Last Update01 May 25Fair value Increased 1.01%

AnalystConsensusTarget has decreased profit margin from 28.2% to 8.8% and increased future PE multiple from 28.5x to 85.2x.

Read more...Key Takeaways

- European approval of the mRNA COVID-19 vaccine could significantly boost sales through broader market access in 31 countries.

- Progress in cystic fibrosis treatment and pandemic influenza vaccine development could create new revenue streams and address unmet medical needs.

- Reliance on milestone revenues and high R&D expenses create revenue volatility, increased cash burn, and doubts on future financial sustainability and profitability.

Catalysts

About Arcturus Therapeutics Holdings- Engages in the development of infectious disease vaccines and other products within liver and respiratory rare diseases.

- European Commission approval of KOSTAIVE, the first self-amplifying mRNA COVID-19 vaccine, offers potential for increased revenue as it is now approved in 31 countries, which could boost sales through broader market access.

- Anticipated regulatory filings for KOSTAIVE in the U.S. and U.K. in late 2025 could open up additional high-value markets, leading to further revenue growth.

- Development of a two-dose vial presentation by Meiji Seika Pharma aims to enhance convenience and ease of vaccination, potentially increasing market penetration and sales in Japan starting in autumn 2025, thus impacting future revenue positively.

- Progress in the Phase II study for ARCT-032 in cystic fibrosis patients not eligible for CFTR modulators and expected interim data by Q2 2025 could address significant unmet medical needs, potentially impacting earnings positively if successful.

- Initiation and advancement of Phase I studies for the ARCT-2304 pandemic influenza vaccine, funded by BARDA, with interim data expected in H2 2025, could provide new revenue streams and enhance long-term earnings prospects by expanding the vaccine franchise.

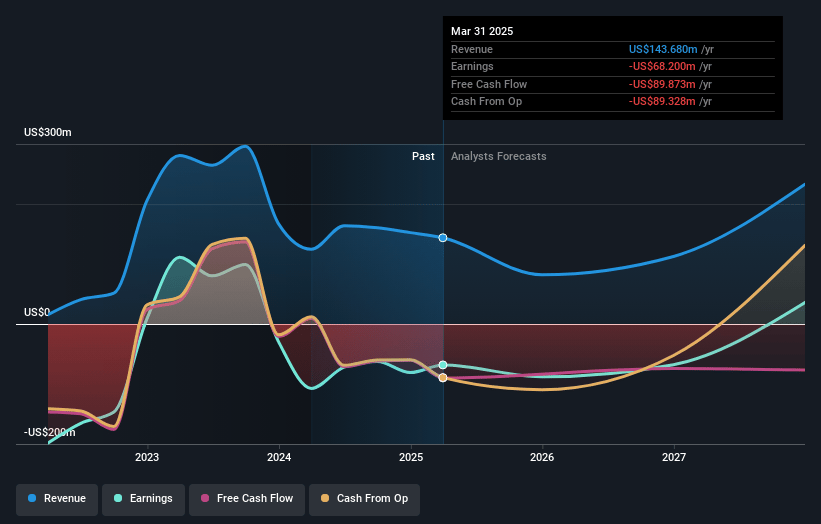

Arcturus Therapeutics Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arcturus Therapeutics Holdings's revenue will grow by 26.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -53.1% today to 8.8% in 3 years time.

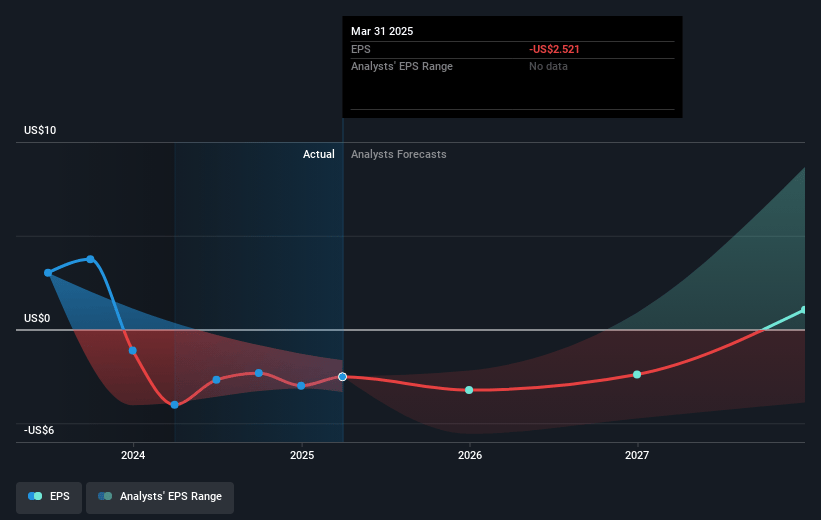

- Analysts expect earnings to reach $26.9 million (and earnings per share of $0.7) by about May 2028, up from $-80.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $264.4 million in earnings, and the most bearish expecting $-176.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 85.2x on those 2028 earnings, up from -4.3x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 0.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.54%, as per the Simply Wall St company report.

Arcturus Therapeutics Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on milestones from CSL for revenue, as indicated by the decrease due to lower milestone achievements, suggests potential volatility in future revenues if these milestones are not consistently met.

- High operating expenses, particularly in research and development, have led to an increasing net loss, which could impact future net margins and the company's ability to become profitable.

- The transition of the COVID program to a commercial phase is expected to result in a decline in development milestones, potentially leading to reduced revenue streams from that program.

- The cash burn is anticipated to increase due to ongoing CF and OTC program trials, which could pressure the company’s cash reserves and impact financial sustainability.

- The current net loss and dependence on future milestone payments highlights a potential risk in achieving profitability, impacting future earnings projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $70.301 for Arcturus Therapeutics Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $44.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $307.3 million, earnings will come to $26.9 million, and it would be trading on a PE ratio of 85.2x, assuming you use a discount rate of 6.5%.

- Given the current share price of $12.82, the analyst price target of $70.3 is 81.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.