Key Takeaways

- Agios's strategic focus on PYRUKYND and a strong early-stage pipeline aims for significant revenue growth and market expansion.

- Effective capital deployment and a strong balance sheet position Agios to manage product launches and potential earnings growth efficiently.

- Agios Pharmaceuticals faces revenue risks from potential regulatory delays, safety concerns, and financial strain from R&D investments versus expected returns on PYRUKYND.

Catalysts

About Agios Pharmaceuticals- A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

- Agios Pharmaceuticals is preparing for the commercial launch of PYRUKYND in thalassemia by September 2025 and in sickle cell disease by 2026, presenting a multibillion-dollar growth opportunity for the company, likely impacting future revenues positively.

- The company’s early and mid-stage pipeline, including initiatives like TevaPIVac for MDS and a siRNA program for polycythemia vera, is robust and poised for clinical advancement, potentially enhancing future revenues and long-term growth.

- Ongoing strategic capital deployment, along with experience from existing launches, positions Agios to effectively manage upcoming product launches, which could lead to operational efficiencies and better net margins.

- The promising ACTIVATE-KIDS Phase III data for mitapivat in pediatric PK deficiency could expand the market reach into younger demographics, potentially contributing to revenue growth.

- Agios’s strong balance sheet and the ability to pursue both internal and external opportunities independently may lead to enhanced earnings potential as the company expands its pipeline and market presence.

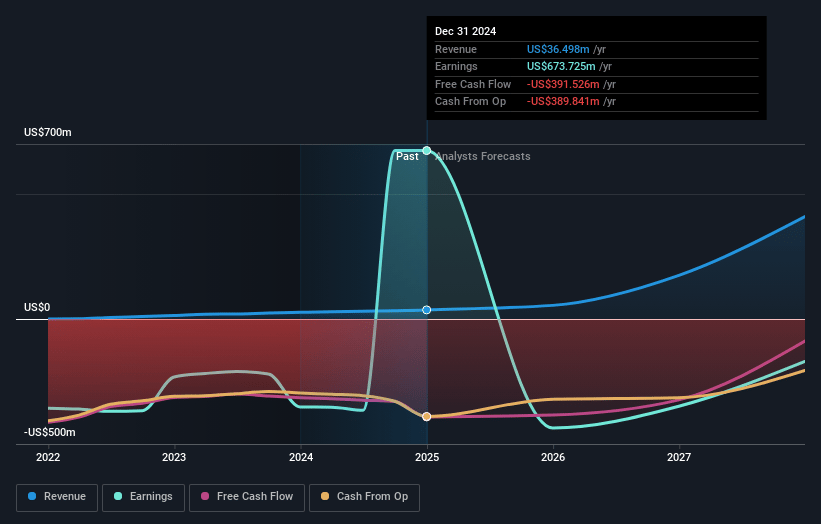

Agios Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Agios Pharmaceuticals's revenue will grow by 122.1% annually over the next 3 years.

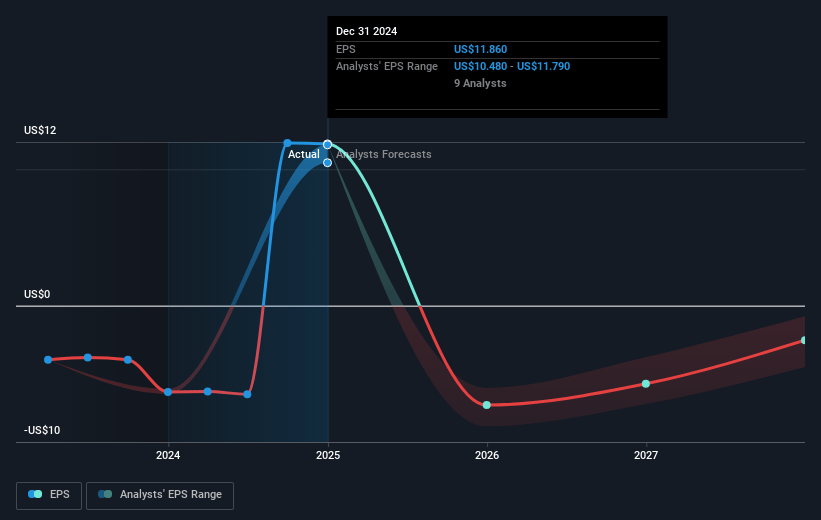

- Analysts are not forecasting that Agios Pharmaceuticals will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Agios Pharmaceuticals's profit margin will increase from 1798.3% to the average US Biotechs industry of 10.5% in 3 years.

- If Agios Pharmaceuticals's profit margin were to converge on the industry average, you could expect earnings to reach $42.8 million (and earnings per share of $0.7) by about July 2028, down from $666.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 88.6x on those 2028 earnings, up from 3.4x today. This future PE is greater than the current PE for the US Biotechs industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Agios Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Agios Pharmaceuticals' reliance on securing regulatory approvals for PYRUKYND's new indications creates a significant risk; any delays or failures in approval processes, such as with the pending thalassemia or sickle cell disease approvals, could negatively impact potential revenue forecasts.

- There are concerns around the safety profile of mitapivat, particularly with liver-related side effects, which could affect physician prescribing behavior and impact sales, thereby affecting the revenue potential.

- The anticipated time lag between drug prescription and therapy initiation, especially during the launch of thalassemia in Q4 2025, may result in slower initial revenue uptake, influencing short-term earnings projections.

- With Agios planning to expand globally, notably into the European market, navigating diverse healthcare systems and securing pricing and reimbursement could prove challenging and impact net margins and profit timelines.

- Increased investments in R&D and SG&A for pipeline and commercial launches without corresponding revenue growth could strain financials, particularly if the expected multibillion-dollar returns on PYRUKYND are not realized as planned, impacting net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $51.571 for Agios Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $71.0, and the most bearish reporting a price target of just $38.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $405.7 million, earnings will come to $42.8 million, and it would be trading on a PE ratio of 88.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of $39.66, the analyst price target of $51.57 is 23.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.