Narratives are currently in beta

- AstraZeneca focuses on high-growth potential areas like oncology and aims for substantial growth in emerging markets, significantly impacting future revenues.

- Commitment to mid-30s operating margin and disciplined investment in R&D and product pipeline underpins long-term growth and profitability.

- Reliance on China, increased capital expenditures, rising SG&A expenses, competition from biosimilars, and regulatory risks could collectively impact AstraZeneca's profit margins and revenue growth.

What are the underlying business or industry changes driving this perspective?

- AstraZeneca's long-term growth is significantly underpinned by their disciplined investment strategy, focusing on areas with the most growth potential like oncology, cardiovascular, respiratory, immune, and rare diseases, which should positively impact revenue.

- The achievement of $45 billion in sales in 2023 highlights AstraZeneca's ability to surpass revenue expectations, indicative of potential underestimation of future growth by the market, impacting revenue and earnings.

- AstraZeneca is planning for substantial growth in emerging markets, including a strong return to growth in China, which is expected to contribute significantly to future revenue increases.

- The company's commitment to mid-30s operating margin in the midterm indicates a strong focus on profitability that could be underestimated by the market. This will likely have a positive effect on net margins.

- Investment in R&D and the upcoming product pipeline, with expectations for new Phase III starts and blockbuster potential, demonstrates a robust strategy for sustaining long-term growth, which should lead to revenue and earnings growth.

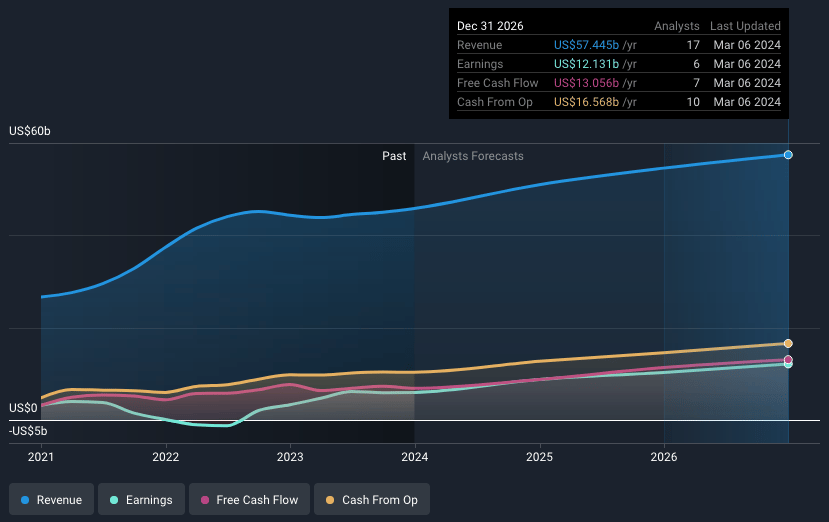

Figures in the charts may differ slightly from those mentioned in the narrative

How have these above catalysts been quantified?

- Analysts are assuming AstraZeneca's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.0% today to 19.4% in 3 years time.

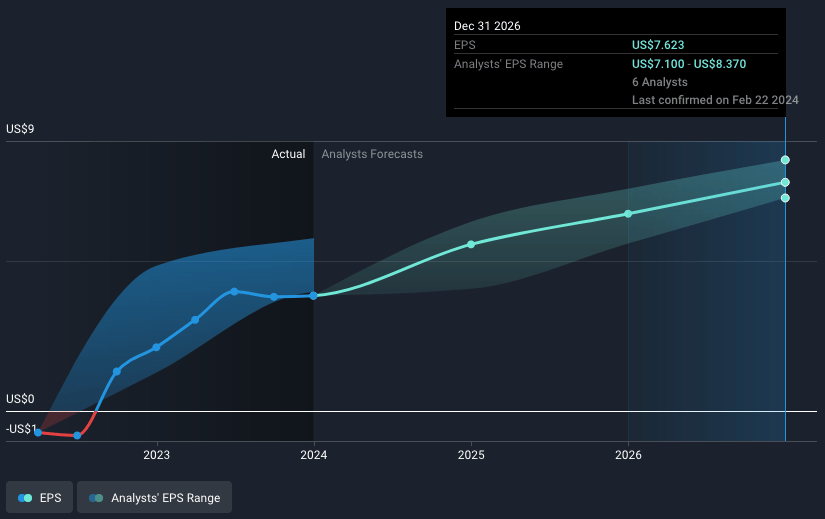

- Analysts expect EPS to reach $7.62 ($11.1 billion in earnings) by about February 2027, up from $3.84 today.

Figures in the charts may differ slightly from those mentioned in the narrative

What could happen that would invalidate this narrative?

- The reliance on China for hospital ordering dynamics could affect Tagrisso's performance, impacting revenue from this key market.

- Anticipated substantial increases in capital expenditure, primarily for investments in new manufacturing capabilities, could pressure profit margins if not managed efficiently.

- Rising SG&A expenses, particularly for the Airsupra launch, may impact operating margins if sales growth does not outpace the investment in the commercial team and marketing efforts.

- The introduction of biosimilars in the rare diseases segment poses a competitive threat to AstraZeneca's Soliris and Ultomiris, potentially affecting their revenue streams.

- Regulatory risks for new products like Dato in non-squamous lung cancer could impact the expected revenue growth if approvals are delayed or not granted, affecting net margins.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives