Key Takeaways

- The company's success hinges on regulatory approvals and pricing power for its key drug, facing major risks from delays, competition, and market access challenges.

- High R&D costs, pipeline concentration, and supply chain vulnerabilities threaten profitability, with potential for prolonged cash burn and weakening financial independence.

- A strong late-stage pipeline, positive regulatory momentum, and strategic global expansion position Agios for diversified growth and enhanced financial stability in rare disease therapeutics.

Catalysts

About Agios Pharmaceuticals- A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

- Significant future revenue growth relies almost entirely on securing regulatory approvals for PYRUKYND in thalassemia and sickle cell disease over the next two years; any delays, negative outcomes, or unexpected regulatory hurdles in major markets will severely constrain anticipated top-line expansion.

- Heightened global pressure to control drug prices, especially for high-cost therapies in the US and Europe, threatens the company's ability to command and sustain premium pricing for new PYRUKYND indications, thereby weakening long-term revenue and gross margin prospects even if approvals are gained.

- With an undiversified pipeline concentrated in rare hematologic disorders and limited recurring revenue, setbacks in late-stage clinical trials, slower-than-expected uptake, or increased competition from rapidly advancing gene therapies and novel modalities risk prolonged cash burn and potential future dilution, dampening earnings potential and net margins.

- Dependence on complex and global supply chains exposes Agios to heightened risks from geopolitical instability, tariffs, and rare reagent shortages, which could escalate R&D expenses and delay both clinical trials and commercial launches, weighing on net profitability.

- Elevated research and development costs, expanding commercial infrastructure ahead of regulatory clarity, and the possibility of costlier and lengthier approval processes across key regions may erode the current financial cushion, leading to diminishing margins and threatening long-run financial independence.

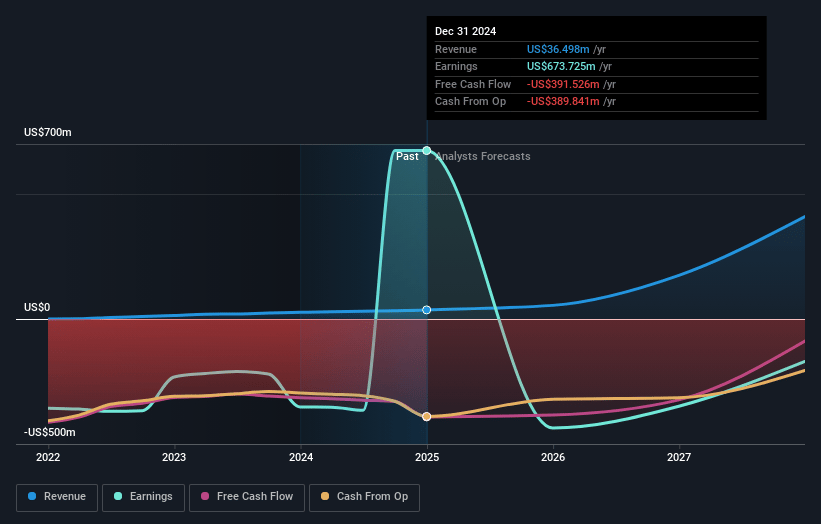

Agios Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Agios Pharmaceuticals compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Agios Pharmaceuticals's revenue will grow by 98.0% annually over the next 3 years.

- The bearish analysts are not forecasting that Agios Pharmaceuticals will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Agios Pharmaceuticals's profit margin will increase from 1798.3% to the average US Biotechs industry of 10.5% in 3 years.

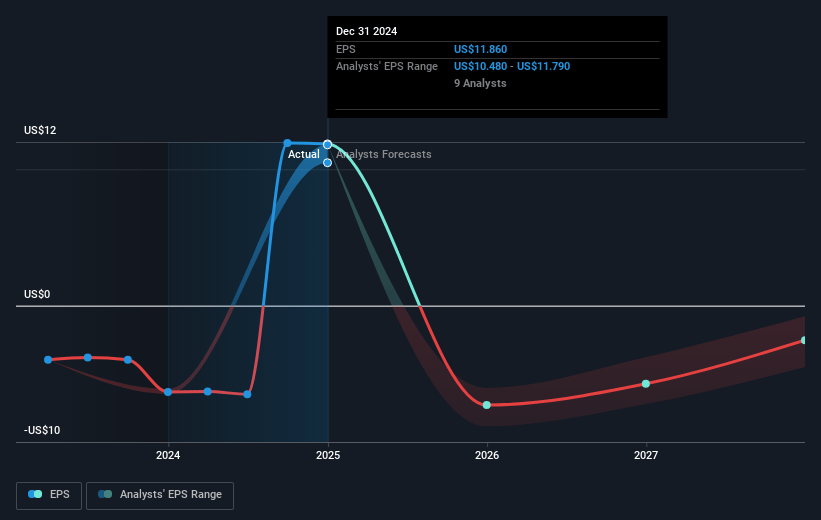

- If Agios Pharmaceuticals's profit margin were to converge on the industry average, you could expect earnings to reach $30.3 million (and earnings per share of $0.5) by about July 2028, down from $666.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 92.1x on those 2028 earnings, up from 3.5x today. This future PE is greater than the current PE for the US Biotechs industry at 17.0x.

- Analysts expect the number of shares outstanding to grow by 1.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Agios Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The robust late-stage pipeline and the potential for sequential approvals and launches of PYRUKYND in thalassemia (likely in late 2025) and sickle cell disease (projected for 2026) could drive significant top-line revenue growth and diversify the company's revenue streams, supporting strong long-term earnings growth.

- Strong positive clinical data in multiple target indications across rare hematologic diseases, combined with positive feedback from regulatory bodies such as the FDA (no advisory committee required, ongoing collaborative review), greatly increase the likelihood of regulatory approvals and commercial success, which may boost revenue and market confidence.

- Agios's financial position, with approximately $1.4 billion in cash and ongoing disciplined capital allocation, provides financial independence to fund product launches and pipeline development without the near-term need for dilutive equity financing or excessive debt, preserving shareholder value and supporting net margins.

- Secular trends such as increased global healthcare spending, favorable rare disease regulatory frameworks, and growing patient advocacy are likely to create a receptive market for innovative therapies like PYRUKYND, potentially granting the company strong pricing power and expanded earnings potential.

- Ongoing progress in expanding the PYRUKYND franchise internationally and into new indications, supported by strategic partnerships (such as the NewBridge collaboration in the Gulf region), may drive revenue growth across multiple geographies and protect against over-reliance on any single market or revenue source.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Agios Pharmaceuticals is $38.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Agios Pharmaceuticals's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $71.0, and the most bearish reporting a price target of just $38.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $287.7 million, earnings will come to $30.3 million, and it would be trading on a PE ratio of 92.1x, assuming you use a discount rate of 6.4%.

- Given the current share price of $39.99, the bearish analyst price target of $38.0 is 5.2% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.