Narratives are currently in beta

Key Takeaways

- Biogen's strategic development in Alzheimer's treatments and operational efficiencies aims to transform revenue and strengthen net margins long-term.

- Expansion in international markets and advancements in drug delivery methods are set to boost revenue and market penetration.

- Biogen faces challenges with revenue growth due to slow market building for new products, competitive pressures, and high-risk pipeline investments.

Catalysts

About Biogen- Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

- Biogen is expected to see significant revenue growth from its late-stage pipeline, with products like LEQEMBI and BIIB080 in Alzheimer's disease potentially driving substantial future sales. This is expected to transform Biogen's revenue base over the longer term.

- The company has achieved operational efficiencies and a cost base reduction through its Fit for Growth initiative, which is projected to improve net margins as well as create room for further investment in key areas.

- Expansion and sequential growth in products like SKYCLARYS and ZURZUVAE across geographic markets, including Europe and newly filed regulatory markets, are anticipated to drive revenue increases while benefiting net margins and earnings.

- Strategic focus on building a robust immunology and rare disease pipeline, including promising candidates like dapirolizumab and felzartamab, is intended to secure long-term revenue streams and contribute to growth in net margins.

- The potential development and commercialization of new delivery methods, like a subcutaneous formulation for LEQEMBI, is likely to increase market penetration and drive revenue growth.

Biogen Future Earnings and Revenue Growth

Assumptions

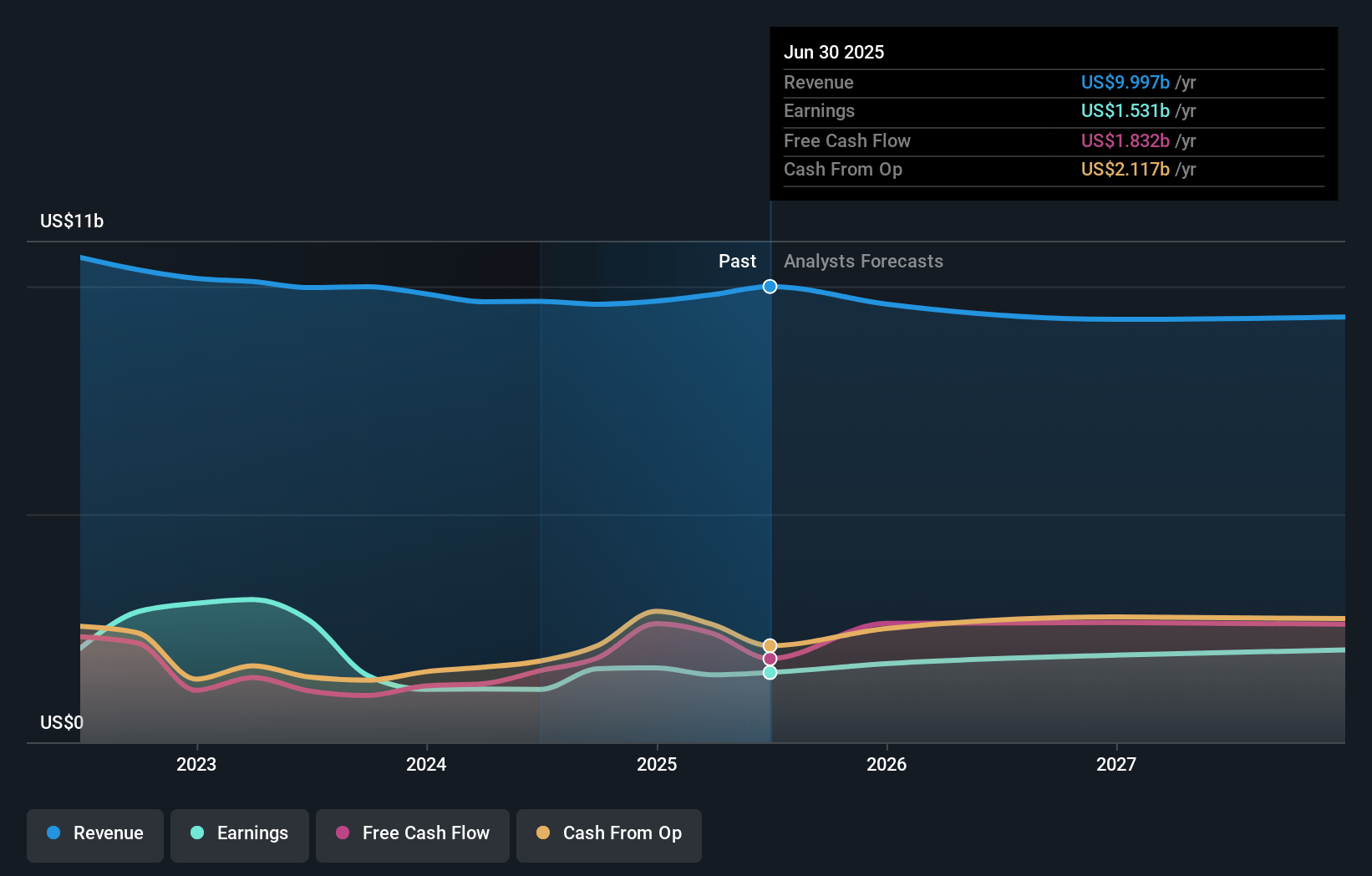

How have these above catalysts been quantified?- Analysts are assuming Biogen's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.8% today to 25.7% in 3 years time.

