Last Update 02 Dec 25

ARVN: Refocus On Neuroscience And Cost Discipline Will Balance Risks And Opportunities

Analysts have revised Arvinas' price target lower. Notable cuts include Goldman's reduction to $6 from $8, reflecting heightened uncertainty around vepdegestrant's outlook and increased competitive pressures in breast cancer therapies.

Analyst Commentary

Analyst sentiment around Arvinas remains divided as the company undergoes a period of strategic transition, especially in light of developments surrounding its lead breast cancer therapy, vepdegestrant. Analysts have weighed both the potential upside as well as emerging risks that could influence the company's future valuation and growth prospects.

Bullish Takeaways

- Bullish analysts highlight ongoing advancements in the company's neuroscience pipeline, notably promising Phase I data for ARV-102. This data demonstrated substantial LRRK2 degradation in both healthy volunteers and Parkinson's patients, suggesting a strong foundation for further clinical development.

- Some analysts see the company's refocus on internal programs as an opportunity to unlock value in new areas, particularly in oncology and neuroscience. They believe the reduced spending on vepdegestrant positions Arvinas to make more strategic investments.

- Bullish sentiment is reinforced by the view that Arvinas' shares are trading at a level that reflects a discount to its cash balance, providing a potential margin of safety and an attractive entry point for long-term investors.

- Planned out-licensing of vepdegestrant, while challenging, is seen as a path to share risk and bring in new sources of non-dilutive capital. This is especially relevant with a clear regulatory timeline set for mid-2026.

Bearish Takeaways

- Bearish analysts express concern over the rapidly changing competitive landscape in hormone receptor-positive/HER2-negative metastatic breast cancer. They caution that faster-moving competitors may limit vepdegestrant's commercial relevance or lead to its obsolescence.

- Uncertainty surrounding the out-licensing process and commercialization timing for vepdegestrant, particularly as Arvinas and its partner search for a third party, has led some analysts to downgrade expectations for near- and medium-term revenue growth.

- Several analysts point out that the reset in Arvinas’ strategy could lead to volatility in execution and greater reliance on cash reserves. This will be closely watched in the coming quarters.

- Anticipated reductions in vepdegestrant’s peak sales forecasts and workforce cuts may signal to investors that challenges could persist for longer than initially expected, weighing on sentiment and valuation multiples.

What's in the News

- Goldman Sachs downgraded Arvinas to Sell from Neutral and lowered the price target to $6 because of increasing risks that vepdegestrant could become obsolete given strong competition in metastatic breast cancer. (Goldman Sachs research note)

- Piper Sandler raised Arvinas’ price target to $16, citing positive Phase I results for ARV-102 in Parkinson’s disease and upcoming plans for a Phase Ib study in Progressive Supranuclear Palsy. (Piper Sandler report)

- Arvinas and Pfizer have agreed to out-license commercialization rights for vepdegestrant and are actively seeking a partner. The change includes limiting additional vepdegestrant spending and implementing further workforce reductions to streamline operations. (Company announcement)

- A 15% reduction in workforce, mainly affecting roles related to vepdegestrant, is expected to be completed in Q1 2026 and will result in approximately $4.5 million in costs. (Company announcement)

- Arvinas presented preclinical data for ARV-806, a KRAS G12D degrader, indicating superior potency and efficacy in solid tumor models and supporting ongoing Phase 1 clinical trials. (Company announcement)

Valuation Changes

- Fair Value Estimate: Remained unchanged at $12.31 per share.

- Discount Rate: Marginally decreased, remaining at 6.96%.

- Revenue Growth: Slightly lower, continuing at -20.13%.

- Net Profit Margin: Effectively unchanged at 20.88%.

- Future Price-to-Earnings (P/E): Stable at approximately 23.58x.

Key Takeaways

- Advancements in targeted therapies and partnerships position Arvinas to capitalize on precision medicine trends and diversify future revenue streams.

- Streamlined operations and supportive industry momentum enhance prospects for improved margins and faster approval timelines.

- Cost-cutting measures, strategic pipeline shifts, and external commercialization uncertainties heighten risks to innovation, growth, and long-term profitability amid rising competition and industry headwinds.

Catalysts

About Arvinas- A clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins.

- Arvinas is positioned to benefit from a growing addressable market due to the rapid aging of the global population and the increasing prevalence of diseases like cancer and neurodegeneration, directly driving long-term potential for revenue growth as more patients seek innovative therapies.

- The company's continued advancements in targeted and personalized therapies, specifically through its differentiated PROTAC platform and new clinical-stage assets such as ARV-102 (for Parkinson's/PSP), ARV-393 (BCL6 degrader), and ARV-806 (KRAS degrader), align with healthcare's shift toward precision medicine and expand opportunities for future high-margin product launches.

- Solid progress and early validation in partnerships and licensing, as seen with Novartis and ongoing collaboration (or renegotiation) with Pfizer, offer the potential for substantial milestone payments and tiered royalties, thus strengthening future earnings and diversifying revenue streams.

- Operational efficiencies executed via company-wide restructuring, strategic pipeline prioritization, and workforce reduction have significantly extended Arvinas' cash runway to 2028, improving the sustainability of R&D and positioning net margins for improvement even ahead of potential major product approvals.

- Industry-wide momentum, including increased M&A and biopharma investment in targeted protein degradation and more supportive regulatory frameworks for breakthrough therapies, are expected to accelerate Arvinas' approval timelines, pipeline value realization, and drive overall earnings uplift as the sector re-rates innovators.

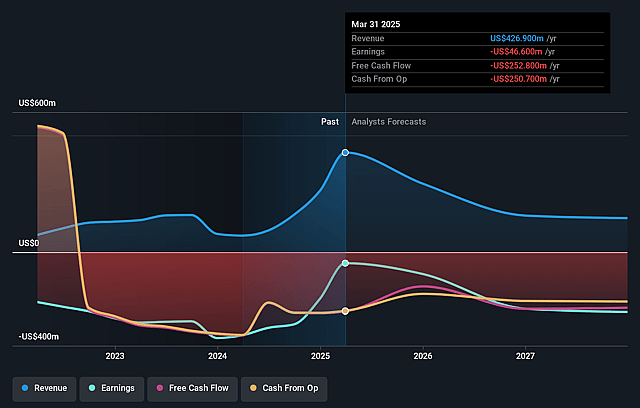

Arvinas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arvinas's revenue will decrease by 22.2% annually over the next 3 years.

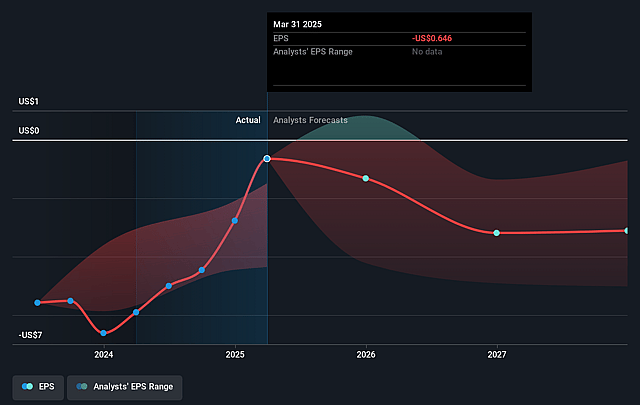

- Analysts are not forecasting that Arvinas will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Arvinas's profit margin will increase from -19.5% to the average US Pharmaceuticals industry of 23.2% in 3 years.

- If Arvinas's profit margin were to converge on the industry average, you could expect earnings to reach $40.7 million (and earnings per share of $0.46) by about September 2028, up from $-72.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.1x on those 2028 earnings, up from -8.0x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 6.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Arvinas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent restructuring resulted in cutting one-third of Arvinas' workforce, reprioritizing the pipeline, and reducing R&D expenses, reflecting a need to conserve cash that may constrain innovation and slow future program growth, potentially limiting long-term revenue and earnings expansion.

- Uncertainty around vepdeg's commercialization path, including ongoing negotiations with Pfizer over development rights and no near-term plan for internal commercial infrastructure, raises the risk of delays or gaps in market launch, which could suppress anticipated revenue streams and earnings from their lead asset.

- Heavy reliance on the unproven PROTAC platform and early-stage pipeline exposes Arvinas to significant R&D and regulatory risks; if pivotal clinical trials disappoint or timelines slip, this could result in prolonged negative net margins and increased cash burn.

- Increasing competition in the targeted protein degradation and oncology space-including large pharma and other biotechs with advanced programs-may erode potential market share, threaten pricing power, and compress long-term revenue and profitability prospects.

- Broader industry and policy trends such as global drug price regulation, rising cost of capital, and potential supply chain disruptions could heighten margin pressure and operational expenses, impacting long-term earnings and Arvinas' ability to sustain profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.444 for Arvinas based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $110.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $175.3 million, earnings will come to $40.7 million, and it would be trading on a PE ratio of 49.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $7.9, the analyst price target of $18.44 is 57.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Arvinas?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.