Key Takeaways

- Rising global demand for biologic therapies and biosimilar adoption are driving market expansion and positioning Alvotech for sustained growth.

- Diversified pipeline and international partnerships enhance revenue stability, reduce single-product risk, and improve overall financial flexibility and margins.

- Revenue volatility, competitive pricing pressures, reliance on a few key launches, high debt, and regulatory uncertainties collectively heighten financial and operational risks.

Catalysts

About Alvotech- Through its subsidiaries, develops and manufactures biosimilar medicines for patients worldwide.

- Rapidly aging global populations and rising prevalence of chronic diseases are driving a significant increase in demand for biologic therapies, expanding the total addressable market for Alvotech’s biosimilars and positioning the company for sustained revenue growth as these secular trends accelerate.

- Heightened healthcare cost containment efforts among governments and payers are leading to increased adoption and reimbursement for lower-cost biosimilars, supporting higher long-term sales volumes and the potential for improved earnings as Alvotech penetrates more markets.

- The company’s accelerated pace of pipeline development and planned launch of four new biosimilars by Q4 2025—with a move from two to six marketed biosimilars by early 2026—will drive revenue diversification, reduce dependency on any single product, and support growth in both revenue and EBITDA over the coming years.

- Expansion into emerging markets and broader international distribution through 20 commercial partnerships across 90 countries (including recent launches in Latin America and strengthened positions in Canada and Europe) are set to bolster global sales, enhance economies of scale, and ultimately benefit net margins as fixed manufacturing costs are leveraged.

- Continued positive cash flow from operations, improving adjusted EBITDA, and the expected transition to being self-funded in 2025 reduce reliance on external funding, improve financial flexibility for future investment, and support long-term earnings and margin expansion.

Alvotech Future Earnings and Revenue Growth

Assumptions

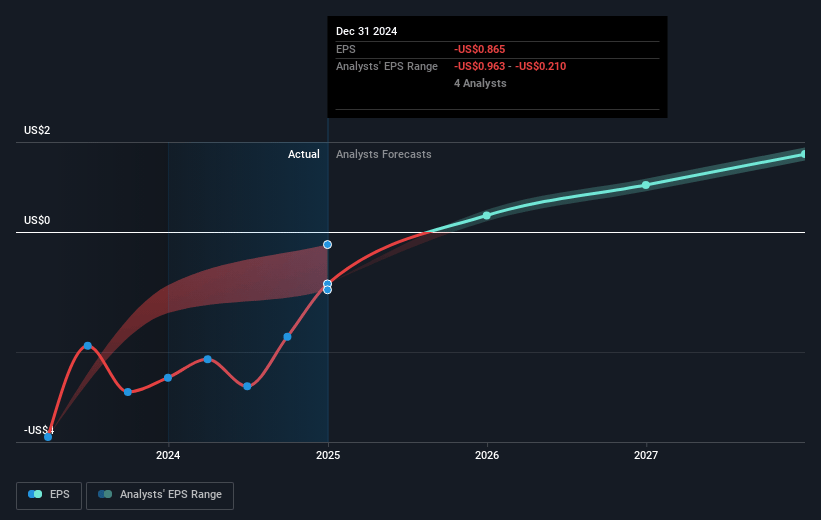

How have these above catalysts been quantified?- Analysts are assuming Alvotech's revenue will grow by 32.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.4% today to 19.5% in 3 years time.

- Analysts expect earnings to reach $266.0 million (and earnings per share of $0.9) by about July 2028, up from $96.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $351 million in earnings, and the most bearish expecting $199.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.1x on those 2028 earnings, down from 27.1x today. This future PE is greater than the current PE for the US Biotechs industry at 17.0x.

- Analysts expect the number of shares outstanding to grow by 0.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

Alvotech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the biosimilar space, especially in the U.S., is evident as Alvotech’s management highlights strong price competition in the Stelara biosimilar market; if rivals like Sandoz gain interchangeable status or employ more aggressive pricing tactics, this could drive down prices and compress margins, negatively impacting net earnings and revenue growth.

- The B2B commercial model leads to inherently “lumpy” revenue streams as partner orders vary in timing and quantity, resulting in unpredictable quarter-to-quarter results and revenue volatility, which could challenge sustained financial momentum and investor confidence.

- Alvotech remains heavily reliant on successful launches and rapid uptake of a limited number of high-profile biosimilars; any delays in regulatory approvals, market access, or slower-than-expected adoption—due to either payer, regulatory, or operational hurdles—can directly impact revenue stability and growth trajectories.

- Persistent high net debt ($1.058 billion as of March 31) and ongoing investments in pipeline development and manufacturing scale mean that despite short-term positive cash flow, the company’s long-term ability to self-fund may be strained if cash generation does not consistently outpace elevated R&D and working capital needs, thereby weighing on net margins and increasing financial risk.

- Possible shifts in global regulatory landscapes and increasing geopolitical risks (such as new U.S. pharmaceutical import tariffs, even if deemed unlikely to be disruptive in 2025) could raise operating costs, delay market entry, or complicate international distribution, threatening both top-line revenue and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.9 for Alvotech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $266.0 million, and it would be trading on a PE ratio of 26.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $8.41, the analyst price target of $17.9 is 53.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.