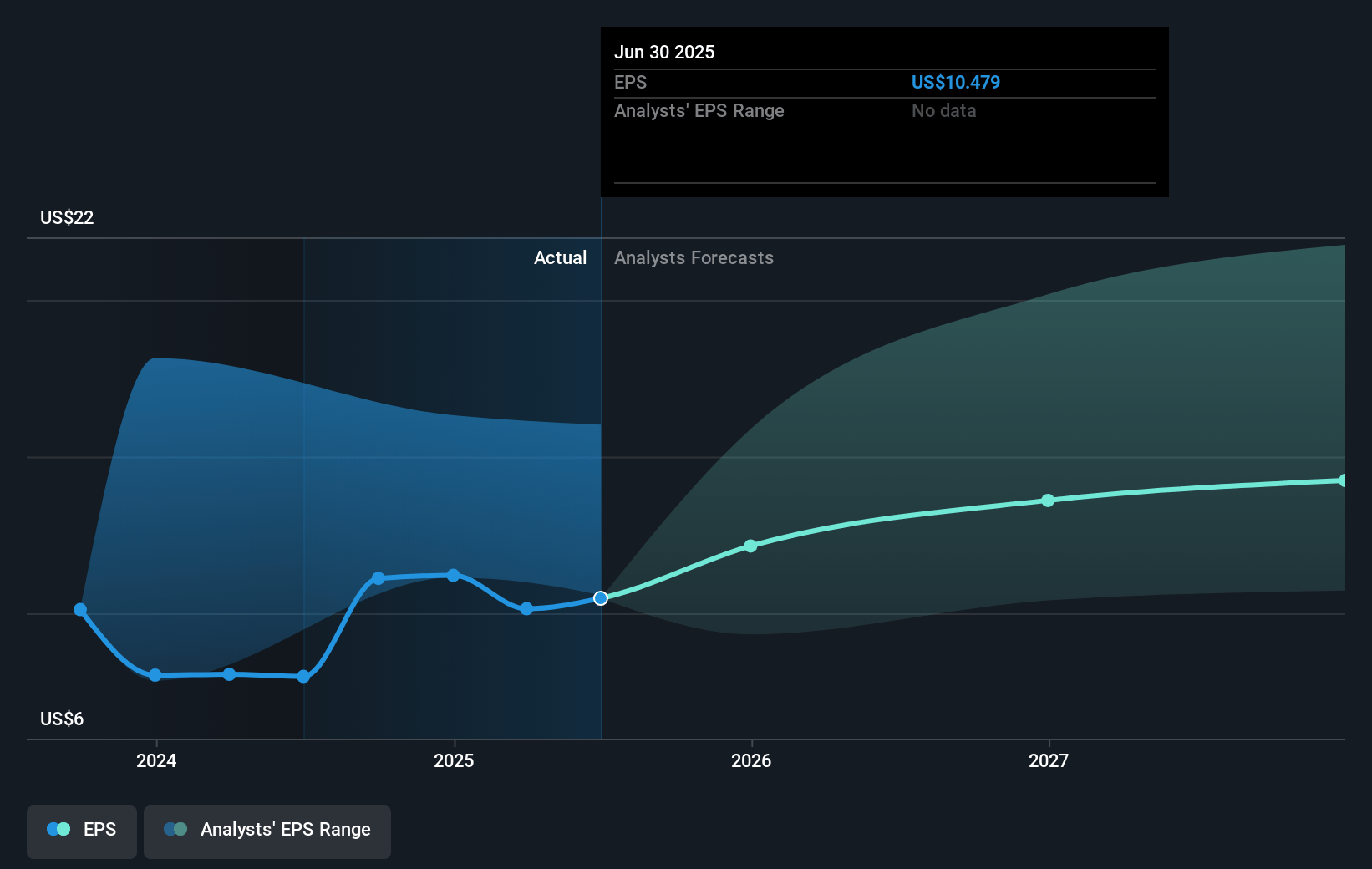

- Analysts expect earnings to reach $2.5 billion (and earnings per share of $17.69) by about January 2028, up from $1.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.5 billion in earnings, and the most bearish expecting $1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, up from 13.1x today. This future PE is lower than the current PE for the US Biotechs industry at 17.5x.

- Analysts expect the number of shares outstanding to decline by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.74%, as per the Simply Wall St company report.

Biogen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LEQEMBI's U.S. revenue continues to be below expectations due to limited expansion of the prescriber base, which could negatively impact Biogen's future revenue growth.

- The launch of LEQEMBI and other new products requires building markets from scratch, which is taking longer and requires a substantial investment, likely impacting net margins.

- Competitive pressures, including TYSABRI's impact from a biosimilar entrant in Europe and ongoing generic challenges to TECFIDERA's patent, pose risks to revenue stability.

- The timing of reimbursement for SKYCLARYS in Europe is uncertain, creating revenue unpredictability and potential impact on earnings.

- Biogen's emphasis on high-risk pipeline investments, particularly in areas like lupus and Alzheimer's, may not yield timely returns, affecting the company's ability to achieve expected revenue and profit growth targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $229.64 for Biogen based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $342.0, and the most bearish reporting a price target of just $138.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.8 billion, earnings will come to $2.5 billion, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of $145.49, the analyst's price target of $229.64 is 36.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives