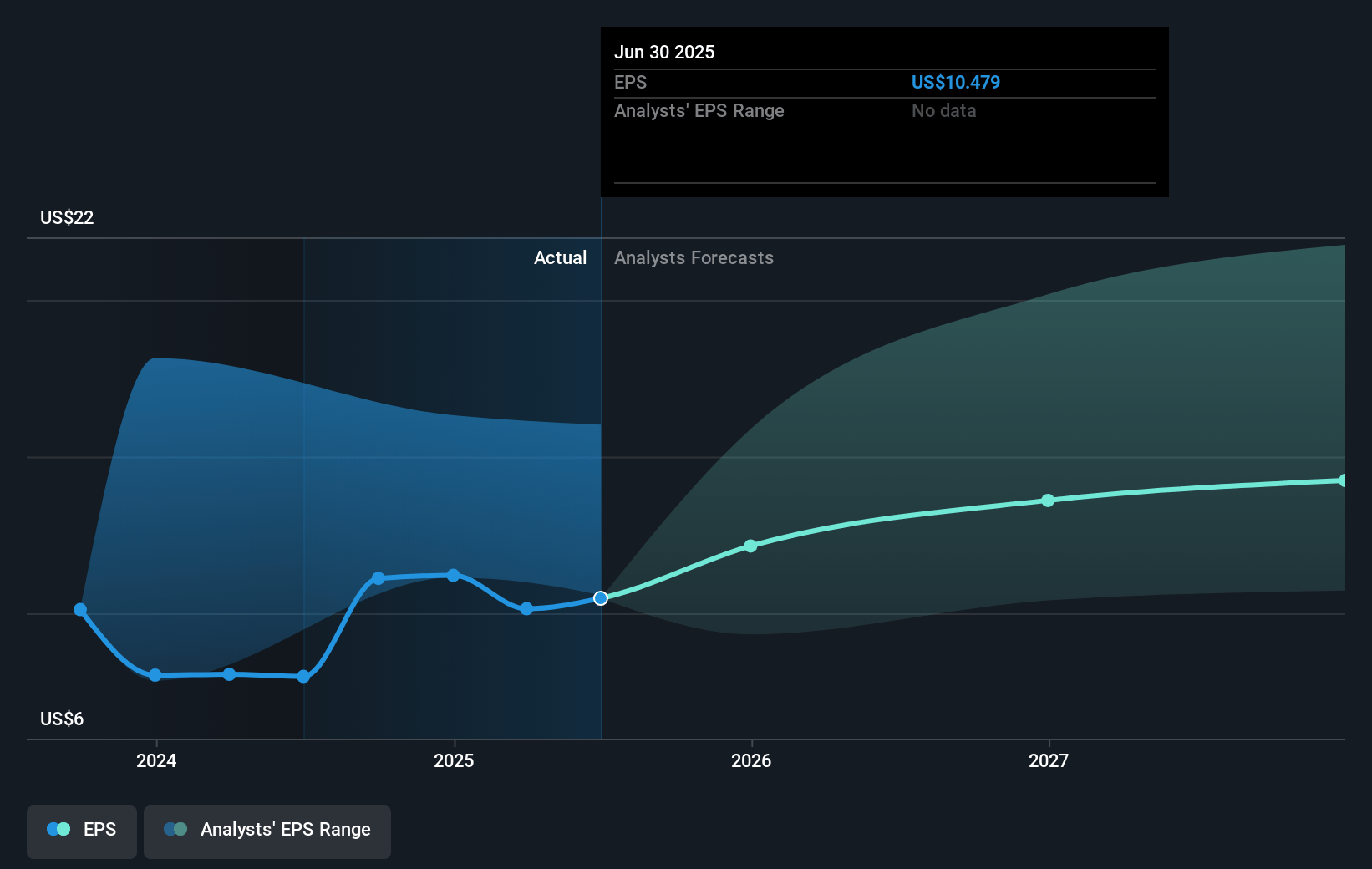

- The bearish analysts expect earnings to reach $1.6 billion (and earnings per share of $11.26) by about July 2028, up from $1.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 13.0x today. This future PE is lower than the current PE for the US Biotechs industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.81%, as per the Simply Wall St company report.

Biogen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong uptake and rapid geographic expansion of new products like LEQEMBI, SKYCLARYS, and ZURZUVAE indicate diversified revenue streams with long runways for growth, which could offset declines in the MS portfolio and lead to revenue stabilization or growth over time.

- Continuous pipeline advancement with five Phase III studies initiating this year, multiple regulatory decisions, and robust late-stage assets in both neurology and immunology provide a foundation for sustained long-term revenue growth and improved earnings.

- Strategic diversification beyond multiple sclerosis, including a rising proportion of revenue from rare diseases, immunology, and Alzheimer’s, reduces portfolio concentration risk and could contribute to more resilient net margins and earnings stability.

- Expansion into new markets and regions—with 55% of revenue coming from outside the U.S. and successful global launches—enhances growth opportunities and creates a more balanced revenue base, reducing reliance on single markets and potentially supporting top-line growth.

- Operational discipline, cost control through initiatives like “Fit for Growth,” and an emphasis on preclinical collaborations rather than expensive late-stage business development could structurally improve profit margins and enable greater reinvestment, supporting long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Biogen is $115.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Biogen's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $260.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.4 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $130.98, the bearish analyst price target of $115.0 is 13.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.